The world’s largest cryptocurrency has shot up one other 5%% on Sunday eve shifting previous $47,000 for the primary time in three months. As of press time, BTC is buying and selling 4.93% up at a [rice of $47,943 with a market cap of $891 billion.

With its latest move, Bitcoin has given a major breakout above the resistance of $45,925. As we can see the candle formation in the below image, Bitcoin is now making a move towards its 200-day moving average (DMA) of $48,278.

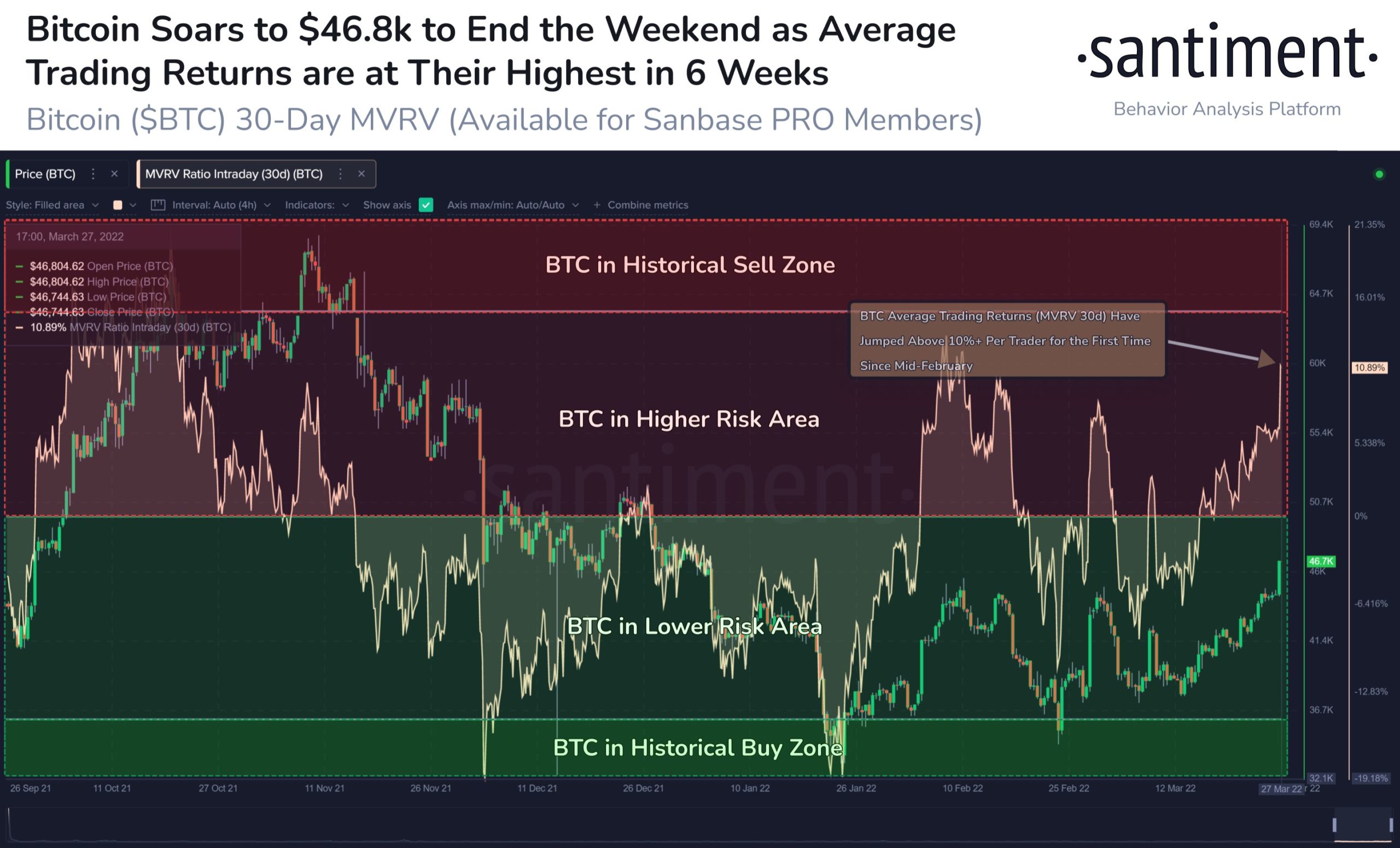

As on-chain data provider Santiment explains, Bitcoin has returned past $47K levels for the first time in 11-weeks after January 4. In the last three months, Bitcoin has been through a rough journey of inflation, war, and COVID-19 fears, but managed to overcome all. As of now, the average trading returns for Bitcoin are at their highest in 6 weeks.

Furthermore, data from Glassnode also shows that a staggering 81% of Bitcoin supply is currently in profit.

According to glassnode, the percent supply in profit of BTC has reached 81.807%, the percent supply in profit of ETH has reached 86.432%, both of which are the highest profit levels this year. pic.twitter.com/IO1qBU4fDm

— Wu Blockchain (@WuBlockchain) March 28, 2022

Altcoin Market Pose Strong Gains

The recent Bitcoin price rally comes with a strong 4% surge in the broader crypto market. Along with Bitcoin, Ethereum too is up 4.67% up and is currently trading above $3,300 levels. It has been showing moves quite closer in tandem with Bitcoin.

Currently, both BTC and ETH are up by more than 15% on the weekly chart. As CoinGape reported, the whale holdings for Ethereum have been on the rise. Furthermore, as per Bloomberg’s discounted cash flow model, analysts believe that the ETH price can rally to $8,000 this year in 2022.

Other altcoins have also been making a strong move. Cardano (ADA) has been the top performer with a staggering 35% gain on the weekly chart. As of press time, ADA is trading at $1.17 with a market cap of $39.5 billion.

On the other hand, Terra’s LUNA is up 3.5% and is currently trading at $94 with a market cap of $33.4 billion.

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.