The crypto market in 2023 Q1 witnessed restoration from bear market, Operation Choke Point 2.0 by US regulators for crypto crackdown, the US SEC lawsuits towards Binance, Coinbase, and different crypto corporations for violating securities legal guidelines, and return of institutional buyers with conventional corporations Bitcoin ETF filings. Will the bullish outlook proceed or are main headwinds coming in 2023 Q2?

Crypto Market Outlook in 2023

US GDP grew 2% in Q1, nicely above the 1.3% estimate. US Federal Reserve Chair Jerome Powell, the European Central Financial institution, and the Financial institution of England cleared on the annual ECB Discussion board occasion that central banks will proceed elevating rates of interest in 2023 H2. Powell on Thursday reiterated two extra hikes this 12 months.

The market expects the US Core PCE inflation information, Federal Reserve’s most well-liked gauge to measure inflation, to return in at 4.7%. It is going to trigger the US Fed to proceed mountain climbing charges in H2, as CME FedWatch signifies an 87% likelihood of a 25 bps in July. The US Treasury Basic Account rebuilding and the US greenback may even influence crypto costs within the second half, with the US greenback index (DXY) rising once more above 103 after two weeks.

Crypto analysts and Bloomberg analysts are bullish on Bitcoin worth hitting $40,000 in July or early August as conventional finance corporations together with BlackRock, Fidelity, and Invesco filed for spot Bitcoin ETF. Nevertheless, Bloomberg analyst Mike McGlone factors to main headwinds for Bitcoin worth within the subsequent quarter on account of excessive US recession risk, central banks mountain climbing charges, and different macro causes. In the meantime, crypto merchants brace for $7 billion in Bitcoin and Ethereum expiry in the present day, June 30, which is without doubt one of the largest and brings main volatility within the crypto market.

Additionally Learn: FTX Begins Talks To Restart And Rename The Exchange, Says CEO John Ray

Bitcoin, Ethereum, and Altcoins to Rally

Many individuals already anticipating the return of the bull market in 2023 H2 on account of Bitcoin ETF, a $199 million institutional inflow in crypto after nearly a 12 months, and US greenback liquidity remaining passable regardless of T-bills subject by US Treasury Dept.

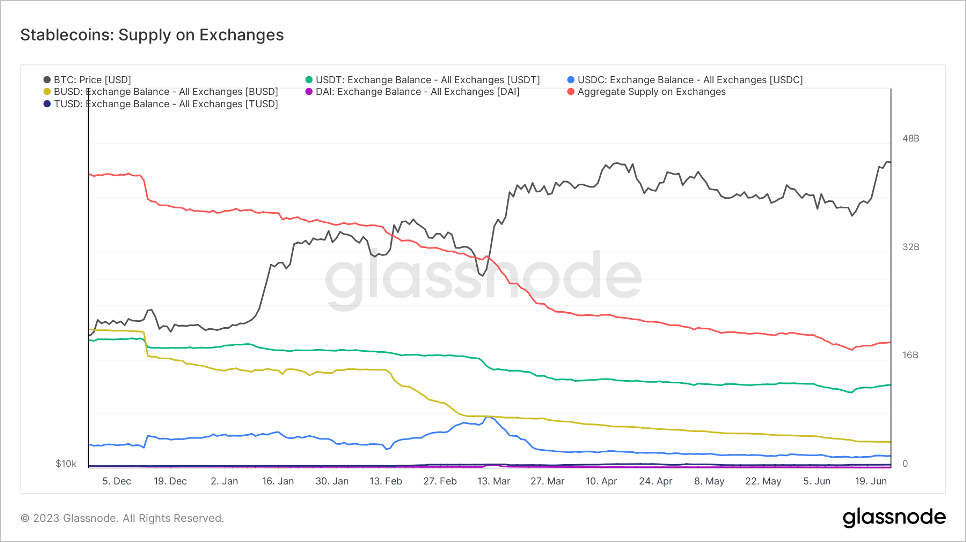

Since mid-Jun, the reserves of stablecoins in main crypto exchanges have rebounded considerably, bringing a rebound in crypto belongings corresponding to BTC and ETH. Moreover, the efforts on crypto rules have resulted in a higher focus of liquidity in established crypto belongings, corresponding to Bitcoin and Ethereum, which can immediate Bitcoin and Ethereum to enter the “technical bull market” earlier.

Furthermore, Bitcoin occupies 50% of the crypto market cap and altcoins are beneath strain. Nevertheless, a decline within the BTC market cap anticipated in 2023 H2 may convey a pointy transfer in altcoins.

Additionally Learn: Terra Classic Community Veto Against “Six Samurai” Team Proposal To Revive LUNC, Here’s Why

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[quads id=14]