Yesterday, Bitcoin (BTC) spiked over 6% following Federal Reserve Chairman Jerome Powell’s announcement that they’re adjusting its coverage and hinting at a possible 25bps charge reduce on the subsequent assembly on September 18. This surprising information has fueled Bitcoin’s latest volatility, with costs swinging unpredictably previously weeks.

Associated Studying

Essential on-chain information from CryptoQuant is offering a glimmer of optimism. In keeping with the information, merchants are positioning for additional worth appreciation.

Because the market digests the Fed’s new stance, all eyes are on Bitcoin to see if this might mark the start of a brand new bullish section.

Bitcoin Knowledge Exhibiting Market Optimism

Bitcoin is buying and selling above $63,000 and gaining momentum because it prepares to interrupt previous the essential $65,000 mark.

On-chain information from CryptoQuant reveals rising market optimism, highlighting a major pattern that might drive costs greater. Particularly, Bitcoin exchange reserves on centralized exchanges have plummeted to an all-time low. For the reason that finish of July, the provision of BTC on exchanges has decreased from over 2.75 million to roughly 2.67 million, representing a 3% drop in simply 30 days.

This decline signifies that much less BTC is obtainable for buying and selling on exchanges, which may create a provide shock, a state of affairs the place demand outstrips provide, resulting in a possible worth surge. As Bitcoin’s availability on exchanges diminishes, the probability of a worth enhance grows.

With Bitcoin beginning to achieve power, the market is carefully monitoring this pattern, probably pushing Bitcoin into new bullish territory.

BTC Worth Motion: $65,000 Subsequent?

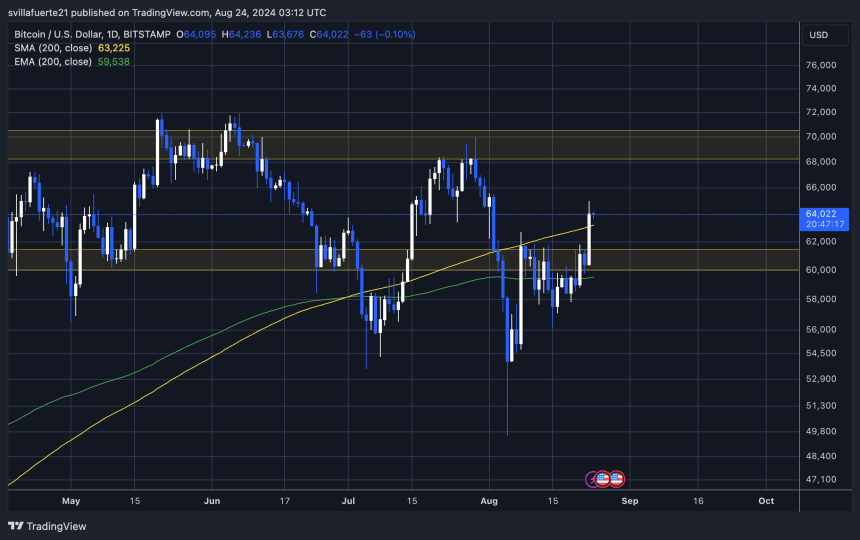

After two weeks of volatility and consolidation, Bitcoin is at the moment buying and selling at $64,100 on the time of writing, holding above the essential each day 200 Moving Average (MA).

This stage is crucial for bulls to take care of the uptrend in a better time-frame. For the value to interrupt previous the $65,000 mark, it should verify its bullish construction by holding above the $57,500 stage. Ideally, staying above the each day 200 Exponential Transferring Common (EMA), which sits at $59,538, is preferable.

These ranges are very important for establishing continued upward momentum. Holding above them would sign power available in the market, reinforcing confidence amongst merchants and traders. The info of declining Bitcoin trade reserves and the central financial institution’s coverage announcement have been met with optimism. Traders are more and more anticipating a Bitcoin rally within the coming months, fueled by these bullish indicators.

Cowl picture from Dall-E, chart from TradingView.