Knowledge exhibits that Bitcoin energetic addresses have sharply dropped regardless of the excessive transaction demand; right here’s why this can be taking place.

Bitcoin Lively Addresses Have Seen A Sharp Plunge Just lately

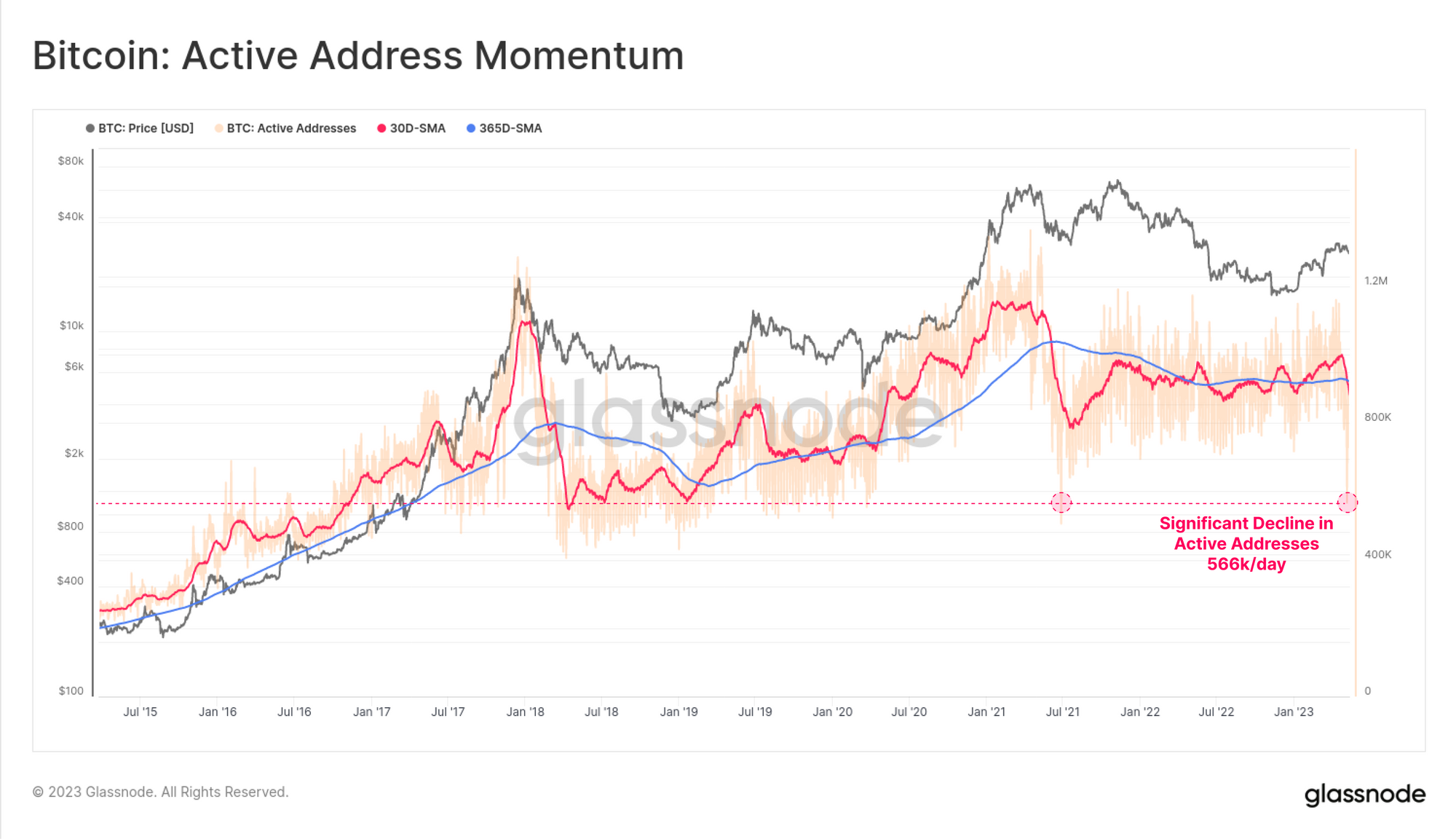

In response to the newest weekly report from Glassnode, the energetic addresses are round cyclical lows of 566,000. The “active addresses” metric measures the every day variety of distinctive Bitcoin addresses taking part in some transaction exercise on the blockchain.

By “distinctive,” what’s meant right here is that the indicator solely checks whether or not an deal with has been concerned in a switch at the very least as soon as. This means that no matter what number of transactions an deal with would possibly make, its contribution to the energetic addresses metric will stay only one unit.

This restriction exists as a result of the variety of distinctive addresses can function an analog to the variety of distinctive customers visiting the blockchain, thus offering an estimate for the every day customers on the community.

One other indicator that’s made for monitoring exercise on the Bitcoin blockchain is the “transaction count,” which, as its title already suggests, tells us concerning the every day complete variety of transfers going down on the community.

When this metric has a excessive worth, it naturally implies that many transactions happen on the blockchain. Such indicator values indicate a excessive demand for utilizing the community at the moment, however the metric can’t say something about how the exercise is distributed; that’s the place the energetic addresses indicator is available in.

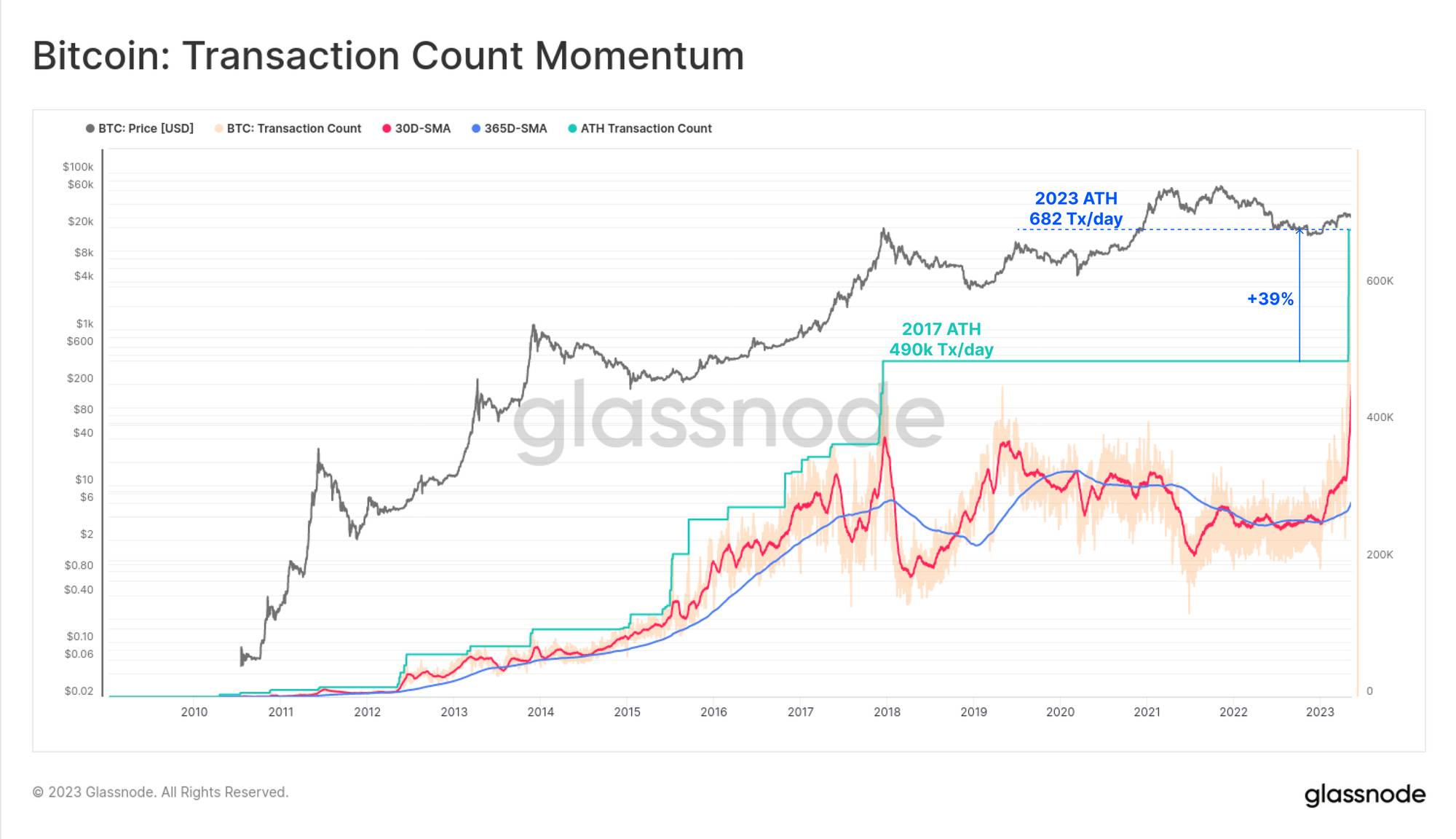

Now, here’s a chart that exhibits the pattern within the Bitcoin transaction rely (in addition to its 30-day and 365-day easy shifting averages) over the complete historical past of the asset:

The worth of the metric appears to have sharply surged not too long ago | Supply: Glassnode's The Week Onchain - Week 20, 2023

As displayed within the above graph, the Bitcoin transaction rely has not too long ago seen a speedy rise and has hit a brand new all-time excessive of about 682,000 every day transfers.

The rationale behind this explosion within the transaction rely is the emergence of the BRC-20 tokens, fungible tokens created on the BTC blockchain utilizing the Ordinals protocol (a strategy to inscribe information like textual content and pictures instantly into the chain).

These BRC-20 tokens have began a brand new memecoin mania, with PEPE being the biggest instance of such a coin. The insanely quick recognition of those tokens has meant that the demand for transacting on the community is greater than ever earlier than.

What concerning the energetic addresses, although? Is that this indicator additionally seeing an increase?

Seems to be just like the metric has plunged not too long ago | Supply: Glassnode's The Week Onchain - Week 20, 2023

From the chart, it’s obvious that the energetic addresses noticed an increase at first, however then it plunged to a worth of 566,000 addresses per day, across the present cyclical low.

This could imply that whereas the demand for making transactions is tremendous excessive proper now, the demand isn’t really coming from numerous customers however a somewhat small variety of them who’re continuously making repeat transfers.

“This can be a curious state of affairs, whereby many BRC-20 customers seem to have re-used their Bitcoin addresses,” explains Glassnode. “Maybe resulting from having extra familiarity with how account-based chains like Ethereum or Solana function, and fewer so with the Bitcoin UTXO system.”

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,400, down 1% within the final week.

BTC has shot up during the last 24 hours | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com