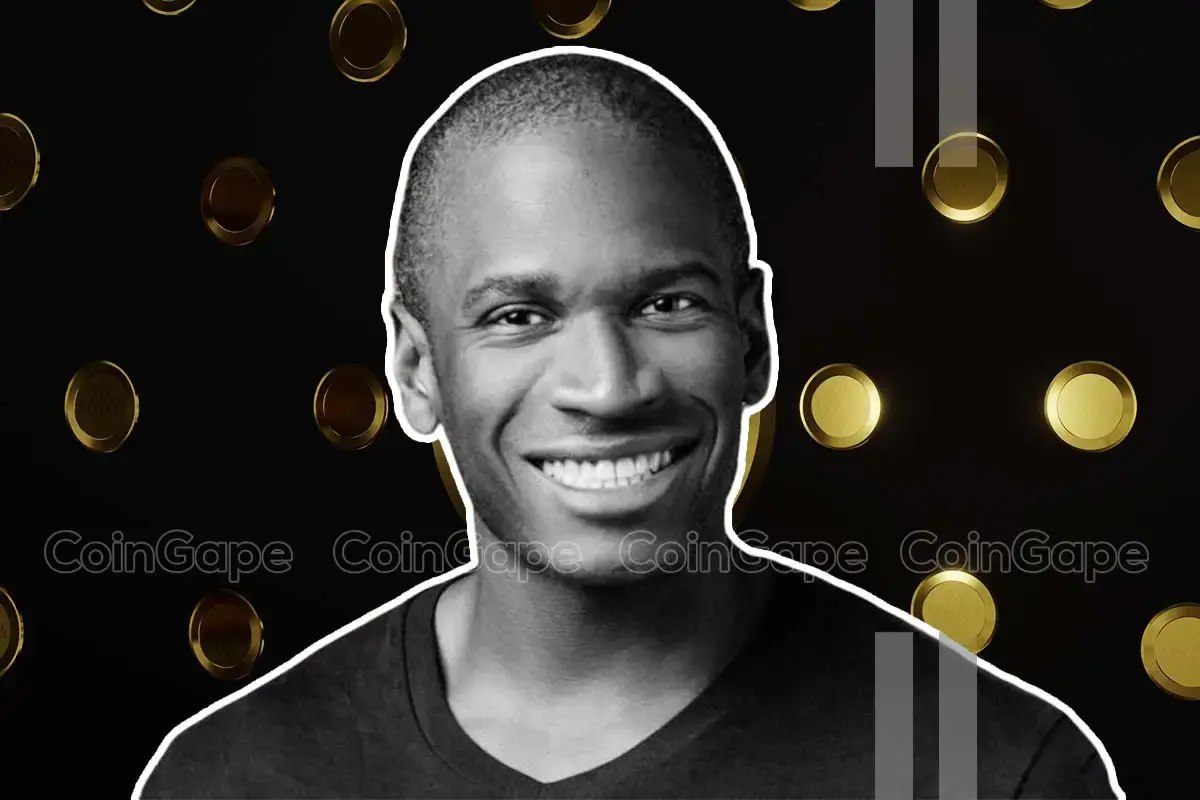

Bitcoin bull and former BitMEX CEO Arthur Hayes has shared that Bitcoin’s dominance within the cryptocurrency market will proceed to rise.

Hayes revealed in a latest tweet that he has been avoiding altcoin investments regardless of their lowering costs.

Arthur Hayes Predicts Bitcoin Dominance Improve

Arthur Hayes has taken a transparent stance on the present market scenario. He’s actively including to his Bitcoin place whereas avoiding altcoin investments. Hayes additionally spoke a few potential interest rate cut within the U.S. and defined the way it might occur in one in all his latest tweets.

In his recent tweet, the previous BitMEX CEO said: “Been nibbling on $BTC all day, and shall proceed. Shitcoins are getting in our strike zone however I feel #bitcoin dominance retains zooming in the direction of 70%.”

Been nibbling on $BTC all day, and shall proceed. Shitcoins are getting in our strike zone however I feel #bitcoin dominance retains zooming in the direction of 70%. So we’re not gorging on the shitcoin grocery store. Bear in mind, cash printing is the one reply they’ve.

— Arthur Hayes (@CryptoHayes) April 7, 2025

Arthur Hayes particularly pointed to financial coverage because the driving issue behind his bullish Bitcoin outlook. He added: “So we’re not gorging on the shitcoin grocery store. Bear in mind, cash printing is the one reply they’ve.” This remark suggests Hayes believes central financial institution insurance policies will proceed to favor Bitcoin as a hedge in opposition to inflation and foreign money devaluation.

The 70% dominance goal is a considerable improve from Bitcoin’s present market share. Such a shift would suggest main capital flows from altcoins again into Bitcoin.

Whale Accumulation Reaches Peak Ranges

On-chain analytics agency Glassnode has recognized a sample of Bitcoin accumulation among the many largest holders. Based on their information, Bitcoin whales holding greater than 10,000 BTC reached an almost excellent accumulation rating of roughly 1.0 on the month’s flip. Which means that there’s intense shopping for exercise over a 15-day interval.

Whales holding >10K $BTC briefly hit an ideal accumulation rating (~1.0) on the flip of the month, reflecting intense 15-day shopping for. The rating has since eased to ~0.65, nonetheless signaling regular accumulation.

In the meantime, cohorts from <1 $BTC as much as 100 $BTC have intensified their… https://t.co/cEo3F7Paid pic.twitter.com/7udA7G8nSM— glassnode (@glassnode) April 7, 2025

Whereas this peak accumulation rating has since moderated to round 0.65, it nonetheless exhibits continued regular shopping for from these main market members. This degree of whale accumulation stands in stark distinction to the conduct of smaller Bitcoin holders.

Glassnode famous: “In the meantime, cohorts from <1 $BTC as much as 100 $BTC have intensified their distribution, all trending towards 0.1–0.2. A transparent and widening divergence between small and enormous holders.”

This distinction in conduct between giant and small holders typically precedes main market actions. Traditionally, durations the place whales accumulate whereas retail sells have preceded bullish phases within the Bitcoin market cycle.

Bitcoin Establishes assist at $74,000

Bitcoin price seems to have established a assist degree round $74,000, in accordance with information shared by Glassnode. Their evaluation comes at a time when Bitcoin and altcoins have misplaced double-digit worth within the final 24 hours.

The information exhibits this value level aligns with “the primary main provide cluster under $80K – over 50K $BTC at $74.2K.” This provide zone is primarily composed of buyers who had been energetic out there for roughly 5 months.

The power of this assist degree will probably be vital for Bitcoin’s short-term value motion because the market strikes by way of its present volatility. If this assist holds, it could possibly be a basis for a possible restoration towards earlier highs.

OKX associate Ted has highlighted a key technical degree that would determine Bitcoin’s subsequent directional transfer. “BTC is attempting to reclaim the weekly 50-EMA degree. This has acted as a bull/bear line for BTC,” Ted famous on X.

$BTC is attempting to reclaim the weekly 50-EMA degree.

This has acted as a bull/bear line for BTC.

If BTC fails to reclaim it, count on a correction in the direction of $69K-$70K (2021 highs), and even the $67K (Saylor common entry) degree could possibly be retested.

In case BTC reclaims this degree, a… pic.twitter.com/CtsyZ7q3FH

— Ted (@TedPillows) April 7, 2025

Based on his evaluation, failure to reclaim this transferring common might set off additional draw back. He talked about potential correction targets at “$69K-$70K (2021 highs) and even the $67K (Saylor common entry) degree.” Conversely, efficiently reclaiming the 50-EMA might spark a “reduction rally.”

Ted’s evaluation additionally comes at a time when the crypto liquidations breached $600 million and Bitcoin fell under the vital $80,000 degree.

Disclaimer: The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: