-

Bitcoin Money worth has fashioned a falling wedge sample on the 4H chart.

-

Focus shifts to the upcoming rate of interest determination by the Fed.

Bitcoin Cash worth has retreated prior to now few weeks because the latest momentum within the crypto business waned. The coin dropped to a low of $240 on Wednesday, a lot decrease than the year-to-date excessive of $329. Which means BCH has dropped by greater than 27% from the very best level this 12 months.

Fed rate of interest determination forward

Bitcoin Money worth has been in a powerful downward development prior to now few weeks. This development began on June thirtieth when the coin soared to a excessive of $329. It additionally mirrors the efficiency of different main cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

The following doubtless catalyst for Bitcoin Money and different cryptocurrencies would be the upcoming rate of interest determination by the Federal Reserve. Economists imagine that the financial institution will determine to hike rates of interest by 0.25%. It should additionally sign that this would be the remaining price hike this 12 months since inflation is falling at a quicker tempo than anticipated.

Knowledge printed earlier this month confirmed that the American shopper worth index (CPI) dropped from 4.1% in Might to three% in June. Inflation has been falling after peaking at 9.1% in 2021. Due to this fact, one other bearish price hike can be a optimistic factor for cryptocurrencies.

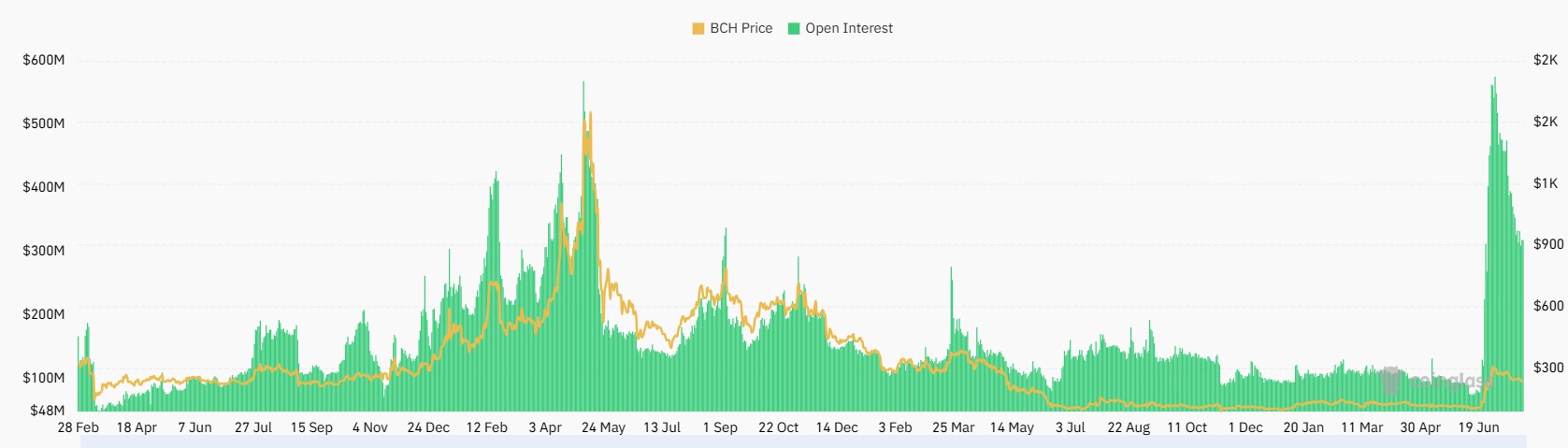

In the meantime, information confirmed by Coinglass exhibits that open curiosity within the futures market has dropped by greater than 1.45% prior to now 24 hours. Open curiosity dropped to $317 million with most of it being in Binance, OKX, Bybit, Bitget, and dYdX. Binance has over $167 million whereas OKX has $58.9 million.

Bitcoin Money’s open curiosity peaked at over $541 million after the Ripple vs SEC lawsuit. It has dropped regularly to the present $317 million, as proven beneath.

Bitcoin Money worth prediction

The 4H chart exhibits that the BCH worth has been in a powerful bearish development prior to now few days. It has moved beneath the 25-period and 50-period transferring averages. Nevertheless, a more in-depth look exhibits that the coin has fashioned a falling wedge sample, which is often a bullish signal.

Most significantly, this sample is nearing the confluence stage, signaling {that a} bullish breakout is feasible. If this occurs, the following stage to look at can be at $280. A break beneath the assist at $220 will invalidate the bullish view.

The submit Bitcoin Cash (BCH) price forms a falling wedge: Is it safe to buy? appeared first on CoinJournal.