Bitcoin costs have returned above $105,000 prior to now 24 hours following a pointy value decline on Thursday triggered by macroeconomic pressures. Notably, US President Donald Trump and former political ally Elon Musk had engaged in a public spat which spiked the volatility in a crypto market already present process a corrective part.

Amidst some stage of renewed stability within the final two days, widespread analytics agency Glassnode has now shared an essential on-chain evaluation highlighting the presently key value ranges within the Bitcoin market.

Bitcoin Prepared For Breakout As Merchants Eye $114K And $83K Ranges

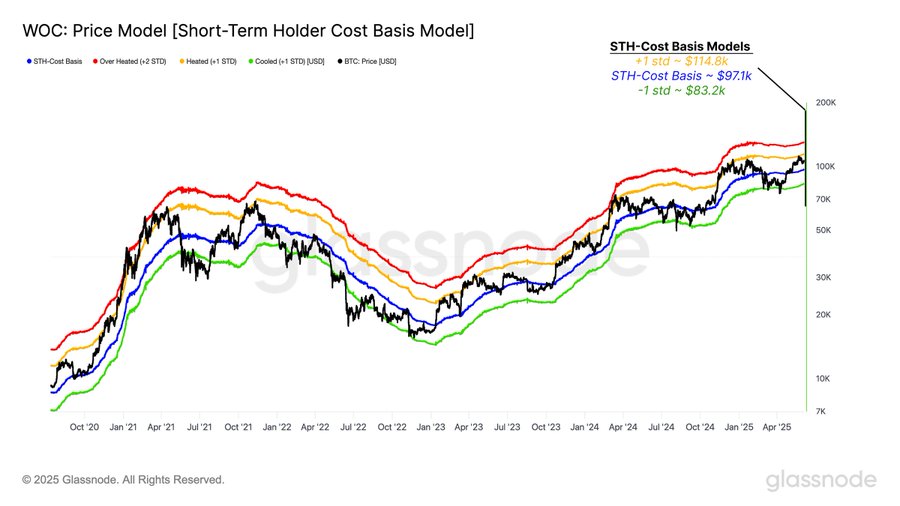

In an X post on June 7, Glassnode gives an perception on potential Bitcoin value motion utilizing the Brief-Time period Holder (STH) value foundation mannequin, derived from the Work of Price (WOC) value framework. Because the title implies, the STH value foundation represents the common bought value of all cash belonging to short-term holders i.e. traders who acquired their Bitcoin inside the final 155 days.

The STH value foundation is a vital market metric because it displays the chance urge for food of newer market members who’re usually probably the most reactive to cost change. Additionally it is a powerful indicator of market sentiment with a capability to behave as resistance or help relying on the worth path.

In response to the information by Glassnode, the present Bitcoin STH value foundation is estimated at $97,100. Utilizing normal deviation bands on this WOC mannequin, Glassnode has additional recognized the $114,800 value stage because the +1STD stage of this value foundation and a probably heated market zone.

Contemplating Bitcoin’s value, this $114,800 value zone represents the subsequent main resistance, a break above which is predicted to set off a large shopping for stress and push the premier cryptocurrency additional into uncharted value territory.

Glassnode’s WOC mannequin additionally identifies the -1STD stage at $83,200 to signify a crucial help zone within the current bullish construction. A decisive value fall beneath this stage would sign market weak point and is prone to trigger a cascade of liquidations and additional value corrections.

Bitcoin Value Overview

On the time of writing, Bitcoin trades at $105,745 reflecting a 1.07% achieve within the final 24 hours. In the meantime, the asset’s day by day buying and selling quantity is down by 34.27% and valued at $38.66 billion. Supplied Bitcoin continues to consolidate above the STH value foundation at $97,100, there’s a legitimate likelihood for a market bullish push in the direction of resistance at $114,800.

Nonetheless, a lack of the crucial help at $97,100 would factors to a retest at $83,200 which holds robust potential bearish penalties.