Bitcoin’s latest worth crash took the entire market by surprise, leaving bullish traders reeling in losses. Notably, this crash noticed Bitcoin dropping its foothold on the $90,000 worth degree and extended a crash across a number of cryptocurrencies.

Technical analyst Rekt Capital recognized this pullback as a draw back deviation inside a re-accumulation vary, hinting at potential market changes within the coming weeks.

Bitcoin’s Drop Under $90,000: A Needed Reset?

Bitcoin’s break beneath $90,000 up to now few days marks its first time buying and selling beneath this degree since November 2024. After months of sustained upward momentum, Bitcoin began to consolidate beneath the $100,000 worth degree, spending most weeks buying and selling between $90,000 and $100,000.

Associated Studying

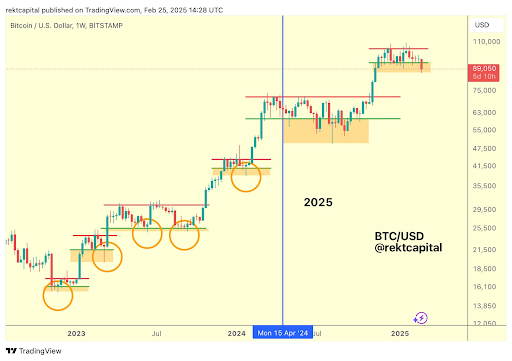

This consolidation part, whereas unsettling to some traders, was interpreted by some analysts as a natural part of Bitcoin’s broader market cycle. Crypto analyst Rekt Capital has pointed out that Bitcoin regularly undergoes phases of re-accumulation throughout bull cycles, permitting the market to reset earlier than the following leg upward. In line with his evaluation, the present worth motion aligns with historic traits, the place Bitcoin establishes an accumulation ground earlier than one other rally.

Apparently, Bitcoin’s recent break below $90,000 is a part of this reaccumulation vary phenomenon. Rekt Capital describes this as a “draw back deviation” beneath the vary low, which is a sample Bitcoin has exhibited a number of occasions in previous cycles.

What To Anticipate From BTC’s Subsequent Transfer

Re-accumulation phases are usually highlighted by shopping for stress amongst a number of whales and retail traders whereas the bigger market continues to promote. In line with data from on-chain analytics platform Glassnode, some long-term Bitcoin holders have remained unfazed by the latest worth crash. In truth, the newest selloff has offered them with a key accumulation alternative, with these long-term addresses rising their whole Bitcoin holdings by 20,400 BTC up to now 48 hours.

Associated Studying

Bitcoin’s future trajectory will rely on the way it reacts inside this re-accumulation vary. If Bitcoin efficiently reclaims $90,000, it might affirm that the break beneath was merely a shakeout earlier than additional positive factors. A robust rebound from this degree would doubtless reignite bullish sentiment, doubtlessly paving the way in which for a considerable break above $100,000.

Nonetheless, an prolonged decline beneath $90,000 could possibly be very devastating for Bitcoin and its long-term holders who’re at present accumulating within the reaccumulation zone, as there isn’t much of a support level to prop up any downtrend till the $70,000 worth degree.

On the time of writing, BTC is buying and selling at $88,628, reflecting a 7.5% decline over the previous seven days. Nonetheless, the cryptocurrency has proven early indicators of stabilization, having rebounded by roughly 2% after hitting an intraday low of $86,867.

Featured picture from Adobe Inventory, chart from Tradingview.com