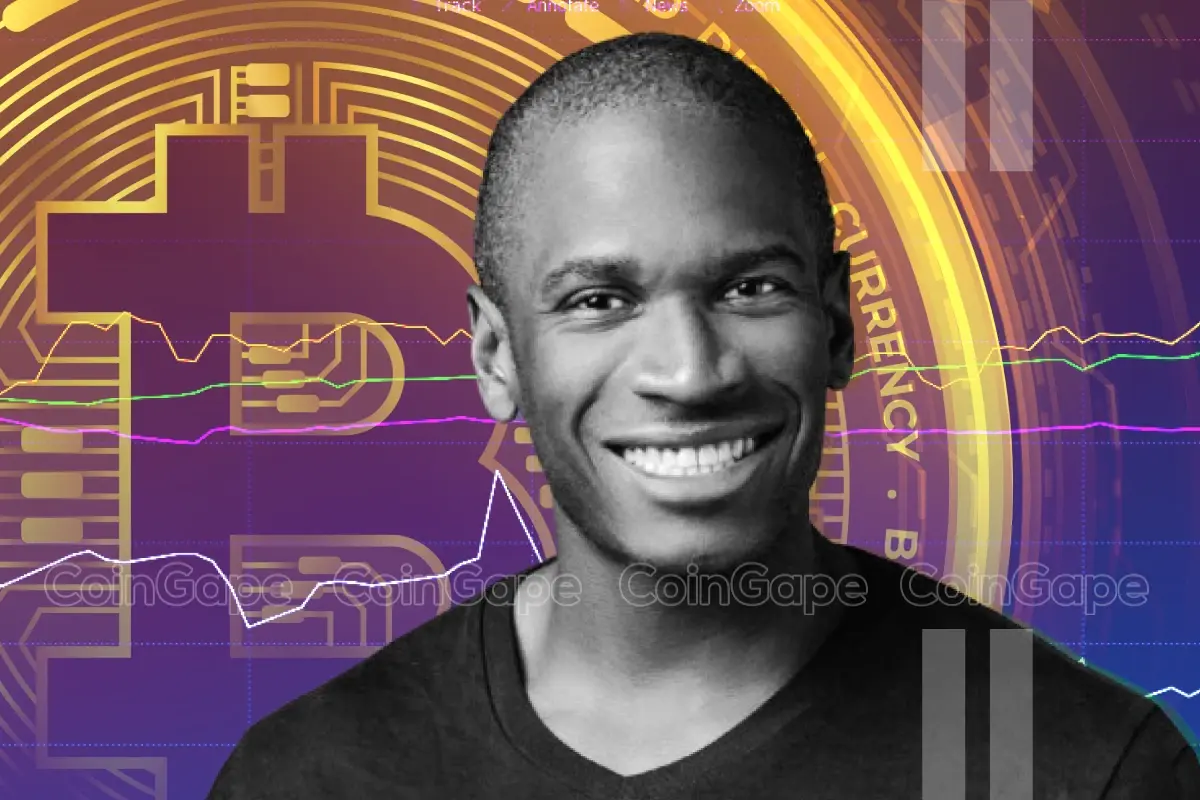

Arthur Hayes, the co-founder of the BitMEX crypto trade, has predicted that the quantitative easing (QE) measures that a number of governments are adopting will profit Bitcoin and the broader crypto market. He additionally revealed how market members may gain advantage from this projected value growth for BTC.

Arthur Hayes Expects Bitcoin To Profit From Cash Printing

Hayes recommended that Bitcoin will profit from world governments printing extra money to suppress volatility. In his latest blog post, ‘Volatility supercycle,’ he said that each one this fiat should go someplace and remarked that it’s going to discover its means into Bitcoin and crypto. He added that BTC “is essentially the most technically sound means on this trendy digital world to steadiness the profligacy of the ruling elite.”

Arthur Hayes’ assertion follows the latest US Fed fee cuts and China’s stimulus bundle to revive its financial system. The Individuals’s Financial institution of China (PBoC) Governor Pan Gongsheng announced fee cuts within the reserve ratio requirement and short-term rates of interest. China additionally plans to inject liquidity into the nation’s shares.

Because the MitMEX founder predicts, these governments’ quantitative easing (QE) measures present a bullish outlook for BTC. A few of this liquidity will circulation into the flagship crypto, inflicting its value to rise. In step with this, Hayes said that the objective of each investor, dealer, and speculator is to “purchase Bitcoin on the least expensive price doable.”

He added that this might imply being paid in BTC, participating in mining companies, or borrowing fiat at low charges to buy the flagship crypto. In the meantime, the BitMEX founder warned in opposition to utilizing leverage to purchase Bitcoin, stating that one is supposed to carry the asset for a protracted interval.

There Are Dangers Concerned

Arthur Hayes warned that the “actual danger” in adopting this Bitcoin technique is when the elites can not suppress volatility, which then surges to its pure degree. He said that this might result in a system reset, alluding to a monetary collapse. He predicts the whole lot will go down when that occurs, though he claims BTC will fall much less.

As such, he remarked that those that adopted the Bitcoin technique will nonetheless outperform, despite the fact that their general wealth will drop. Regardless of the idea that BTC and crypto property can present a haven for traders, Hayes remarked that nothing is “risk-free” within the universe.

For now, Hayes expects Bitocin to take pleasure in clean crusing because the governments proceed to ease financial situations. He predicts that the US Federal Reserve will proceed to chop rates of interest whereas the banking system produces extra {dollars}. The Fed revealed they might cut rates by two extra 25 foundation factors (bps) this yr.

Arthur Hayes said that nationwide governments in Europe will power banks to problem extra loans to native firms to allow them to present jobs and rebuild the crumbling infrastructure. The crypto founder expects China to print cash if the Fed decides to take action. He claimed that will simply be the beginning and that the true “bazooka” would start when China’s President Xi Jinping instructs banks to problem extra credit score.

As financial situations start to ease, Hayes predicts that the fiat worth of Bitcoin and different crypto property will begin to pump. He once more suggested anybody holding fiat to take a position it within the crypto market.

Disclaimer: The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: