September was a breakout month for Binance-backed decentralized trade Aster. The platform notched three main data that mirror its speedy ascent in decentralized finance (DeFi).

From Ethereum inflows to overtaking rivals in buying and selling exercise, Aster’s progress is attracting merchants, whales, and influencers alike.

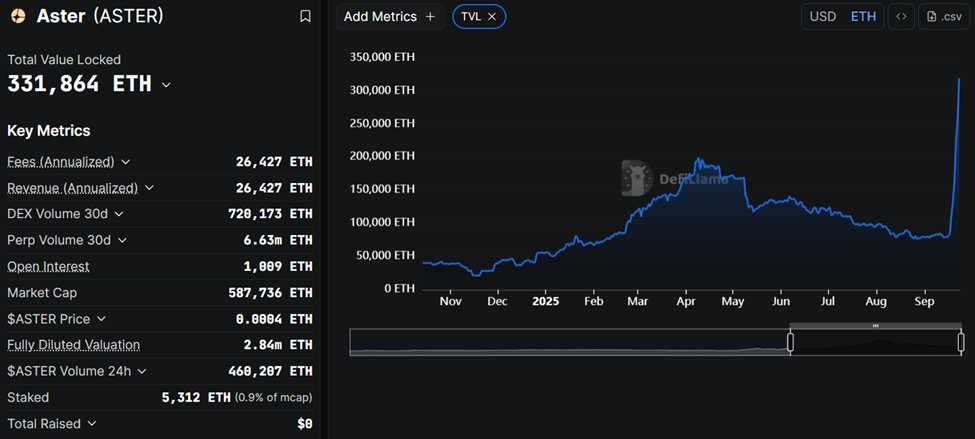

Ethereum Locked in Aster Surpasses 331,000

In accordance with DefiLlama knowledge, the quantity of ETH locked in Aster reached 331,864 Ethereum as of September 23. This follows a pointy spike within the remaining week of the month.

Sponsored

Sponsored

The milestone displays a wave of liquidity rotation into the protocol. It suggests customers more and more view Aster as a aggressive hub for decentralized buying and selling and yield opportunities.

Liquidity inflows usually act as a barometer of consumer confidence, suggesting that Aster has moved from a speculative launch right into a platform the place capital is sticking.

This sturdy basis is important for sustaining volumes, decreasing slippage, and supporting bigger gamers on-chain.

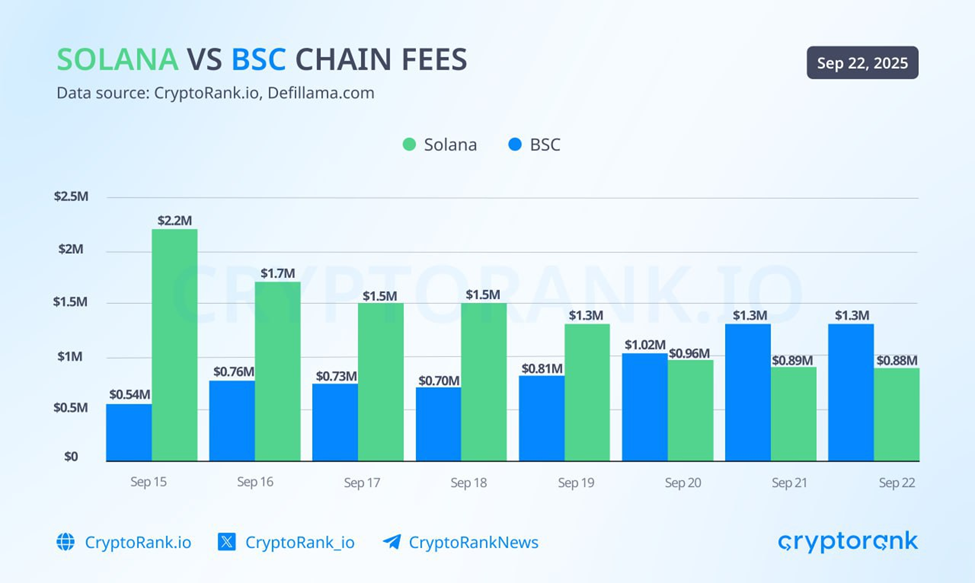

BNB Chain Flips Solana in Day by day Charges

Aster’s affect has additionally rippled into broader blockchain competitors. Knowledge from CryptoRank exhibits that BNB Chain overtook Solana in daily chain fees between September 20 and 22.

From September 15 to 19, Solana led with day by day charges peaking at round $2.2 million, in comparison with BNB Chain’s $0.6–$0.8 million.

Sponsored

Sponsored

Nonetheless, the tables turned following Aster’s launch and its liquidity pull. BNB Chain charges climbed to $1.1–1.4 million per day, whereas Solana cooled close to $0.85–0.95 million.

Charges are broadly thought-about a easy but highly effective sign of actual demand, as they point out how much users are willing to pay for blockspace.

The shift means that Aster has been a serious catalyst, bringing exercise again to BNB Chain. It has additionally strengthened its aggressive place in opposition to Solana within the ongoing battle for customers and liquidity.

Aster Tops Hyperliquid in DEX Buying and selling

Maybe essentially the most placing milestone was Aster overtaking Hyperliquid in day by day decentralized exchange (DEX) buying and selling volumes.

For 3 consecutive days, Aster’s 24-hour DEX volume led the market, with $793 million recorded at its peak.

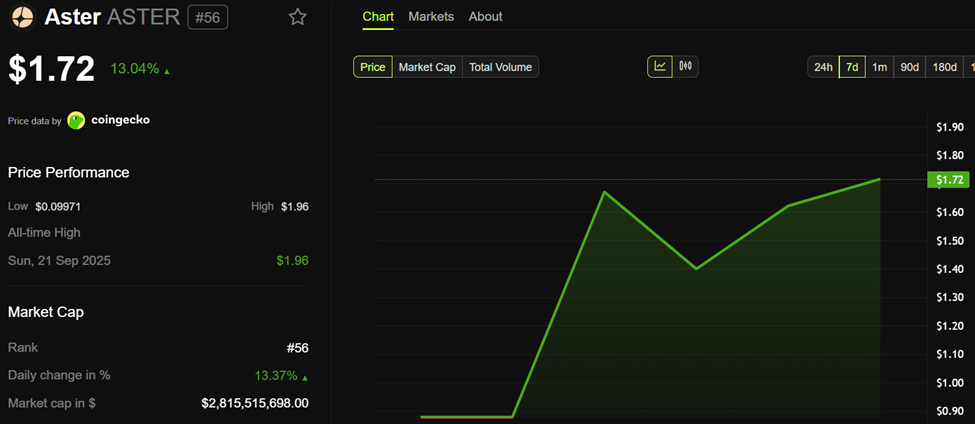

The surge coincided with an 800% rally in Aster’s native token, which just lately hit an all-time excessive close to $2. Whales booked multimillion-dollar earnings whereas retail merchants flocked to the platform for liquidity and reward incentives.

Sponsored

Sponsored

This mixture has amplified hypothesis and adoption, giving Aster the uncommon community results so early in a venture’s lifecycle.

Nonetheless, Hyperliquid has since climbed the ranks, transferring from place 9 to seven on DEX quantity metrics, with Aster slipping from place six to 10.

Consideration from CZ, MrBeast, and the Group

Aster’s momentum has not are available isolation. Public assist from Binance founder Changpeng Zhao gave the venture early legitimacy.

In the meantime, influencer participation, together with consideration from YouTube star MrBeast, has broadened its attain past conventional crypto circles.

Sponsored

Sponsored

MoneyLord, a preferred consumer on X, added to the thrill, noting that Aster is producing $1.7 million in day by day income. Based mostly on this, the consumer forecasted a climb towards $10 million per day.

He emphasised {that a} portion of the supply will be burned and group customers rewarded, whereas whales profit from having the ability to execute giant trades with out “getting hunted.”

With practically 332,000 ETH locked, BNB Chain charges surging, and strides in DEX volumes, Aster has cemented itself as one of the intently watched tasks in DeFi this month.

As of this writing, ASTER is buying and selling for $1.72, up by over 13% within the final 24 hours.

Nonetheless, the problem forward is whether or not it may possibly maintain momentum past the hype, seeing because it has already misplaced its edge over Hyperliquid on DEX quantity metrics.