Key Notes

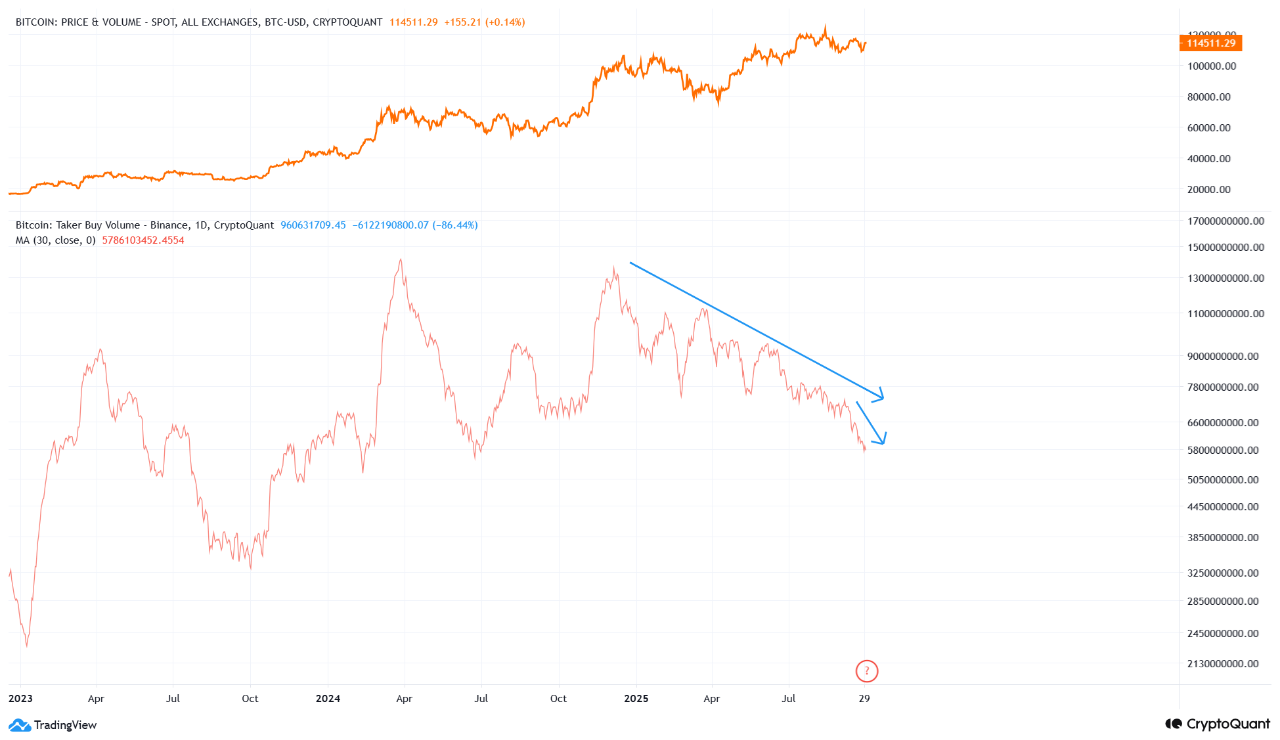

- Bitcoin taker purchase quantity falls to its weakest degree since early 2024.

- BTC trades round $113,200, down 9% from its all-time excessive in August.

- Analysts warn of weak demand however many are bullish on October good points pattern.

Bitcoin’s

BTC

$113 329

24h volatility:

1.0%

Market cap:

$2.26 T

Vol. 24h:

$60.52 B

shopping for strain has weakened to its lowest level in a yr, elevating questions on the place the world’s largest cryptocurrency is headed subsequent. Knowledge from CryptoQuant reveals that the month-to-month shifting common of Taker Purchase Quantity is now at ranges not seen for the reason that begin of 2024.

The decline began in December and has continued in a downtrend, suggesting cautious investor sentiment on the purchase aspect. Traditionally, sharp drops in Taker Purchase Quantity have typically led to consolidation or heavy promoting strain and worth declines.

Bitcoin taker purchase quantity on Binance | Supply: CryptoQuant

According to a CryptoQuant contributor, and not using a rebound in demand, Bitcoin may enter a impartial or bearish part within the medium time period.

Structural Help Nonetheless in Place: Glassnode

Regardless of the weakening buy-side exercise, Glassnode reported that youthful coin provide valuations have reset. The MVRV ratio sits close to 1.0 as newer buyers commerce round their value foundation.

#Bitcoin younger provide valuations have reset, with MVRV close to 1.0 as newer buyers commerce round value foundation. Value holding above the 135d SMA alerts structural help, with the reset doubtlessly setting the stage for extra sustainable accumulation.

🔗https://t.co/vXMt3RFbrn pic.twitter.com/2M83frrofN— glassnode (@glassnode) September 30, 2025

Importantly, Bitcoin continues to be holding above its 135-day easy shifting common, which Glassnode views as structural help. They argue that this might lead to a extra sustainable accumulation.

The place Is BTC Heading?

Bitcoin is getting into This fall buying and selling close to $113,200, with a 36% uptick in its 24-hour buying and selling quantity. CoinMarketCap data reveals that the cryptocurrency is 9% down from its file excessive of $124,450 reached on Aug. 14.

Since then, BTC has twice examined the $108,000–$109,000 help vary, most not too long ago final week. Analysts at Swissblock observe that defending $110,000 is essential as holding this degree retains the bullish outlook alive.

Bitcoin, what’s the plan?

Begins per week that ends one month and kicks off one other, marking the beginning of This fall.

Q3 started by conquering $110K:

Holding it’s the key pivot—lose it and momentum stalls, defend it and the bullish path stays alive. pic.twitter.com/8070BVjdsU

— Swissblock (@swissblock__) September 29, 2025

Traditionally, October has been considered one of Bitcoin’s strongest months, delivering good points in eight of the previous ten years. Whereas short-term alerts stay bearish, CoinGlass believes a seasonal rally may very well be close to for BTC and top altcoins.

#Bitcoin Month-to-month returns(%)#Uptober is coming!https://t.co/X5PsVkpePm pic.twitter.com/WPqpmsVjSh

— CoinGlass (@coinglass_com) September 29, 2025

Lengthy-Time period Bullish Momentum Intact

Widespread crypto dealer Kamran Ashgar not too long ago steered to his followers to give attention to Bitcoin’s long-term “mega-bull run.” He defined that the present worth trajectory follows wholesome accumulation, and the $150,000 worth goal continues to be intact.

Cease calling it a dip. That is accumulation. $BTC chart stacking confirms the mega-bull run continues to be on monitor. $150K is the minimal goal. Prepare. 🚀 pic.twitter.com/Ex08Ld6l8Q

— (@Karman_1s) September 30, 2025

This comes as institutional interest in Bitcoin stays regular. BitcoinTreasuries.NET reported that Japanese public firm Star Seeds is elevating $6.83 million to buy BTC, reinforcing long-term demand.

JUST IN: Japanese public firm Star Seeds (3083.T) is elevating $6.83 million to purchase #Bitcoin. pic.twitter.com/6aFGEKq1NN

— BitcoinTreasuries.NET (@BTCtreasuries) September 30, 2025

Bitcoin Hyper Secures $193 Million as Presale Momentum Builds

With Bitcoin setting sights on contemporary This fall highs, Bitcoin Hyper (HYPER) is rapidly capturing market consideration. The challenge has already attracted $19.3 million in presale funding, which alerts sturdy investor confidence.

Constructed as a next-generation Layer 2 resolution, it employs an optimized digital machine to course of transactions sooner and cheaper, all whereas remaining securely anchored to Bitcoin’s strong base layer.

Early adopters additionally get pleasure from beneficiant advantages, with staking rewards reaching 61% APY, permitting token holders to earn whereas supporting community enlargement.

HYPER Tokenomics and Presale Particulars

HYPER token serves because the challenge’s important utility asset. It handles transaction funds, powers staking incentives, and unlocks superior options throughout the platform, making it a cornerstone of the community’s operations.

At the moment, the HYPER presale affords early HYPER token consumers a reduced price. With the subsequent worth adjustment set to happen in simply hours, momentum is constructing rapidly.

HYPER Presale

- Ticker: HYPER

- Presale Value: $0.013005

- Funds Raised: $19.3 million

For buyers in search of Bitcoin’s Layer 2 improvements, Bitcoin Hyper presale presents a well timed alternative earlier than the subsequent worth step. On our web site, you’ll be able to learn extra about how to buy Bitcoin Hyper (HYPER).

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

A crypto journalist with over 5 years of expertise within the trade, Parth has labored with main media shops within the crypto and finance world, gathering expertise and experience within the area after surviving bear and bull markets over time. Parth can be an writer of 4 self-published books.