Arthur Hayes, the co-founder of BitMEX, as we speak expressed a bleak outlook for the Bitcoin value’s speedy future. On his X profile, Hayes revealed his private market maneuver, stating, “BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky quick. Pray for my soul, for I’m a degen.”

Why Hayes Presumably Expects A Bitcoin Worth Crash

Whereas Hayes shunned offering specific causes for his prediction, the timing of his assertion intently aligns with important US financial indicators set to be launched this Friday. The US jobs knowledge has been a crucial issue for market analysts recently. The Kobeissi Letter analysts, commenting on the state of affairs, famous the rising affect of unemployment knowledge on Federal Reserve insurance policies.

Associated Studying

They defined by way of X that, “Prediction markets are actually pricing in 4 price cuts in 2024, or 100 bps of cuts, for the primary time because the August fifth crash, in accordance with Kalshi. During the last 2 days, prediction markets have priced-in a further price reduce in 2024. This comes as labor market knowledge has deteriorated across the board. It’s clear that unemployment knowledge is shortly turning into the first driver of Fed coverage, together with inflation.”

In accordance with the analysts, as we speak’s jobs report would be the key think about figuring out if the US Federal Reserve (Fed) will reduce rates of interest by 50 bps or 25 bp. The subsequent FOMC meeting takes place from September 17-18, 2024. “If the roles report is in-line with expectations, or higher, we imagine a 25 bps rate cut is coming. Rate of interest expectations look like shifting too dovish once more,” The Kobeissi analysts imagine.

Notably, the deteriorating labor market state of affairs was simply highlighted by knowledge launched earlier within the week. US job openings, as reported by the JOLTs survey, fell to 7.67 million in July from the earlier 7.91 million in June, marking the bottom degree since January 2021. Analysts had anticipated a determine round 8.09 million, making the precise knowledge a big miss from expectations.

Associated Studying

Since March 2022, job openings have declined by an alarming 4.51 million, or 38%, a discount that The Kobeissi Letter describes as “MASSIVE.” They added, “Essentially the most notable drop was seen in development openings which fell to 248,000 in July, their lowest since October 2020. In the meantime, the ratio of job vacancies to unemployed staff fell to 1.07 in July, according to 2018 ranges.”

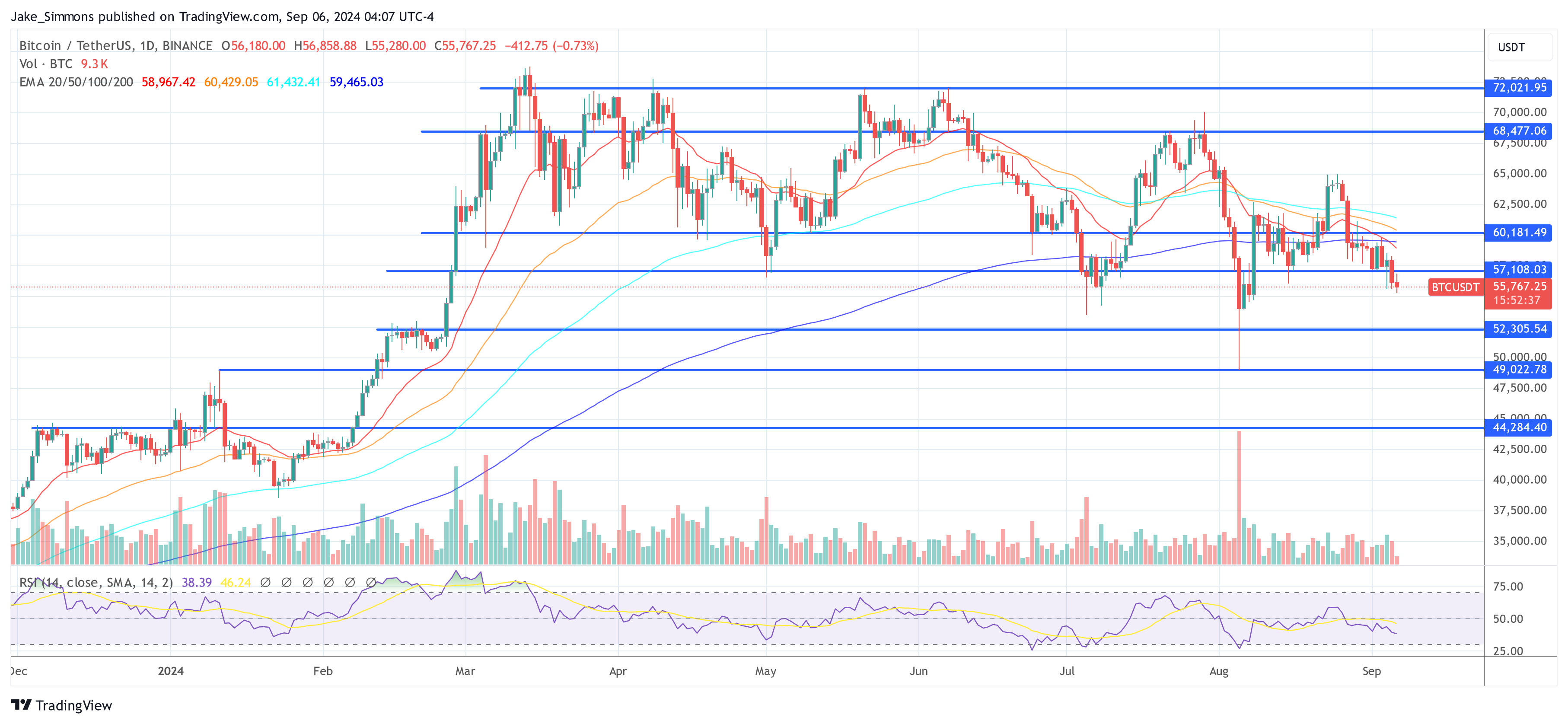

This backdrop of weakening job knowledge and revised financial forecasts has undoubtedly contributed to the unhealthy sentiment on the Bitcoin market. Hayes appears to count on extra unhealthy macro knowledge, which he believes may push the Bitcoin value beneath $50,000.

Is $46,000 The Backside?

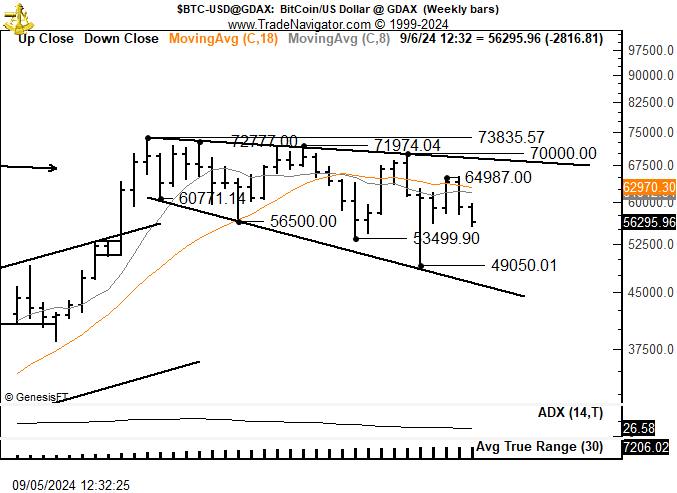

Including to the refrain of bearish outlooks, famend dealer Peter Brandt additionally offered his technical evaluation, observing what he phrases an “inverted increasing triangle or a megaphone” sample in Bitcoin’s weekly chart. Brandt highlighted the potential for Bitcoin to check a decrease boundary round $46,000, underscoring a dominance of promoting strain over shopping for curiosity out there.

He identified, “That is known as an inverted increasing triangle or a megaphone. A take a look at of the decrease boundary can be to 46,000 or so. A large thrust into new ATHs is required to get this bull market again on monitor BTC. Promoting is stronger than shopping for on this sample.”

At press time, BTC traded at $55,767.

Featured picture from YouTube, chart from TradingView.com