- A diversified portfolio with gold and Bitcoin is sensible as Bitcoin’s buying and selling quantity rises

- Gold’s stability offsets Bitcoin’s volatility

- This manner, traders might take part in Bitcoin’s upside potential with out compromising on danger parameters

Portfolio administration offers with managing danger. All danger can’t be averted, and a risk-averse investor wouldn’t need to take no danger.

As an alternative, a risk-averse investor would love greater risk-adjusted returns. Naturally, the upper the potential return, the upper the danger.

Traders construct portfolios of various belongings to seek out the very best risk-adjusted returns. Ideally, the belongings have a destructive correlation, thus bringing diversification advantages to the investor.

But it surely additionally is sensible to construct a portfolio with correlated belongings. Whereas the portfolio is riskier, another asset properties might attraction to traders keen to take a much bigger danger.

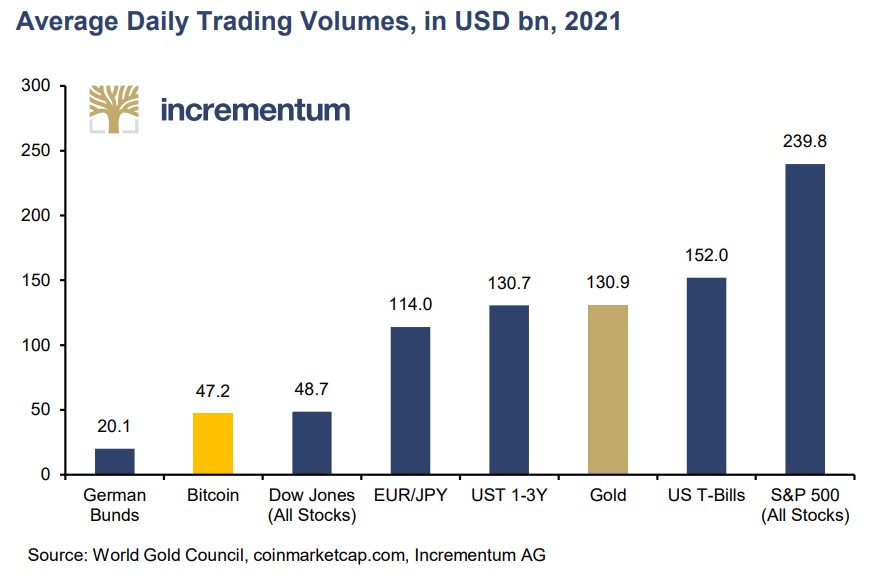

As Bitcoin’s common each day buying and selling quantity rises, such a diversified portfolio might include gold and Bitcoin.

Why so as to add gold and Bitcoin to a portfolio?

Diversified portfolios unfold the danger throughout uncorrelated belongings. A portfolio supervisor’s problem is discovering that diversification degree past which diversification brings no advantages anymore.

Historically, gold’s position in a portfolio is to carry stability. By including Bitcoin to a portfolio, one might take part within the cryptocurrency’s upside potential and, on the similar time, mitigate the danger related to Bitcoin’s volatility by combining it with gold.