Spot Bitcoin ETFs web flows have been adverse on Friday regardless of vital inflows recorded by BlackRock, Constancy, Bitwise, and Ark 21Shares Bitcoin exchange-traded funds (ETFs). The Genesis and Gemini state of affairs took a toll on the Bitcoin ETF web flows as GBTC outflow rate grew in the previous couple of days. Nonetheless, the week was nice for Bitcoin ETFs with a $1.7 billion web influx.

Bitcoin ETFs Recorded $140 Million New Outflow

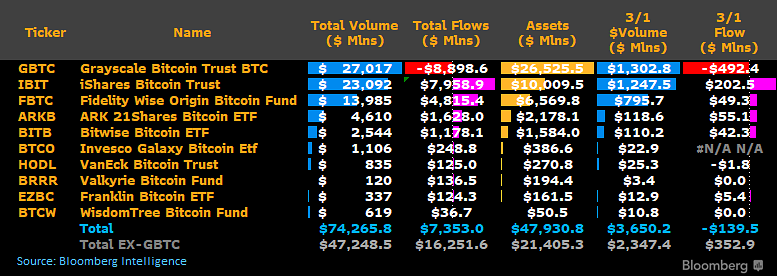

Spot Bitcoin exchange-traded funds (ETF) witnessed $140 million web outflow on March 1, in keeping with knowledge by Bloomberg and BitMEX Analysis. This got here amid large $492.2 million GBTC outflow, with Bitcoin ETFs influx taking successful.

Bloomberg ETF analyst James Seyffart stated the large outflows from GBTC have been virtually definitely associated to Genesis and Gemini state of affairs. Crypto lender Genesis final month obtained chapter court docket approval to promote 35 million GBTC shares price $1.3 billion.

Spot Bitcoin ETFs recorded large buying and selling volumes on March 1. Eric Balchunas, senior ETF analyst at Bloomberg, famous that this was the “third-biggest day ever Wed and Thur. All advised $22b traded this week, a few month’s price of quantity in 5 days.” He additionally checked out the potential of inflows subsiding within the subsequent few days.

BlackRock’s iShares Bitcoin ETF (IBIT) noticed $202.5 million influx, falling considerably from the latest largest inflows. Following the newest influx, BlackRock’s web influx hit over $7.95 billion and asset holdings jumped over $1o.5 billion.

Constancy Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF noticed $49.3 million and $55 million inflows, respectively. Bitwise (BITB) and different spot Bitcoin ETFs noticed marginally low inflows. VanEck Bitcoin ETF (HODL) noticed one other outflow of $1.8 million.

Notably, GBTC recorded one other main outflow of $492.4 million after a $598.9 million outflow on Thursday. GBTC web outflows reached over $8.89 billion so far.

Additionally Learn: Bitcoin Supply Shock — Bitcoin ETFs Have Already Scooped Up 4% of Total BTC

BTC Value Rally to Maintain or a Fall Forward?

BTC price buying and selling sideways within the final 24 hours after a forty five% acquire final month. Value is at the moment buying and selling at $62,046, with a 24-hour high and low of $57,093 and $63,913, respectively. Moreover, the buying and selling quantity has decreased by 30% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Latest experiences have hinted a possible correction in BTC worth to $42K after bitcoin halving, giving buyers one other buy-the-dip alternative for $100K.

Bitcoin futures and choices open pursuits (OI) stay at file ranges, with complete futures OI rising over 1% to $27.26 billion, as per Coinglass knowledge. Bitcoin price to $100K prediction stays regardless of Bitcoin choices places exceeding calls attributable to sky-high funding charges.

Additionally Learn: Binance Burns 2.21 Billion Terra Luna Classic, LUNC Price Skyrockets Over 30%

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: