Cardano (ADA) bulls will not be holding again their pleasure because the crypto market rewards affected person traders for enduring an extended crypto winter. Like most altcoins, ADA is following in the footsteps of its older sibling Bitcoin, which for the primary time in 2023 climbed to $35,000 on Tuesday.

The aggressive good contracts token has elevated by 10% to commerce at $0.2889 on the day, bringing cumulative features to fifteen% in every week and 17.3% in 30 days. Its market cap surged by 10% to $10 billion bolstered by a powerful 117% spike within the eighth-largest crypto’s buying and selling quantity to $418 million.

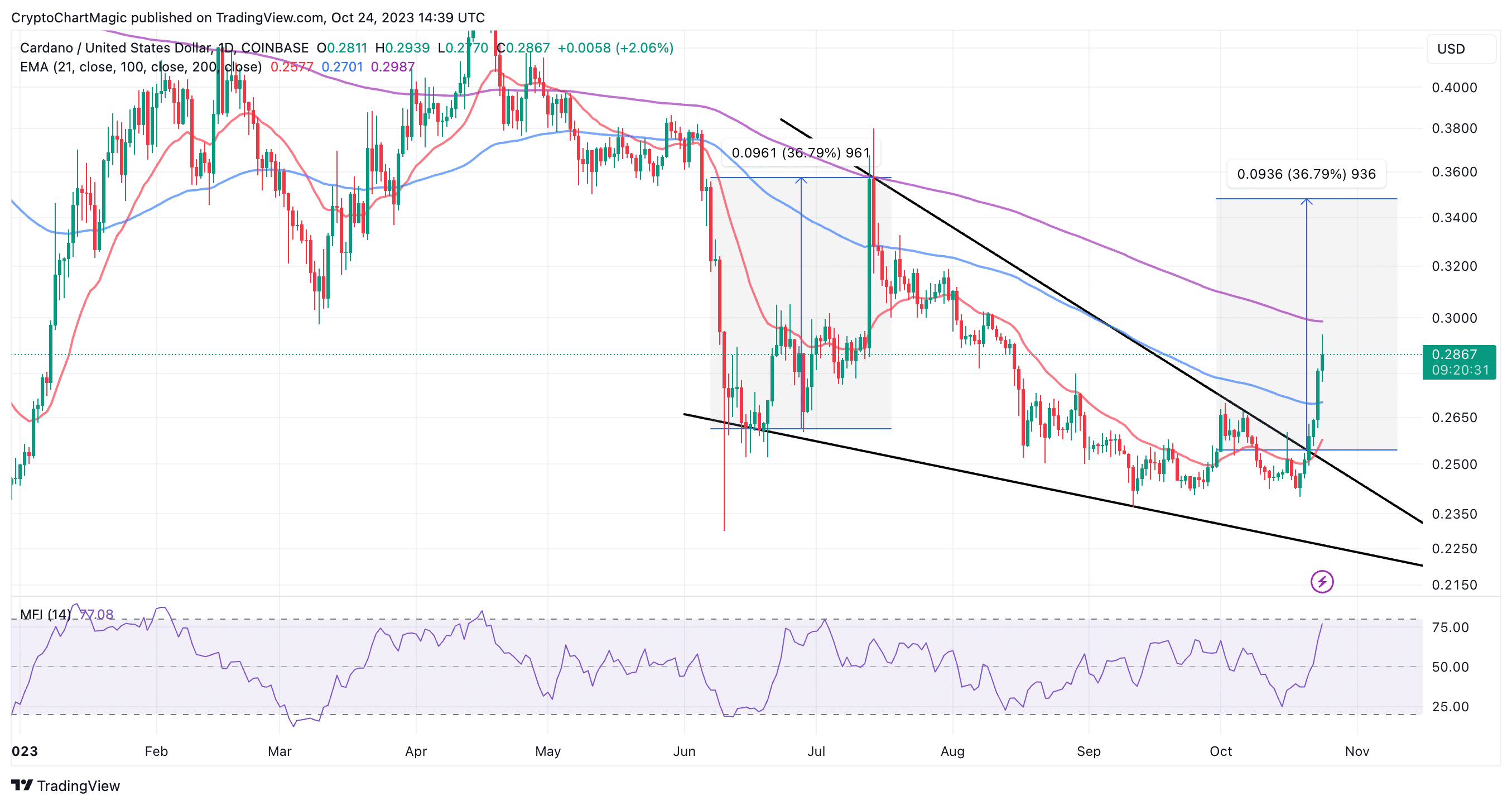

Based mostly on the prevailing technical outlook, Cardano price, which has not too long ago validated a pattern reversal sample, might climb to $0.3481 as a part of the preliminary restoration section into the 2024/2025 bull run.

If investors rally behind Cardano, the trail with the least resistance would stay to the upside, thus supporting the anticipated transfer to $1.

Cardano Worth Rallies As Builders Modify Staking Parameters

Based on an announcement shared on X (previously Twitter) by the Cardano Foundation, the group efficiently voted to make vital modifications to the community’s staking parameters.

“On account of the Stake Pool Operator [SPO]-Ballot and a subsequent analysis by the Parameters Committee, the Cardano Basis has efficiently submitted a transaction on the Cardano mainnet to decrease the minPoolCost parameter from 340 to 170 ADA,” the Cardano Basis stated by way of X.

The replace which has already been submitted to the mainnet noticed quick motion from pool operators like “Stake with Pleasure” which intends to “decrease minPoolCost to 170 completely, and Margin to 0% quickly” primarily based on market dynamics.

The Cardano min Pool Price charge has been dropped to 170 $ADA from 340.

SPOs can drop their charges beginning epoch 445 on October twenty seventh.

PRIDE will decrease minPoolCost to 170 completely, and Margin to 0% quickly, as market dynamics are assessed. #Cardano https://t.co/rXRrAyYiiR pic.twitter.com/PXbtto0xD5

— St₳kΣ with Pleasure 🌈 (@StakeWithPride) October 23, 2023

Based on a weblog put up revealed by the Cardano Foundation, minPoolCost was designed to be a defend in opposition to Sybil assaults and to make sure that pool operators have been assured a ground earnings to maintain their server operations operating.

The Cardano Basis clarified that the replace doesn’t “implement however enable the operators to cut back their ‘ground’ earnings.” This transfer would enable smaller pool operators extra room to regulate their operations amid altering market dynamics.

Cardano Worth Confirms 37% Rally

Following months of consolidation, Cardano price finally validated a falling wedge sample breakout. This sample types in direction of the top of a downtrend, marking a interval of consolidation the place bulls and bears tussle on a comparatively stage floor.

Worth motion above the higher descending trendline normally validates the uptrend and could be accompanied by a major improve in buying and selling quantity. Merchants buying and selling this sample place their purchase orders barely above the trendline, anticipating a breakout equal to the space between the 2 widest factors, as proven on the day by day chart.

As FOMO drives merchants and traders to capitalize on the bullish transfer, momentum intensifies behind the asset, sustaining the uptrend.

Bullish sentiment towards ADA will proceed to enhance, with ADA holding above two essential transferring averages, beginning with the 21-day Exponential Shifting Common (EMA) (pink) and the 100-day EMA (blue).

The place of the Cash Circulation Index (RSI) at 77.3 reinforces the bullish outlook. Motion into the overbought area above 80 is sure to draw extra traders to hunt publicity to Cardano.

Nonetheless, merchants should be cautious as a result of overbought situations imply {that a} correction is across the nook. That stated, a break above the quick resistance at $0.3 — the 200-day EMA is required to maintain investor curiosity intact. In any other case, merchants might be watching a possible reversal as ADA drops to hunt liquidity from decrease help areas just like the 100-day EMA at $0.2701 and the 21-day EMA at $0.2577.

Associated Articles

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: