The Bitcoin worth has as soon as once more dropped at present, falling beneath the $60,000 mark, whereas the U.S. Spot Bitcoin ETFs famous a constructive momentum for the fourth straight day. Notably, a number of market analysts have attributed the latest sluggish buying and selling of the U.S. Spot Bitcoin ETF as a key purpose behind the BTC worth dip.

Nevertheless, with the U.S. Bitcoin ETF staying within the inexperienced this week, it seems that there are particular different components in play.

US Spot Bitcoin ETF Recorded Inflows For 4 Days

Bitcoin has confronted a downturn, slipping beneath the $60,000 mark, attributed to tepid buying and selling in U.S. Spot Bitcoin ETFs. Nevertheless, regardless of this worth dip, the ETFs have seen constructive momentum for 4 consecutive days, indicating a posh interaction of market forces. The latest inflow is notably pushed by vital contributions from BlackRock’s IBIT.

In line with information from Farside Buyers, the general U.S. Spot Bitcoin ETF sector recorded a $73 million inflow. BlackRock, a serious participant, recorded its first vital inflow since June 20, with a considerable $82.4 million injected into its IBIT ETF. Notably, this inflow stands out in opposition to the backdrop of outflows from different main Bitcoin ETFs.

For context, GrayScale’s GBTC and Constancy’s FBTC, historically robust performers within the Bitcoin ETF market, reported outflows of $27.2 million and $25 million, respectively. But, the outflows had been counterbalanced by BlackRock’s substantial inflow and extra contributions from Ark 21Shares’s ARKB, which noticed a $42.8 million inflow.

In the meantime, this redistribution of capital suggests a strategic shift amongst buyers, favoring ETFs exhibiting resilience and potential for progress. In addition to, the latest inflows replicate rising investor confidence in Bitcoin ETFs, regardless of the general market’s combined efficiency.

Additionally Learn: Coinbase, MicroStrategy, and Crypto Stocks Record Weekly Upswing

Weekly Tendencies Sign Combined Sentiment

The week has been turbulent for Bitcoin ETFs, marked by a big outflux of $174.5 million on June 24. This substantial outflow set a difficult tone for the week.

Notably, the next 4 days noticed a complete inflow of $137.2 million, culminating in a internet outflux of $37.3 million for the week. These figures spotlight a risky but optimistic market panorama.

In the meantime, the constructive streak over the previous 4 days suggests a possible restoration and resilience within the Bitcoin ETF sector, pushed by focused investments and strategic capital reallocations. In addition to, the distinction between the preliminary outflux and the next inflows factors to a market attentive to altering dynamics, with buyers adapting rapidly to rising alternatives.

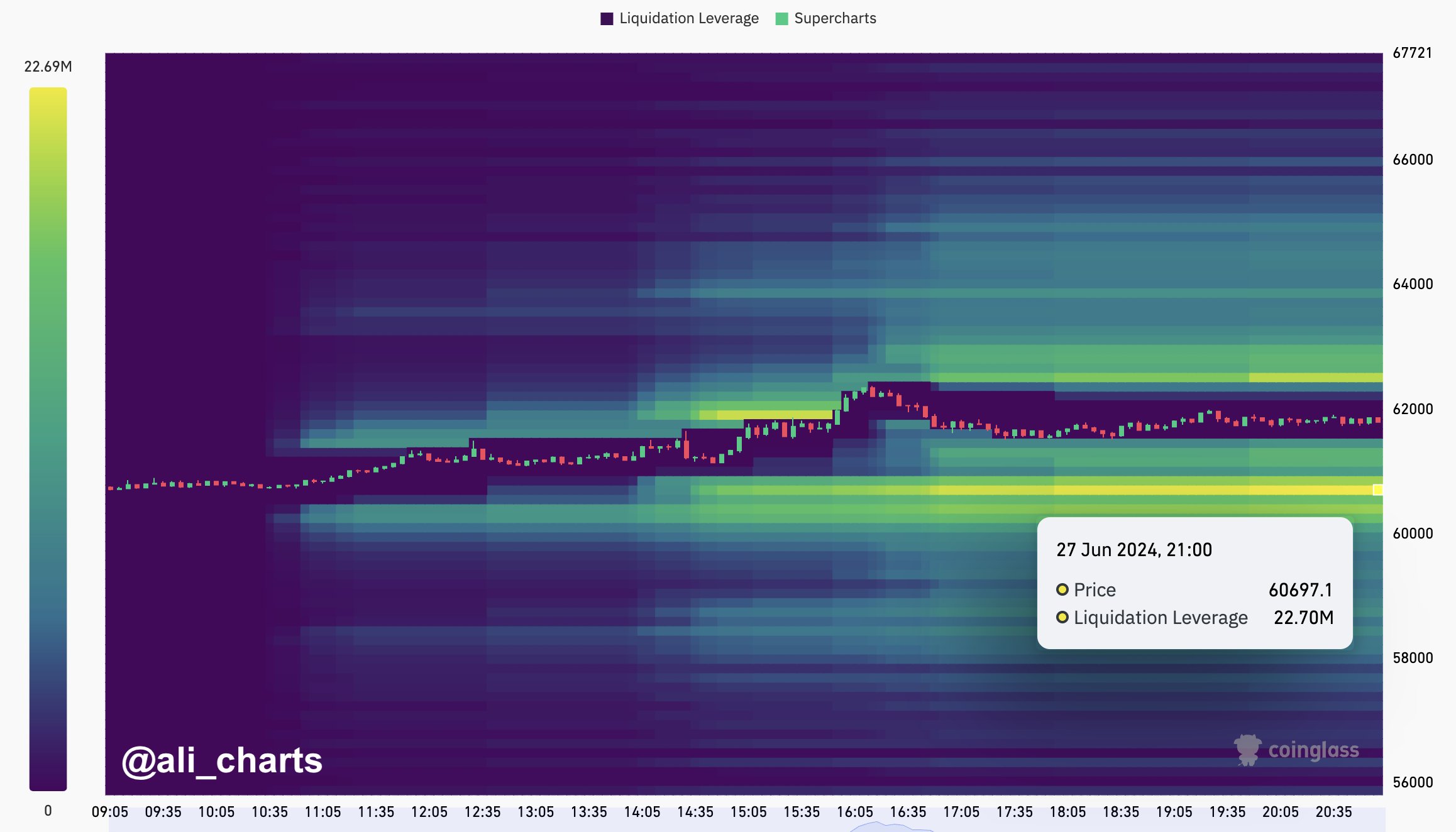

As Bitcoin’s worth fluctuates, the efficiency of its ETFs presents a crucial barometer for investor sentiment and market well being. As of writing, Bitcoin price was down practically 1.5% and exchanged fingers at $60,668. Over the past 24 hours, the crypto has touched a excessive of $61,720.31, with CoinGlass information exhibiting that BTC Futures Open Curiosity falling over 2% to $31.62 billion in the identical timeframe.

Notably, the market is now conserving a detailed observe of the BTC price movements with analysts warning of a big liquidation. For context, standard crypto market analyst Ali Martinez warned of over $22 million liquidation if Bitcoin drops to the $60,700 stage.

Additionally Learn: Could Solana Mimic Ethereum and Surge to $1,000? Analysts Weigh In

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: