The U.S. Spot Bitcoin ETF skilled a turbulent week, leading to a major outflow of almost $200 million on June 14. Constancy’s FBTC led the exodus with an $80.1 million outflow, adopted by Grayscale’s GBTC at $52.3 million.

Notably, as Bitcoin’s worth exhibits indicators of volatility amid the gloomy U.S. Spot Bitcoin ETF buying and selling, consultants weigh in on the potential implications for the cryptocurrency market.

Bitcoin ETF Information $200M Outflow

The U.S. Spot Bitcoin ETF confronted a difficult week, with persistent outflows totaling $581.4 million over the previous 5 days. On Friday alone, outflows reached $189.9 million, with Constancy’s FBTC and Grayscale’s GBTC being the principle contributors.

Notably, Constancy’s ETF noticed the biggest single outflow, amounting to $80.1 million. Grayscale’s ETF adopted intently, shedding $52.3 million in property.

In the meantime, this week’s development exhibits Bitcoin ETFs struggling to keep up investor curiosity. Outflows occurred on 4 of the previous 5 buying and selling days, suggesting a shift in market sentiment. Nevertheless, it’s value noting that these withdrawals come after a interval of strong inflows, marking a sudden reversal in investor conduct.

As well as, the speedy outflows replicate broader market issues and elevated volatility in Bitcoin worth. This sentiment shift has led to elevated warning amongst buyers, weighing on the risk-bet urge for food of the buyers. Nevertheless, the query now could be whether or not these developments will proceed or stabilize because the market adjusts to latest worth fluctuations.

Additionally Learn: Bitcoin Price Bull Run Is Intact As Per These Five On-chain Metrics

What’s Subsequent For Bitcoin Worth?

Regardless of the latest constructive indicators out there, Bitcoin continued to document a major decline over the previous few days. In different phrases, the numerous ETF outflows have coincided with notable volatility in Bitcoin’s worth. BTC has struggled to keep up stability, fluctuating round key ranges.

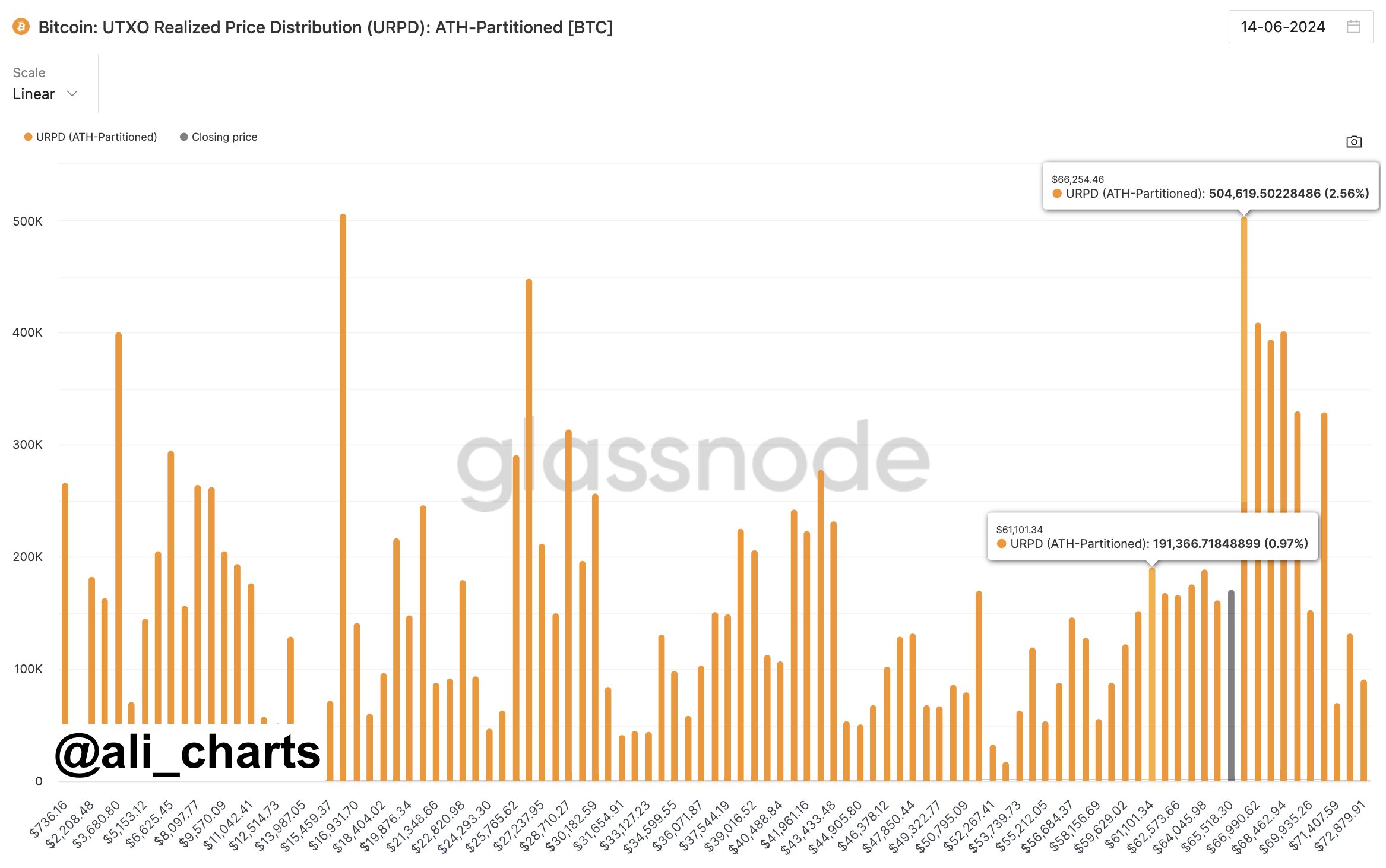

Amid this, outstanding crypto market analysts highlighted a key level that Bitcoin should maintain to keep away from an extra dip to $61,000. In a latest evaluation shared on the X platform, Martinez stated that Bitcoin wants to remain above the $66,254 mark, in any other case BTC worth witness a possible correction all the way down to $61,100.

As of writing, Bitcoin price exchanged palms at $66,242.59, noting a drop of 1.01% over the past 24 hours. In addition to, the buying and selling quantity additionally dropped barely, whereas its worth noticed a 24-hour low of $65,049.23.

Regardless of the latest dip, the CoinGlass knowledge confirmed that Bitcoin Futures Open Curiosity recorded a slight restoration within the final 4 hours whereas dropping greater than 2% within the 24-hour timeframe.

Additionally Learn:

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: