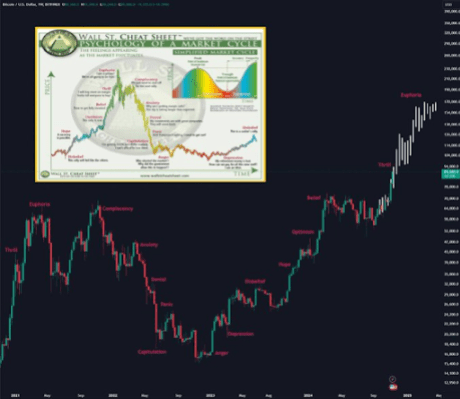

Crypto analyst Ash Crypto has revealed that Bitcoin has entered the ‘thrill’ section. The analyst additional defined what to anticipate from the flagship crypto shifting ahead, having entered this section of the bull run.

What To Count on From Bitcoin In ‘Thrill’ Part

In an X put up, Ash Crypto revealed that Bitcoin is getting into the joys section. Based mostly on this, he instructed market contributors to count on excessive volatility and extra liquidation. General, the analyst remarked that the Bitcoin worth pattern shall be to the upside because it continues to hit new all-time highs (ATHs). He predicts that BTC will rally to as excessive as $150,000.

Associated Studying

His accompanying chart confirmed that the joys section of the market cycle is when traders and merchants might get overexcited in regards to the bull rally and resolve to go all in with leverage. Nonetheless, as Ash Crypto indicated, this might go incorrect since there shall be loads of liquidations throughout this era.

Regardless of this being a bull market, the Bitcoin worth has, at totally different instances, corrected after reaching new highs and flushing out over-leveraged longs within the course of. Alex Thorn, Head of Analysis at Galaxy Analysis, additionally defined earlier within the 12 months that bull markets aren’t straight strains up and that important worth corrections are anticipated.

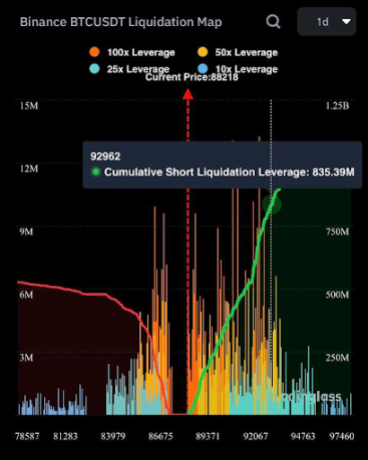

Nonetheless, in the long term, the bears get the brief finish of the stick in a bull run as costs pattern upwards. Crypto analyst Ali Martinez lately revealed that over $800 million shall be liquidated if Bitcoin rebounds in direction of $93,000. This can be a worth stage that BTC simply reached two days in the past because it rallied to a brand new ATH of $93,400.

The Bitcoin worth has since corrected and dropped beneath $90,000. This was partly as a result of US PPI inflation data, which was increased than forecasted. That improvement has solid some doubts about whether or not the Fed shall be prepared to additional lower rates of interest in December.

Extra Value Correction In The Quick Time period?

Ali Martinez advised that the Bitcoin worth may expertise additional declines within the brief time period. In an X put up, the crypto analyst stated that the each day Relative Strength Index (RSI) reveals that Bitcoin is in overbought territory, which usually alerts a possible worth correction forward.

Associated Studying

This worth correction may additionally occur as Bitcoin traders look to safe earnings. Martinez revealed that $5.2 billion in BTC earnings have been realized and that the sell-side threat ratio has surged to 0.524%. He warned market contributors to remain alert and proceed with warning. Bhutan Government falls amongst whales which can be already securing earnings as they lately bought $33 million price of BTC, simply weeks after promoting $66 million BTC.

On the time of writing, the Bitcoin worth is buying and selling at round $87,780, down over 2% within the final 24 hours, in keeping with data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com