Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Based mostly on experiences from analyst Moustache, Bitcoin could also be gearing up for its subsequent massive transfer. The world’s largest cryptocurrency climbed above $105,000 for the second time this week. At press time, it was buying and selling at practically $104,000, up 0.50% over the previous 24 hours.

Associated Studying

Historic RSI Breakouts Might Sign New Push

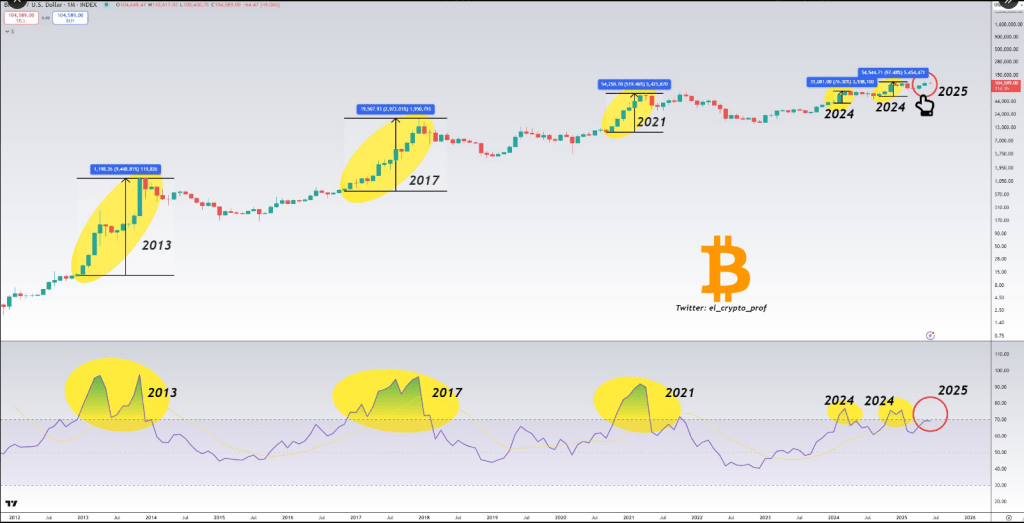

In keeping with the charts shared by Moustache, Bitcoin’s month-to-month Relative Energy Index (RSI) tends to surge into overbought territory simply earlier than main rallies. Again in July 2013, Bitcoin sat at $66, then jumped to just about $1,120 by November because the RSI hit excessive ranges.

An identical spike occurred in Might 2017, when BTC rose from about $1,300 to $19,700 by December. On April 1, 2021, Bitcoin reached $64,800 whereas the RSI once more climbed past its traditional vary. In 2024, these RSI peaks got here on March 1 at $73,800 and once more in November when it cleared $100,000.

#Bitcoin$BTC month-to-month RSI is so near getting into overbought territory.

The actual run begins with this. Take a look at the previous and you already know why. pic.twitter.com/8O1Z8RDuNs

— ⓗ 🧲 (@el_crypto_prof) June 19, 2025

Whales Stack Up Bitcoin Whereas Retail Pulls Again

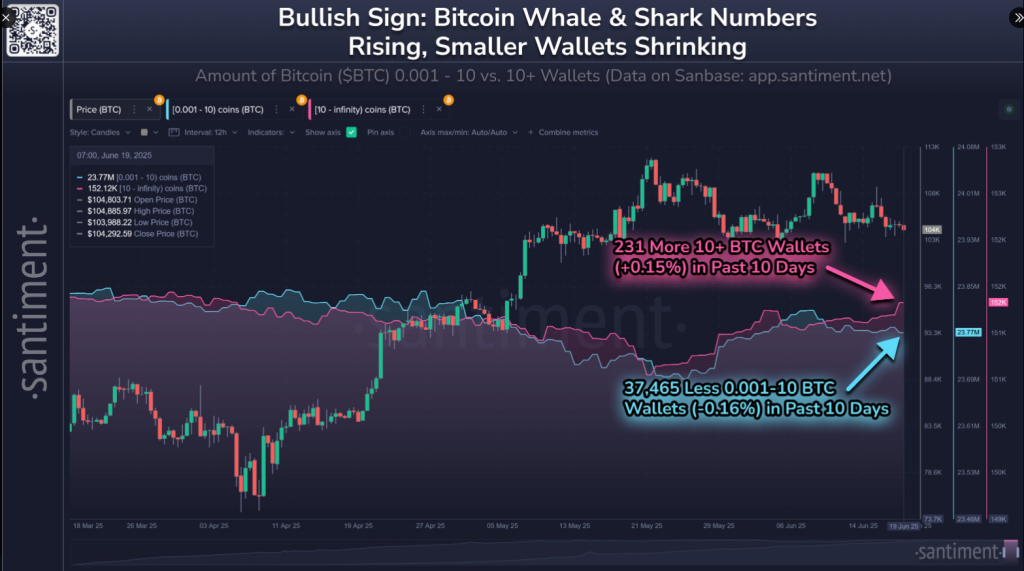

Based mostly on experiences from on‑chain knowledge supplier Santiment, giant holders are scooping up cash at the same time as smaller traders step apart. During the last 10 days, wallets with at the least 10 BTC rose by 231 addresses.

On the similar time, retail wallets holding between 0.001 and 10 BTC fell by 37,460 addresses. That shift suggests massive gamers are utilizing current dips as a shopping for probability. In previous cycles, comparable strikes by whales have come earlier than sustained value positive aspects.

📊 Bitcoin’s elite vs. mortal wallets are shifting in two completely different instructions as its market worth sits simply north of $104.3K.

🐳 Wallets with 10+ $BTC: +231 Wallets in 10 Days (+0.15%)

🦐 Wallets with 0.001 to 10 $BTC: -37,465 Wallets in 10 Days (+0.15%)When giant wallets… pic.twitter.com/uhZf6rPYvq

— Santiment (@santimentfeed) June 19, 2025

Overbought However Not Out

Analysts warn that an overbought RSI doesn’t all the time imply an instantaneous surge. In previous runs, Bitcoin usually paused or pulled again for days and even weeks earlier than the true rally received underway.

Generally the RSI stayed elevated whereas costs drifted sideways. In 2017, for instance, a correction adopted the excessive RSI however the broader uptrend saved going. Right this moment’s RSI is close to those self same ranges—and will linger there for some time.

Associated Studying

What Comes Subsequent For Bitcoin

Traders will likely be trying past technical cues. Macro occasions, ETF strikes and regulatory bulletins might information the following route. If establishments proceed to build up and retail continues to keep away from, value strain will develop.

However a shock headline or coverage change may go the opposite route. For now, the intersection of excessive RSI and rising whale demand suggests a setup that has fueled earlier bull frenzies.

Featured picture from Unsplash, chart from TradingView