The previous week has been an eventful seven-day span for the Bitcoin worth motion and the overall cryptocurrency market. From the flagship cryptocurrency reaching a six-figure valuation to “flash crashing” to underneath $90,000, buyers have gone by way of numerous feelings over the previous week.

Unsurprisingly, the Bitcoin “flash crash” has been a significant supply of commentary up to now day, with a number of pundits offering insights as to how this phenomenon may have an effect on the Bitcoin trajectory. Beneath are a number of the on-chain classes realized from the sudden worth plunge, based on CryptoQuant’s head of analysis.

What Occurred In The BTC Futures Market?

In a brand new submit on the X platform, CryptoQuant’s head of analysis Julio Moreno weighed in on the flash “crash” of the Bitcoin worth to round $88,800 on Thursday, December 5. For context, a flash crash refers to a state of affairs when the worth of an asset abruptly declines however recovers virtually instantly.

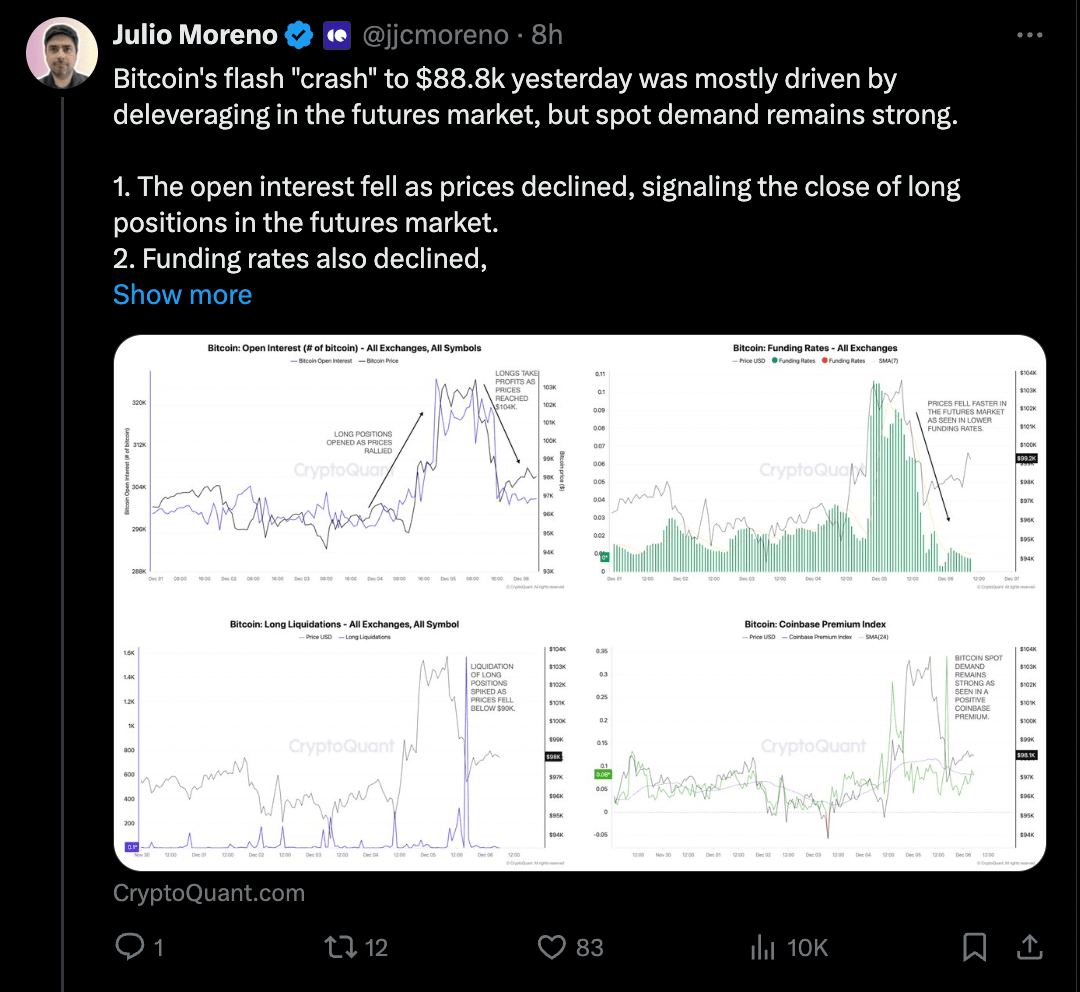

In accordance with Moreno, the newest flash crash skilled by the premier cryptocurrency was triggered by a sell-off cascade and deleveraging within the BTC futures market. The crypto skilled revealed that open curiosity dwindled as the worth of Bitcoin fell on Thursday, signaling the liquidation of a good portion of the leveraged lengthy positions within the futures market.

Moreover, the funding rates, which check with the periodic funds exchanged between merchants within the perpetual futures market, skilled a pointy decline when the Bitcoin worth dropped. When the funding charges flip destructive, it means that the market is changing into bearish, with brief merchants prepared to pay a premium.

Moreno famous that the declining funding charges signaled that the costs of perpetual futures are falling sooner than spot costs. It’s value noting that when the funding charges are within the destructive throughout a worth crash, it might sign that traders anticipate additional bearish strain within the brief time period.

Supply: JJCMoreno/X

An on-chain remark that stood out from the submit of CryptoQuant’s head of analysis is that the spot demand stays sturdy regardless of the weak futures market dynamics. That is based mostly on the Coinbase Premium metric, which tracks the distinction in worth on Coinbase (a spot trade) and different exchanges (normally futures-dominated). In accordance with Moreno, the premium has grown stronger within the optimistic territory, reflecting a robust shopping for curiosity amongst US buyers.

Bitcoin Worth At A Look

As of this writing, the price of BTC sits simply beneath the $100,500 mark, reflecting a 2% enhance up to now 24 hours. In accordance with knowledge from CoinGecko, the premier cryptocurrency now boasts a market capitalization north of $2 trillion.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView