Bitcoin and Ethereum costs, main crypto and indicators for the crypto market, will witness volatility on Friday as international traders brace for first month-to-month expiry after spot Bitcoin ETFs approval and itemizing.

BTC worth and buying and selling volumes took successful after spot Bitcoin ETFs itemizing, with costs tumbling beneath the $40,000 psychological stage to a low of $38,521. Crypto worry and greed index slipped from 80 (excessive greed) on Jan 11 to 49 (impartial) as we speak, indicating swift modifications within the sentiment.

Bitcoin and Ethereum $5.7 Billion Choices Expiry

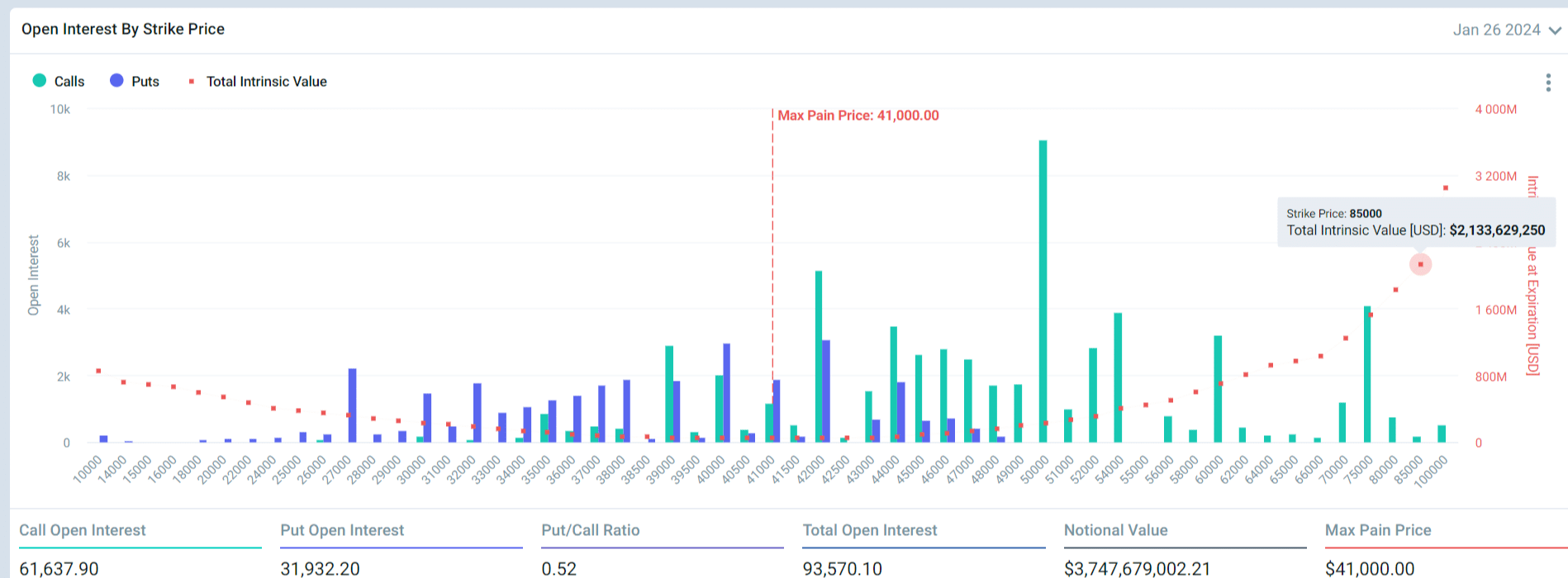

Notably, 93,588 BTC choices of notional worth $3.7 billion are set to run out on January 26, with a put-call ratio of 0.52. The max ache level is $41,000, indicating that merchants are beneath promoting stress. Merchants can anticipate big volatility as BTC worth is at the moment buying and selling beneath the max ache worth at $40,059.

Whole BTC futures open curiosity elevated 0.41% over the past 24 hours, with 0.60% rise in 4 hours. BTC open curiosity fell 2% to $4.59 billion on CME however up 1% to $4.11 on Binance. Additionally, complete BTC choices open curiosity is at $15 billion.

Furthermore, 929,432 ETH choices of notional worth $2 billion are set to run out, with a put name ratio of 0.31. The max ache level is $2,300, which can also be larger than the present worth of $2,220. Merchants couple be awaiting a restoration above max ache level, however the situation may fail on account of different stress with a sudden worth change.

In the meantime, complete ETH futures open curiosity is $7.78 billion, dropped 0.56% within the final 24 hours and rose 0.28% within the final 4 hours. There’s vital improve on high three ETH futures exchanges Binance, Bybit, and OKX.

Common analyst Michael van de Poppe predicts lower in volatility from right here as BTC enter last phases of this correction. The range-low remains to be $36-39K, with upward momentum to the Bitcoin halving beginning quickly. Nonetheless, analysts have warned about huge liquidation if BTC falls beneath $38,130.

Additionally Learn: Bitcoin Whales Have Been Buying Every Dip, BTC Price Recovers to $40,000

Macro Development On The Mark

The following few days are essential for crypto and inventory markets as a number of macro information launch are in line from as we speak onwards that may affect the U.S. Federal Reserve rate of interest choice on Jan 31.

US GDP development in This fall has seen slowing to 2%, the bottom development in six quarters and far lower than 4.9% development fee in Q3. The Fed’s tightening marketing campaign took successful on the economic system, however tight labor market present sufficient help to shopper spending.

Markets additionally stay up for Friday’s US PCE inflation information, the central financial institution’s most well-liked inflation gauge. The market anticipate annual core PCE to drop to three% from 3.2%.

The US 10-year Treasury (US10Y) was round six-week highs of 4.16% and US greenback index (DXY) at regular at 103.20, as merchants await key financial information to evaluate the efficiency.

Additionally Learn: Ripple Sends Letter To Judge Netburn Over SEC’s “Factual Mischaracterization”

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: