There’s no denying the launch of Spot Bitcoin ETFs has performed wonders for the worth of Bitcoin and different cryptocurrencies on the whole. These ETFs have now unlocked institutional demand into the world’s largest crypto asset to alter the dynamics forward of the subsequent halving. Then again, current tensions between Iran and Israel have seen Bitcoin falling to as little as $61,000 up to now 24 hours to undo weeks of value will increase.

Bitcoin ETF Wallets Now Whale Addresses

The institutional demand for Bitcoin has been ramping up because the starting of the yr from the issuers of the assorted Spot Bitcoin ETFs. These fund suppliers have been scooping up Bitcoin left and proper, now holding 4.27% of the whole BTC provide, as famous by on-chain analytics platform IntoTheBlock.

These whale wallets have now joined an in depth record of whales on the Bitcoin community who collectively own 11% of the whole circulating provide.

Not like previous BTC halvings, this time there’s a brand new supply of demand coming from the normal institutional sector.

The newly launched Bitcoin ETFs drive institutional demand, resulting in ETF wallets already amassing 4.27% of the Bitcoin provide! pic.twitter.com/volLU15Wgd

— IntoTheBlock (@intotheblock) April 13, 2024

It’s noteworthy to say that BlackRock’s IBIT and Constancy’s FBTC ETFs have positioned themselves because the lead of the pack. In keeping with data from BitMEX Research, these two spot ETFs now maintain 405,749 BTC on the shut of the buying and selling session on April 12.

This surge of institutional cash has fueled Bitcoin’s meteoric rise to a new all-time high of $73,737 and underscored its potential as a mainstream asset class. Nonetheless, a brewing battle between Iran and Israel appears to be undoing months of this value improve. Notably, Bitcoin has seen a noteworthy drop to $61,000 from $67,800 up to now 24 hours.

Fundamentals, nevertheless, level to this value drop being short-term and the crypto is already reversing the vast majority of this loss. On the time of writing, Bitcoin is buying and selling beneath the $65,000 value mark.

Bitcoin is now buying and selling at $64.330. Chart: TradingView

Altering Halving Dynamics

One in all such fundamentals pointing to a gradual Bitcoin price increase in the coming months is the approaching Bitcoin halving. Buyers are steadily approaching the end result of this halving, with the Bitcoin blockchain now lower than 1,000 blocks to the subsequent occasion.

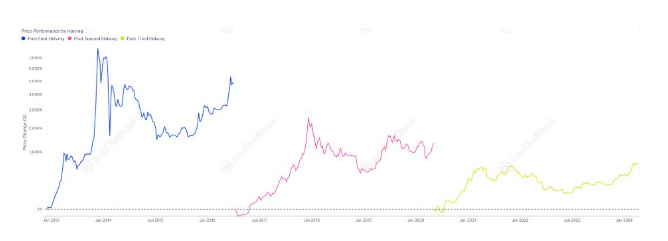

Previous halvings on their very own have led to a value improve for Bitcoin within the days post-halving. Bitcoin went on a surge of over 7,000% within the months after the primary halving in 2012. The halving in July 2016 led to a 3,000% value surge within the months after. The newest halving in Could 2020 led to a surge of virtually 1,000% within the months after.

As famous by IntoTheBlock, the approaching halving is completely different from earlier ones. Not like the final three halvings, there’s “a brand new supply of demand coming from the institutional sector” via Spot Bitcoin ETFs. A repeat of past halving outcomes may see Bitcoin simply surging above the $100,000 value degree.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.