Key indicators for predicting an Altcoin Season—corresponding to Bitcoin Dominance (BTC.D) and the Altcoin Season Index—continued to point out unfavourable traits in June. These developments make the prospect of an altcoin rally more and more unlikely.

As political tensions escalate between the US and Iran, buyers seem like restructuring their altcoin portfolios to scale back threat.

Bitcoin Dominance Hits Highest Degree Since 2021

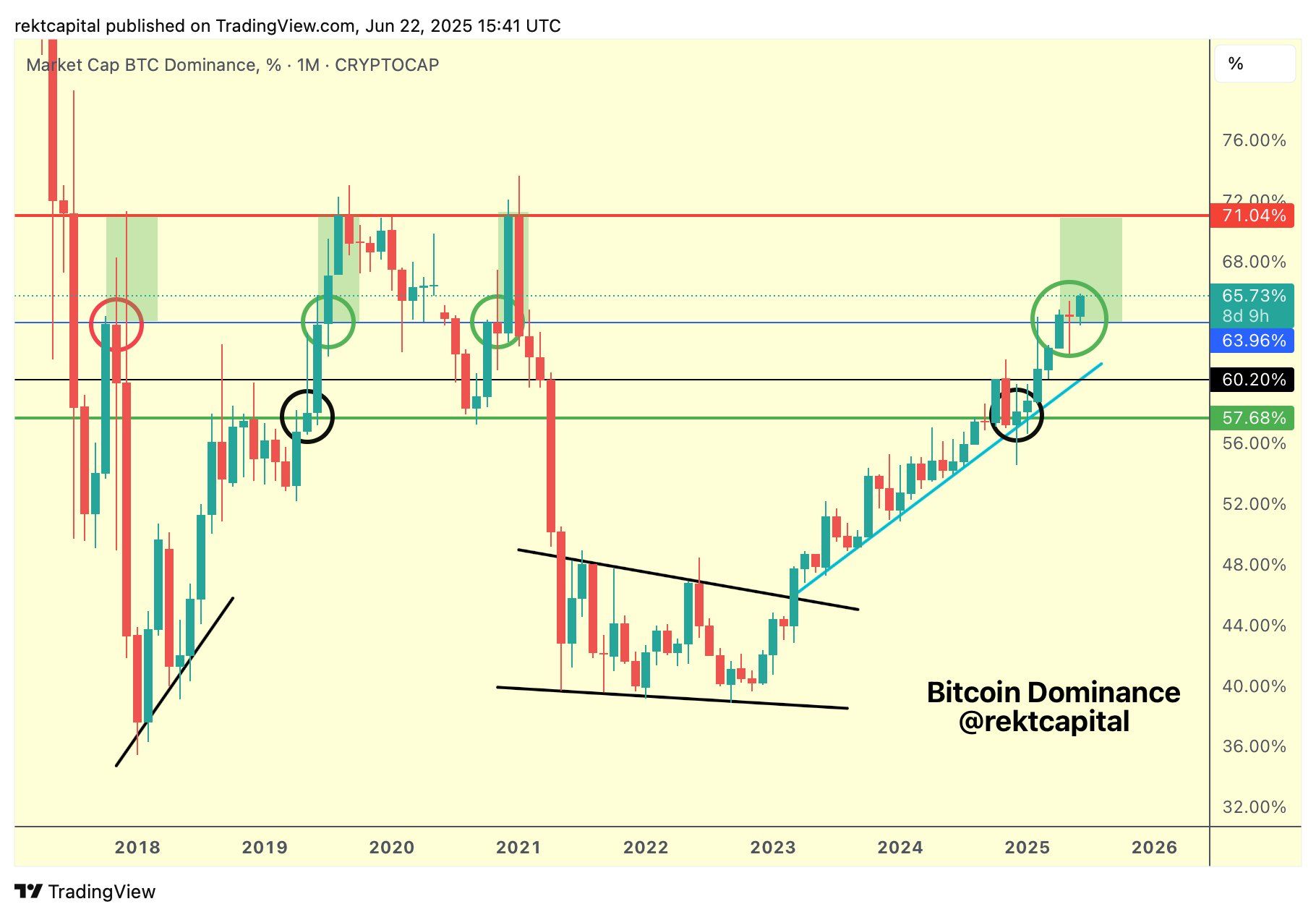

On the time of writing, Bitcoin Dominance (BTC.D), which measures Bitcoin’s market capitalization as a share of the full crypto market, has hit a brand new excessive for 2025. It now exceeds 65%, marking the best level since February 2021.

Information from TradingView exhibits that BTC.D has risen for seven consecutive quarters with no single quarterly correction. This development displays sturdy long-term confidence in Bitcoin from each retail and institutional buyers.

Crypto analyst Rekt Capital made a daring prediction that Bitcoin Dominance could rise to 71% within the close to future.

If that occurs, it may set off a pointy correction within the altcoin market. An analogous situation performed out in February 2025, when Bitcoin’s dominance peaked and led to steep declines in lots of main altcoins.

“Now Bitcoin Dominance is simply 5.5% away from 71%. Altcoins gained’t go to zero. As a substitute, they might react equally to Feb 2025,” Rekt Capital predicted.

In February 2025, the altcoin market cap (TOTAL2) fell from $1.4 trillion to $1 trillion. If Rekt Capital’s prediction holds true, the altcoin market cap may drop under $700 billion.

Nic, Co-founder of CoinBureau, additionally suggested that BTC.D may rise to 70%—a prediction near Rekt Capital’s. Raoul Pal, Founder and CEO of RealVision, shared the identical outlook. He believes altcoins will bleed greater than Bitcoin throughout any correction.

The rising tensions between the US and Iran, marked by airstrikes and threats of bigger military deployments from President Trump, have induced unexpected market volatility.

Though leaders within the crypto business remain optimistic, their sentiment doesn’t prolong to altcoins.

Altcoin Season Index Hits Rock Backside

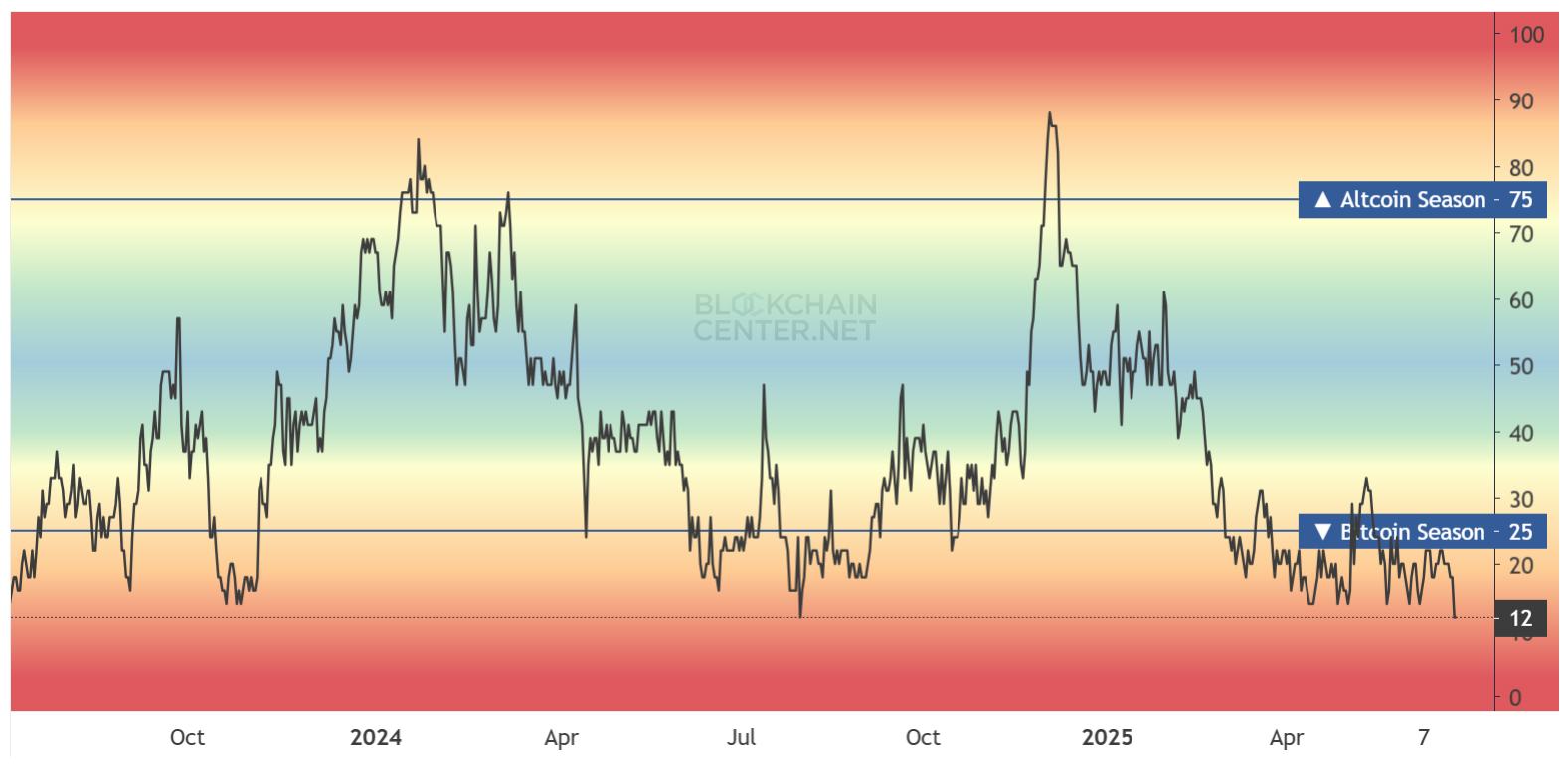

As of June 23, the Altcoin Season Index dropped to 12 factors—its lowest stage in two years. This index tracks whether or not altcoins have outperformed Bitcoin over the previous 90 days. A rating of 75 or larger usually indicators an altcoin season. The present studying is much from that threshold.

“It’s now the furthest we’ve been from Altcoin season in nearly a yr. That’s if you happen to imagine the ‘Altcoin Season Index’,” Nic said.

Nevertheless, famend crypto analyst Michaël van de Poppe identified an fascinating sample. Lately, the Altcoin Season Index has tended to backside out in June or July.

This means a seasonal development: buyers are inclined to shift capital into Bitcoin initially of summer season, after which probably rotate again into altcoins in July or August.

Analyst 0xNobler additionally believes altcoin seasons usually start in the summertime. This aligns with the earlier predictions that Bitcoin Dominance should still rise to 71% earlier than present process any correction.

Due to this fact, these analysts say persistence is vital for altcoin buyers, regardless of surprises from ongoing geopolitical conflicts.

Nevertheless, a latest report by BeInCrypto highlighted several reasons why the altcoin winter could last longer. And even when an altcoin season does happen, it might not profit each undertaking presently available on the market.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.