Bitcoin, the main cryptocurrency, continues to captivate traders’ consideration because it breaks out of a bull flag sample. Notably, based on a distinguished crypto market analyst, this bullish sample may ship the Bitcoin worth to a brand new all-time excessive.

In the meantime, amid current volatility pushed by components just like the U.S. Spot Bitcoin ETF outflux final week, renewed confidence in Bitcoin’s potential is evidenced by sturdy fund inflows. So, let’s check out the analysts’ insights and the way they could assist Bitcoin costs to achieve new heights.

Bitcoin’s Bullish Momentum Fuels Hypothesis of Document Highs

Bitcoin’s current ascent to a brand new all-time excessive of $73,750 in mid-March underscored its resilience amid market fluctuations. Nevertheless, subsequent volatility, partly attributed to outflows within the U.S. Spot Bitcoin ETF, briefly dampened investor sentiment.

However the momentum appears to have reversed this week with a resurgence in ETF fund flows signaling renewed optimism amongst Wall Avenue gamers in the direction of Bitcoin. As well as, the regaining institutional curiosity additionally reignites hypothesis of additional worth appreciation.

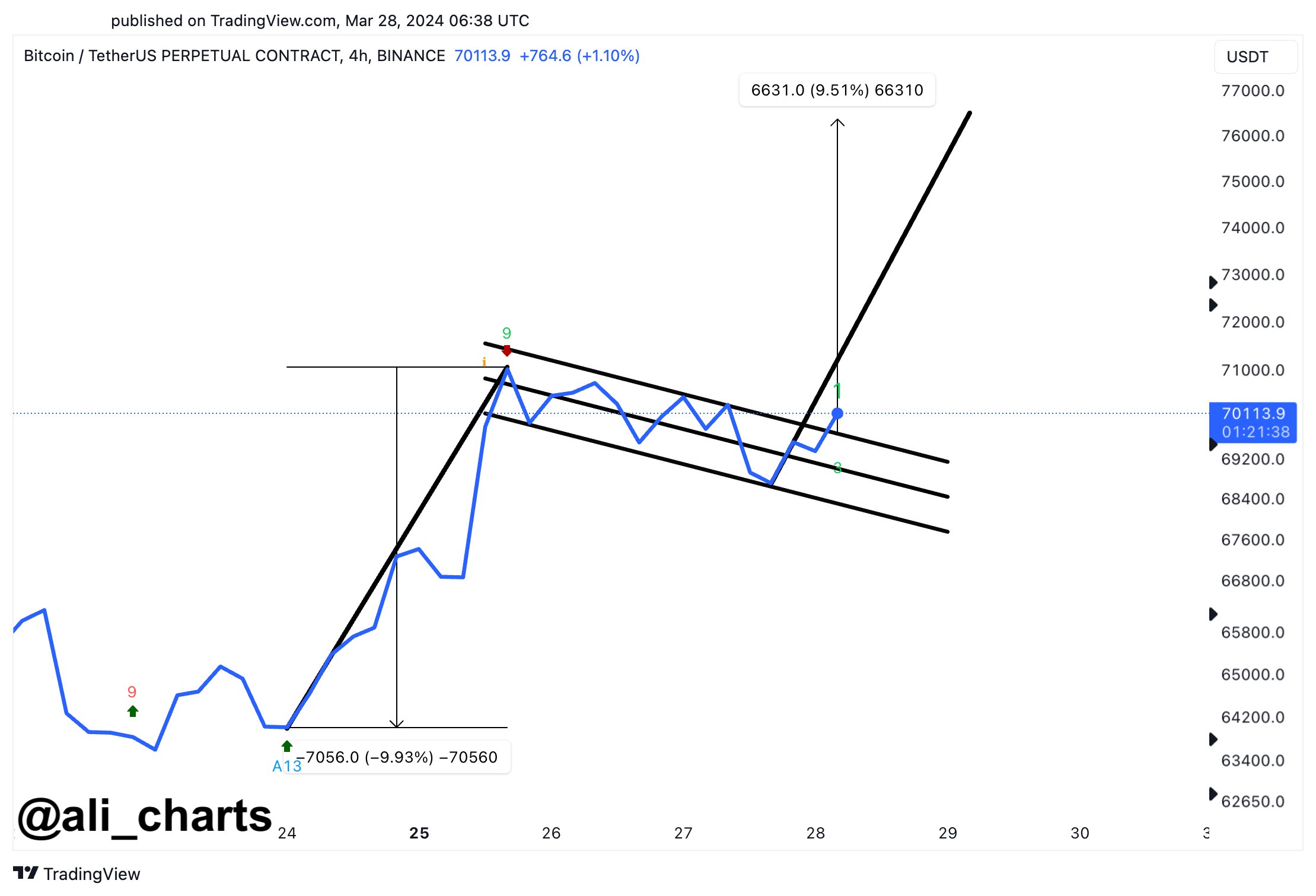

In the meantime, amid the speculations, Ali Martinez, a distinguished crypto market analyst, highlights Bitcoin’s potential breakout from a bull flag sample on the 4-hour chart. Notably, Martinez predicts that if Bitcoin maintains its place above $70,000, a surge of almost 10% to $77,000, is imminent.

This forecast aligns with rising anticipation amongst crypto fans for Bitcoin to realize new report highs. Moreover, the upcoming Bitcoin Halving occasion additionally bolsters market confidence, particularly as a result of traditionally related worth rallies after the occasion.

Additionally Learn: Top Reasons Why Pepe Coin Might Hit New ATH

Value & Efficiency Amid Optimistic State of affairs

The bullish sentiment surrounding Bitcoin is additional bolstered by predictions from business consultants. Notably, FOX journalist Eleanor Terrett not too long ago stated that Valkyrie CIO Steven McClurg forecasts Bitcoin’s worth to achieve a powerful $150,000 throughout the 12 months. Such optimistic projections underscore confidence in Bitcoin’s long-term worth proposition and its potential to disrupt conventional monetary markets.

As well as, Bitcoin Futures Open Interest (OI) signifies rising curiosity and funding exercise in Bitcoin derivatives. In response to CoinGlass knowledge, Bitcoin Futures OI surged by 1.73% to 545.73K BTC, equal to $38.56 billion, within the final 24 hours. Notably, the CME Trade leads with a notable 2.17% enhance in Bitcoin Futures OI, signaling growing participation and confidence in Bitcoin’s future trajectory.

In the meantime, as of writing, the Bitcoin price was up 0.90% and traded at $70374.24, whereas its buying and selling quantity rose 21.59% to $41.78 billion from yesterday. Over the past 24 hours, the BTC worth noticed a excessive of $71,727.68 and a low of $68,381.93, reflecting the still-continuing volatility available in the market.

Additionally Learn: Cardano’s Charles Hoskinson Defends ADA & Ripple Against Forbes “Zombie” Tag

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: