After hitting its $124,000 all-time excessive again in July, the Bitcoin worth has now moved again right into a phase of struggling and consolidation. Whereas many have known as this out as solely a brief cease, anticipating the Bitcoin worth to proceed its ascent as soon as the decline is over, crypto analyst EXCAVO has taken a extra bearish outlook. In accordance with the analyst, the present market pattern really factors to the tip of the bull market and the start of the subsequent bear market.

Why The Bitcoin Value Will Crash

Within the evaluation, EXCAVO outlined why they believe that the Bitcoin bear market was really over. These got because the basic indicators of a prime of the market, and there have been three in whole. The primary of those is what the analyst known as “Common Optimism.”

This common optimism merely factors to the truth that everyone seems to be bullish at this level, along with seemingly bullish developments. EXCAVO factors to the truth that governments are actually accepting crypto and creating reserve funds as the rationale common optimism is an indication of the highest.

Associated Studying

Subsequent is that company shopping for has continued, particularly for the likes of Bitcoin. Public firms resembling Technique have amassed massive reserves of Bitcoin, with Ethereum treasuries not ignored. These treasury firms have now purchased tens of billions of {dollars}’ value of Bitcoin and Ethereum.

Final however not least, is that positive news around crypto is presently dominating the media. The analyst believes that with a lot optimistic information and traders being reluctant to promote as they anticipate greater costs, resembling $200,000, $300,000, and $500,000, it’s a sign that the Bitcoin worth has topped.

The Exit Technique

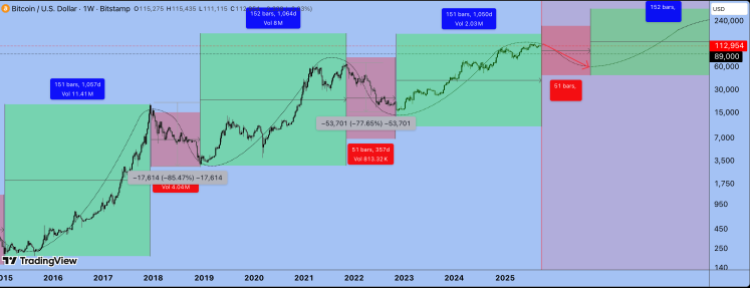

Taking part in into the concept that the Bitcoin worth has topped and is headed into another bear market, the crypto analyst defined that they’ve offered every part. The plan is to attend till September 2026 earlier than shopping for again in. In accordance with the crypto analyst’s chart, they count on the Bitcoin worth to fall beneath $61,000 right now.

Associated Studying

The analyst additionally backs this up with the cycle principle, which says there are round 151 weeks of development adopted by 51 weeks of decline. Going by this, the expansion part is already accomplished, and between September 13 and October 6 is the beginning of the reversal zone that begins the bear market decline.

Moreover, the crypto analyst additionally dismisses the idea of an altcoin season. Because of the massive variety of cryptocurrencies proper now, sitting at over 1 million cash, EXCAVO says it’s not potential for all cash to be pushed up on the identical time, prefer it did in 2017. Somewhat, there will probably be selective pumps on altcoins that gamers are keen on.

“I’ve not grow to be a bear perpetually. I consider Bitcoin will hit $300,000. However not within the coming months,” the analyst acknowledged. “It will likely be value that in 2.5 years, after a wholesome 50-60% correction from the height.”

Featured picture from Dall.E, chart from TradingView.com