The road demarcating cryptos and conventional monetary devices has turn into a supply of rigorous debate amongst market members and regulators. The US Securities and Change Fee (SEC) has emerged as a central determine on this dialog, primarily as a consequence of its position in regulating securities.

Current choices by the SEC have now firmly labeled sure cryptos as securities, a transfer with substantial implications for traders, exchanges, and the broader trade.

The SEC’s Perspective on Cryptos and Securities

The SEC has asserted that many digital tokens represent securities, making use of requirements established below the Securities Act of 1933 and additional interpreted by a number of landmark court docket choices.

The pivotal case, SEC v. W. J. Howey Co., set forth the “Howey Test” standards to find out whether or not a transaction qualifies as an funding contract, a kind of security. This take a look at checks if a transaction entails an funding in a typical enterprise, anticipating income primarily from others’ efforts.

Applying these criteria to the cryptocurrency market, the SEC has underscored the chance that a number of tokens meet this definition, due to this fact requiring adherence to established securities legal guidelines.

In a major transfer, the SEC has just lately pinpointed a number of cryptocurrencies as securities. This crypto securities listing encompasses:

The inclusion of Filecoin was notably contentious, contemplating its broad buying and selling base on a number of US exchanges and its earlier plans for a proposed belief with Grayscale Investments. The sudden SEC dedication resulted within the termination of the belief proposal, leaving stakeholders to grapple with the implications.

“Grayscale doesn’t imagine that FIL is a safety below the federal securities legal guidelines and intends to reply promptly to the SEC employees with a proof of the authorized foundation for Grayscale’s place,” the corporate stated.

Understanding the Penalties of Buying and selling Crypto Securities

Promoting unregistered securities typically constitutes a violation of US law. This regulation necessitates that securities bear registration with the SEC earlier than their sale to the general public.

Whereas there are exemptions to this rule—like gross sales to accredited traders or personal placements—unregistered securities’ sale might result in vital penalties, together with fines and revenue disgorgement.

In mild of the SEC’s new classification, exchanges listing these tokens could face legal scrutiny. Some US exchanges already listing over a dozen cryptos the SEC classifies as unlawful to promote, which could set off regulatory actions and subsequently impact their operations.

The panorama has undoubtedly turn into extra advanced for traders in these newly labeled securities. The regulatory compliance required for securities buying and selling means traders should think about components akin to securities legal guidelines and rules.

Moreover, the marketability and liquidity of these tokens could be affected, given their new authorized standing.

Buyers could discover that buying and selling alternatives for these tokens turn into restricted if exchanges delist them to keep away from potential regulatory penalties. This might, in flip, scale back the liquidity of those tokens, making them more difficult to purchase or promote available in the market.

Crypto exchanges itemizing these securities face their very own set of challenges. From a regulatory perspective, they risk sanctions and legal repercussions in the event that they proceed to listing these securities with out the mandatory registration or exemptions.

Mitigating the Dangers: Authorized Recommendation is Essential

Given the legal complexities surrounding the sale of unregistered securities and the particular exemptions which may apply, obtaining professional legal advice has turn into important for all stakeholders on this house. Buyers, challenge creators, and particularly crypto exchanges should equip themselves with a nuanced understanding of the regulatory surroundings to navigate these evolving dynamics efficiently.

Critics argue that the SEC’s current enforcement actions and interpretive decisions might stifle blockchain and crypto trade innovation.

“Regulation by enforcement doesn’t work. It encourages corporations to function offshore, which is what occurred with FTX,” said Coinbase CEO Brian Armstrong.

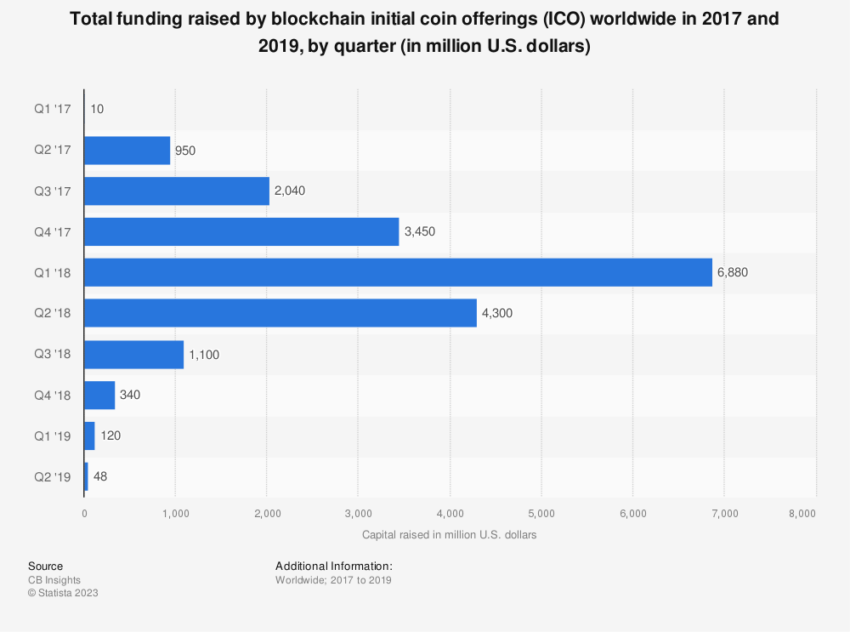

Blockchain initiatives usually increase funds via preliminary coin choices (ICOs), which might be deemed securities choices below the SEC’s interpretation. Due to this fact, these projects must adhere to strict regulatory requirements, usually cumbersome and costly, discouraging smaller modern initiatives.

The SEC’s approach could shift some actions to extra lenient jurisdictions. Nonetheless, given the worldwide nature of cryptos, US traders might nonetheless be not directly affected.

For example, a challenge could block US traders from taking part in an ICO to keep away from the attain of US securities legal guidelines. This might restrict US traders’ alternatives to take part in modern blockchain initiatives.

Cryptos Securities: Trying Forward

The recent actions by the SEC in classifying sure cryptos as securities symbolize a major shift within the regulatory panorama. The fallout of those determinations is prone to have far-reaching penalties, not only for the digital tokens in query but in addition for the broader crypto trade.

Reclassifying these cryptos as securities might result in decreased liquidity, restricted market entry, and potential authorized repercussions for unregistered securities’ buying and selling. This not solely presents challenges for particular person traders and exchanges however might additionally influence innovation inside the trade.

The exact ramifications of the SEC’s determinations will depend upon varied components. These embody the authorized methods affected events undertake, potential regulatory surroundings adjustments, and the broader market’s response.

The intertwining of cryptos and securities legal guidelines underscores the significance of understanding the regulatory landscape during which these digital property function. Whereas the current SEC choices have launched further complexity to the equation, in addition they underline the need of regulatory readability on this fast-evolving discipline.

By skilled authorized recommendation and a proactive method, stakeholders can handle the challenges posed by these developments and proceed to take part within the dynamic crypto market.

Disclaimer

Following the Belief Undertaking tips, this function article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making choices primarily based on this content material.