On-chain knowledge exhibits small Bitcoin holders have gathered lately whereas whale holdings have decreased, an indication that could be bullish in the long run.

Bitcoin Traders With 0-1,000 Cash Have Elevated Their Holdings Lately

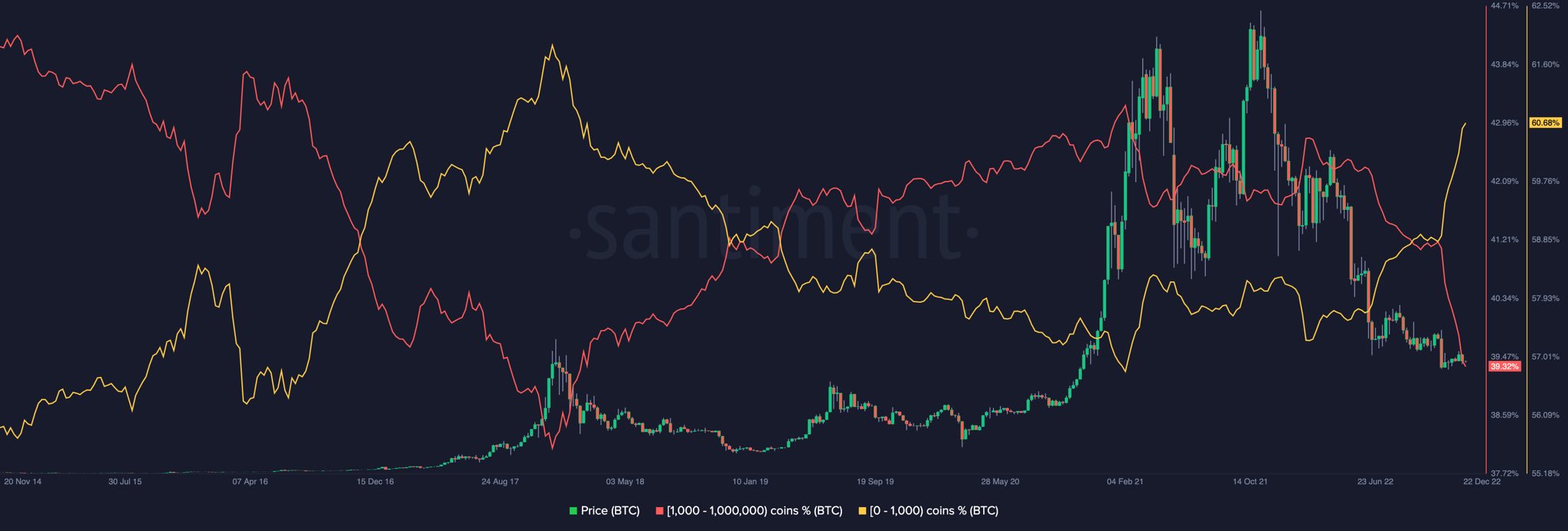

As a Twitter user has identified utilizing knowledge from Santiment, holders with pockets quantities within the 0-1,000 cash vary have aggressively gathered at current lows. The related indicator right here is the “Bitcoin Provide Distribution,” which tells us which pockets teams are holding what proportion of the full provide proper now.

Wallets (or extra merely, holders) are divided into pockets bands primarily based on the variety of cash they’re holding in the mean time. For instance, the 1-10 cash cohort consists of all addresses which can be at the moment carrying a minimum of 1 and at most 10 BTC. The Provide Distribution metric for this group measures the collective stability of all of the wallets falling inside this vary.

Now, here’s a chart that exhibits the development within the Bitcoin Provide Distribution knowledge for the 0-1,000 cash and 1,000-1,000,000 cash bands:

Seems to be just like the values of the metric for the 2 teams have moved oppositely to one another in current days | Supply: ₿igMak on Twitter

As you may see above, the Bitcoin Provide Distribution curve for the 1,000-1,000,000 cash band has noticed a pointy decline lately. The holders belonging to this group are the whales, which signifies that the proportion of the provision held by these humongous holders has been taking place, suggesting that they’ve been capitulating throughout this deep bear market.

The provision share held by the 0-1,000 cash group, alternatively, has quickly elevated lately, implying that retail investors have been accumulating massive quantities in the course of the current lows within the value of the asset.

From the chart, it’s obvious that such a sample was additionally seen in the course of the 2018/2019 bear market, albeit the dimensions of motion from each these teams was a lot smaller. Curiously, this development solely fashioned in that bear after the cyclical low was already in for BTC.

Thus, if historical past is something to go by, this current accumulation from the 0-1,000 cash group may assist Bitcoin type the underside for the present cycle (if it’s not already in), and subsequently reverse the coin in direction of a bullish development in the long run.

BTC Value

On the time of writing, Bitcoin’s price floats round $16,800, up 1% within the final seven days. Over the previous month, the crypto has gained 2% in worth.

The worth of the crypto appears to nonetheless be caught in a sideways development | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.web