A crypto analyst has forecasted a 98% Bitcoin price crash following a considerable rally to $250,000. Apparently, the analyst is assured that Bitcoin will ultimately attain this formidable quarter-million-dollar goal. Nonetheless, they warning that after earnings are taken at this high, Bitcoin might decline considerably to new lows.

Bitcoin Value Projected To Crash 98%

On October 30, crypto analyst Gert van Lagen told his 106,700 followers on X (previously Twitter) that the Bitcoin value might drop to the $24,000 vary as soon as it hits $250,000. Lagen revealed that many traders have felt overly assured that Bitcoin might by no means expertise a 98% crash once more, particularly with the introduction of Spot Bitcoin Exchange Traded Funds (ETFs).

Associated Studying

Countering this overconfidence, the crypto analyst asserted that ETF assets are inclined to lose important worth in periods of financial recession. Consequently the analyst predicts that the Bitcoin value might first expertise a “blowoff” of as much as $250,000, marking a historic milestone. At this level, many traders would begin taking earnings, triggering huge selling pressure as they liquidate forward of potential value declines.

Following Lagen’s evaluation, as soon as the market sentiment for the Bitcoin price shifts, institutional traders, who might have been the prime drivers for the $250,000 rally, are prone to unload their holdings. Lagen has described this huge sell-off because the “shake out of the century,” when the Bitcoin value might plummet dramatically to 98% of its excessive.

This means that after hitting $250,000, the BTC price could crash to $2,000, buying and selling beneath Ethereum’s present value, which is buying and selling at $2,635, in accordance with CoinMarketCap.

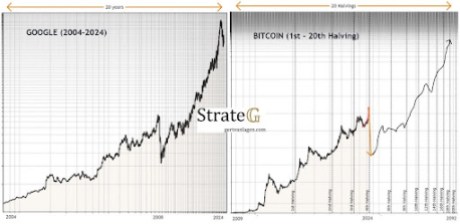

Highlighting the reasoning behind this surprising bearish value crash, Lagen revealed that by plotting the Bitcoin value on the “Syslog scale,” it clearly reveals a Excessive-Time Body (HTF) rising wedge, which factors at a value goal between $1,000 and $10,000. He additionally disclosed in a a lot earlier publish that if Bitcoin does expertise his projected shakeout and value decline to $1,000, it can take 4 halving events earlier than the cryptocurrency can return to its $200,000 value excessive.

BTC To Break Above $73,000 And Rally Larger

As of writing, the Bitcoin price is buying and selling at $72,433 after experiencing greater than a 7.8% improve this week. Lagen has stated that the Bitcoin value motion factors to a attainable “triangle bearish continuation sample,” which generally indicators a possible downward development in a cryptocurrency.

Associated Studying

The crypto analyst has set a brand new goal of $71,200 for Bitcoin, suggesting that if the cryptocurrency follows by way of with the triangle bearish continuation sample, its price could decline significantly. On the flip aspect, Lagen has predicted that if Bitcoin can break the $73,000 threshold, it might invalidate the triangle bearish continuation sample. This might point out the tip of the downtrend and probably result in a stronger upward momentum.

Featured picture created with Dall.E, chart from Tradingview.com