Key Notes

- BCH achieved a rising wedge breakout with technical indicators pointing towards a possible $1,000 worth goal within the close to time period.

- Open curiosity in Bitcoin Money derivatives elevated 4.5% as contemporary capital entered the market, validating the rally’s power past rotation.

- The altcoin benefited from broader danger urge for food as US equities turned constructive and merchants anticipated one other Federal Reserve charge discount.

Bitcoin Cash

BCH

$605.0

24h volatility:

2.7%

Market cap:

$12.09 B

Vol. 24h:

$360.18 M

worth traded as excessive as $609 on October 3, benefitting from elevated investor danger urge for food, amid constructive US inventory market efficiency and expectations of a second consecutive Fed charge minimize. This brings BCH worth beneficial properties over the past 5 days to 14.2%.

As compared, Bitcoin

BTC

$122 556

24h volatility:

2.5%

Market cap:

$2.45 T

Vol. 24h:

$82.21 B

worth solely gained 3% intraday, consolidating under all-time highs close to $124,000 at press time. BCH additionally mildly outperformed Ethereum

ETH

$4 503

24h volatility:

1.1%

Market cap:

$545.12 B

Vol. 24h:

$45.34 B

, XRP

XRP

$3.05

24h volatility:

0.1%

Market cap:

$182.86 B

Vol. 24h:

$7.94 B

, and Solana

SOL

$232.4

24h volatility:

1.8%

Market cap:

$126.84 B

Vol. 24h:

$10.34 B

on October 3. This reveals that larger danger urge for food has seen traders flip to mid-cap altcoins as US equity markets flipped green round mid-week.

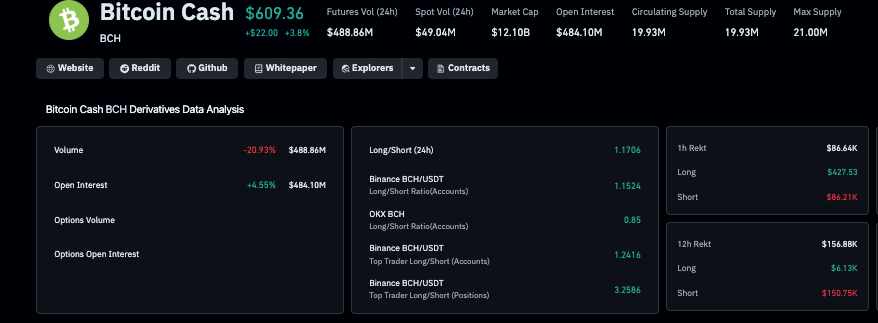

Bitcoin Money Derivatives Market Evaluation | Supply: Coinglass, October 3, 2025

Capital flows inside Bitcoin Money derivatives markets over the past 24 hours additional emphasize the bullish stance. As seen within the Coinglass chart above, BCH open curiosity grew by 4.5%, preserving tempo with the intraday spot worth uptick, whereas 24-hour buying and selling quantity declined 20.9%. This confirms that the most recent leg of the rally was propelled by new capital, not mere rotation of current funds.

BCH Value Forecast: Rising Wedge Breakout Targets $1,000

Bitcoin Money worth has staged a powerful rebound from September lows. Technical indicators counsel BCH could possibly be set for extra upside with its newest leg above $600 confirming a rising wedge breakout on October 3. As seen under, the rising wedge sample hints at a long-term goal at $1,000.

The MACD indicator on the weekly timeframe additionally reveals bullish outlook with the MACD line crossing above the sign line, presently printing 49.5 versus 47.9.

Bitcoin Money Technical Value Forecast | October 3, 2025

In the meantime, Value Quantity Development (PVT) information reveals a gentle enhance in capital inflows since mid-2024, validating the breakout as greater than a latest quick squeeze occasion.

Within the bullish situation, a sustained rally might see BCH worth clear the $800 provide zone.

Nevertheless, in a bearish situation, failure to carry the $580 help zone might set off a retest of $450. On the flip facet, a breakdown under $450 would invalidate the wedge breakout sign.

Maxi Doge Presale Positive factors Momentum as Merchants Search Excessive-Threat Performs Past BCH

Bitcoin Money’s surge above $600 displays urge for food for high-risk performs, making a spillover impact into new initiatives like Maxi Doge (MAXI).

Maxi Doge gives high-risk merchants as much as 1000x leverage with no-stop loss required, amplifying the potential earnings throughout bull-cycles.

Maxi Doge Presale

The Maxi Doge presale is presently priced at $0.00026 and has already raised greater than $2.7 million of its $3 million goal. With simply hours left earlier than the subsequent worth tier, potential traders can nonetheless take part by way of the official Maxi Doge presale website.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.