Key Notes

- Fusaka implements PeerDAS enabling consensus with out particular person nodes processing all accessible knowledge on the community.

- Vitalik identifies three limitations: L2 throughput points, proposer-builder bottleneck, and lacking sharded mempool element.

- ETH exhibits technical assist at $2,880-$2,950 with potential resistance at $3,160 if present bullish momentum sustains.

Ethereum

ETH

$3 118

24h volatility:

0.0%

Market cap:

$376.02 B

Vol. 24h:

$30.76 B

value moved above the $3,000 mark on Thursday, Dec. 4, as investor sentiment strengthened following the profitable completion of the Fusaka improve on Dec. 3.

In a press release shared on X, Vitalik Buterin, co-founder of Ethereum, declared PeerDAS in Fusaka will now allow consensus on blocks with out requiring any single node to see greater than a tiny fraction of the info. He famous that this mechanism stays proof against 51% assaults.

PeerDAS in Fusaka is critical as a result of it actually is sharding.

Ethereum is coming to consensus on blocks with out requiring any single node to see greater than a tiny fraction of the info. And that is strong to 51% assaults – it is client-side probabilistic verification, not… pic.twitter.com/OK81xBteER

— vitalik.eth (@VitalikButerin) December 3, 2025

Vitalik added that sharding has been a dream for Ethereum since 2015, and that knowledge availability sampling has been researched since 2017, all now actualized by Fusaka. Nonetheless, he highlighted three areas the place Fusaka’s sharding implementation stays incomplete. The primary considerations throughput on transactions on Layer-2 networks (L2s), however not on the Ethereum L1.

Vitalik listed a proposer–builder bottleneck because the second limitation and the shortage of a sharded mempool because the third lacking element which nonetheless must be developed.

Regardless of these gaps, Vitalik described Fusaka as a elementary step ahead within the blockchain’s preliminary design. He stated the subsequent two years will likely be dedicated to refining PeerDAS, rising its scale, making certain stability, utilizing it to develop L2 throughput, and finally flip it inwards to scale Ethereum L1 fuel, as soon as ZK-EVMs mature.

Vitalik’s rhetoric rang by way of the market. Derivatives confirmed a cautious undertone amongst speculative merchants, keeping track of the weak macro sentiment maintaining Bitcoin

BTC

$91 937

24h volatility:

0.8%

Market cap:

$1.83 T

Vol. 24h:

$71.06 B

value pinned beneath $95,000 because the breakdown beneath $83,000 late in November.

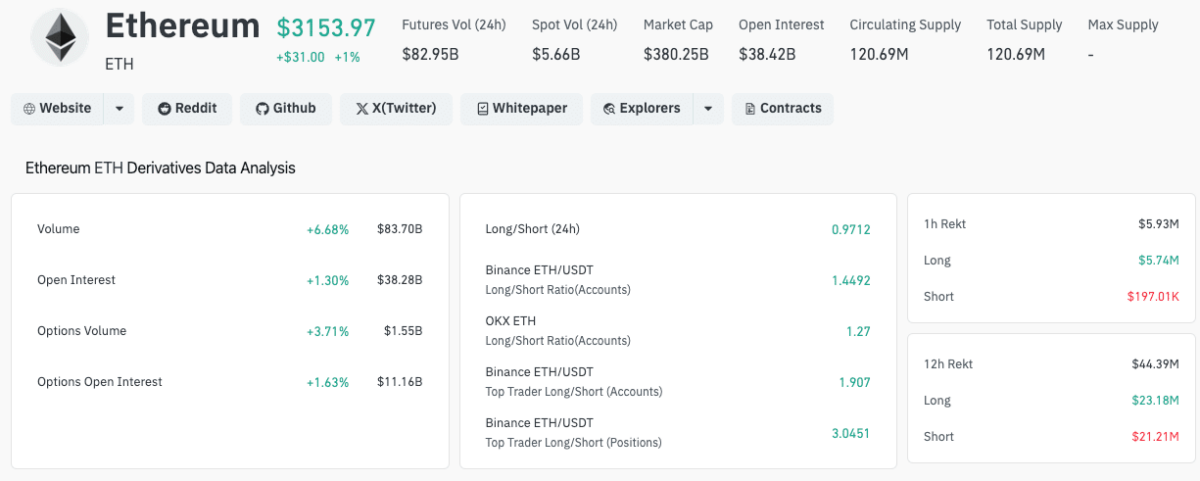

Ethereum (ETH) Spinoff Market Evaluation | Supply: Coinglass

Whereas the Fusaka announcement helped drive a 3% spot value enhance, Coinglass data confirmed restricted urge for food for leveraged lengthy positions. Buying and selling quantity rose 6.68% to $83.70 billion, however open curiosity elevated only one.30% to $38.28 billion. The muted response alerts reluctance amongst derivatives merchants to chase the rally.

The lengthy/quick ratio at 0.9712 exhibits that many of the incremental open curiosity got here from quick positions, indicating that merchants are positioning for the potential of an early pullback regardless of the technical breakthrough above $3,000.

Ethereum Value Forecast: What Subsequent for ETH Value After the Fusaka Improve?

ETH value consolidating $3,100 with sturdy assist at $2,880–$2,950 assist channel, as merchants in current classes recorded excessive profitability of over 63%. The win–loss ratio on short-term holders flipped constructive for the primary time this week, confirming improved spot participation following Vitalik’s Fusaka commentary.

Ethereum value is now making an attempt to interrupt above the mid-range resistance at $3,080. A clear candle shut above this degree exposes the higher band of the ascending channel close to $3,160, which aligns with the R1 pivot.

A transfer previous R1 would convey the subsequent upside goal at $3,240 into view, representing a 6.8% upside from present ranges. The R2 pivot at $3,310 is the eventual bullish goal if momentum accelerates and short-squeeze circumstances emerge.

Ethereum (ETH) Technical Value Evaluation | TradingView

The RSI sits in a balanced mid-50s vary, indicating room for enlargement with out coming into overbought territory. This implies ETH can maintain gradual appreciation with out fast exhaustion. Profitability traits stay supportive: with the vast majority of holders in inexperienced however not excessively so, the market isn’t close to a mass-distribution threat zone.

If ETH maintains momentum and derivatives shorts fail to achieve traction, Ethereum might retest $3,160 within the close to time period. Sustained bullish flows into subsequent week might put $3,240 in sight. However elevated quick participation and weak macro sentiment counsel this end result stays unlikely.

Bitcoin Hyper Presale Crosses $28 Million as Merchants Guess on Ethereum Rebound

Because the Ethereum value rebounds this week, early stage tasks like Bitcoin Hyper are drawing consideration.

Along with staking rewards of as much as 40%, Bitcoin Hyper (HYPER) guarantees lightning-fast and low-cost transactions aimed toward increasing Bitcoin’s use circumstances for funds, meme cash, and dApps.

Bitcoin Hyper Presale

HYPER has raised over $28.9 million, with its presale value at the moment set at $0.013235 per token. Potential traders can go to Bitcoin Hyper’s official presale website to get in early earlier than the subsequent value tier unlocks.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.