- Bitcoin value has recovered from its dip to $25,800, with value at the moment above $27,400.

- BTC might proceed to bounce into the $28,000-$30,000 vary as broader market sentiment improves.

- Nonetheless, an analyst’s Bitcoin value prediction suggests unhealthy information for BTC if $27,600 turns into new resistance stage.

The worth of Bitcoin as of Might 15, 2023 9:50 am ET is $27,405, with BTC up 2% up to now 24 hours. 911.81. Whereas Bitcoin might but break above a key resistance stage and goal previous assist above $28,000, a preferred crypto analyst says failing to breach the stated provide wall might see the digital gold retreat to a intently watched assist stage.

Analyst shares Bitcoin value prediction as markets eye new bounce

The outlook for Bitcoin is nevertheless nonetheless broadly bullish long run, significantly after the crypto sector navigated the collapse of FTX. The present US regulatory surroundings stays a key concern for the ecosystem although and this in addition to continued correlation with the inventory market might show one other wobbly trajectory for crypto costs.

In response to crypto analyst Rekt Capital, Bitcoin value might dip previous the largely anticipated buffer zone at $25,000 if present ranges don’t maintain.

Though the stock market seems poised for good points as traders see a debt restrict deal and inflation fears throughout company America easing, a flip in sentiment each within the equities and in crypto might ship BTC under $25k.

Rekt thinks the flagship crypto’s value might fall to the $20,000 stage. He tweeted early Monday as BTC/USD bounced from lows of $25,800:

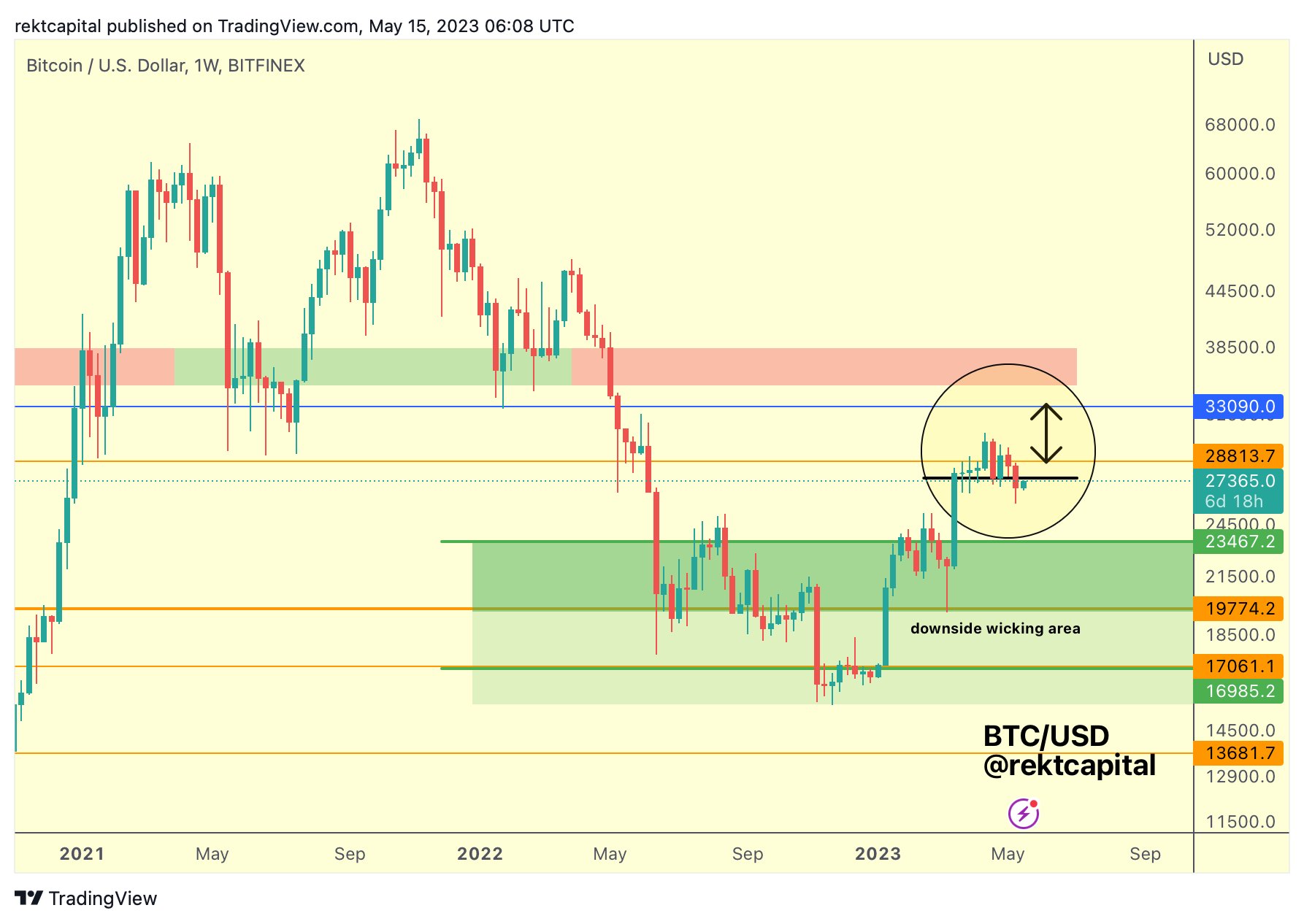

“First, #BTC did not reclaim the $28800 stage on the Weekly (orange). After which $BTC Weekly Closed under $27600, failing to carry it as assist (black). Flip $27600 into resistance and this might allow additional draw back into the low $20,000s.”

The analyst defined his Bitcoin value prediction additional in one other tweet.

“The issue with this #BTC bounce is that it’s occurring after a Weekly Shut under black assist. Such a 1W shut is setting BTC up for extra draw back particularly if this rebound is a aid rally. Reject at $27570 (black) would seemingly drive extra draw back,” he famous.

Under is the analyst’s chart highlighting the value ranges, with potential draw back wicks past the multi-month assist line.

Bitcoin value prediction on the weekly chart. Supply: Rekt Capital on Twitter

Bitcoin value prediction on the weekly chart. Supply: Rekt Capital on Twitter

On the upside, the important thing problem can be round $28,800. Consolidation is probably going between $28k and $30k. Above that lies the provision zone close to $33,000.