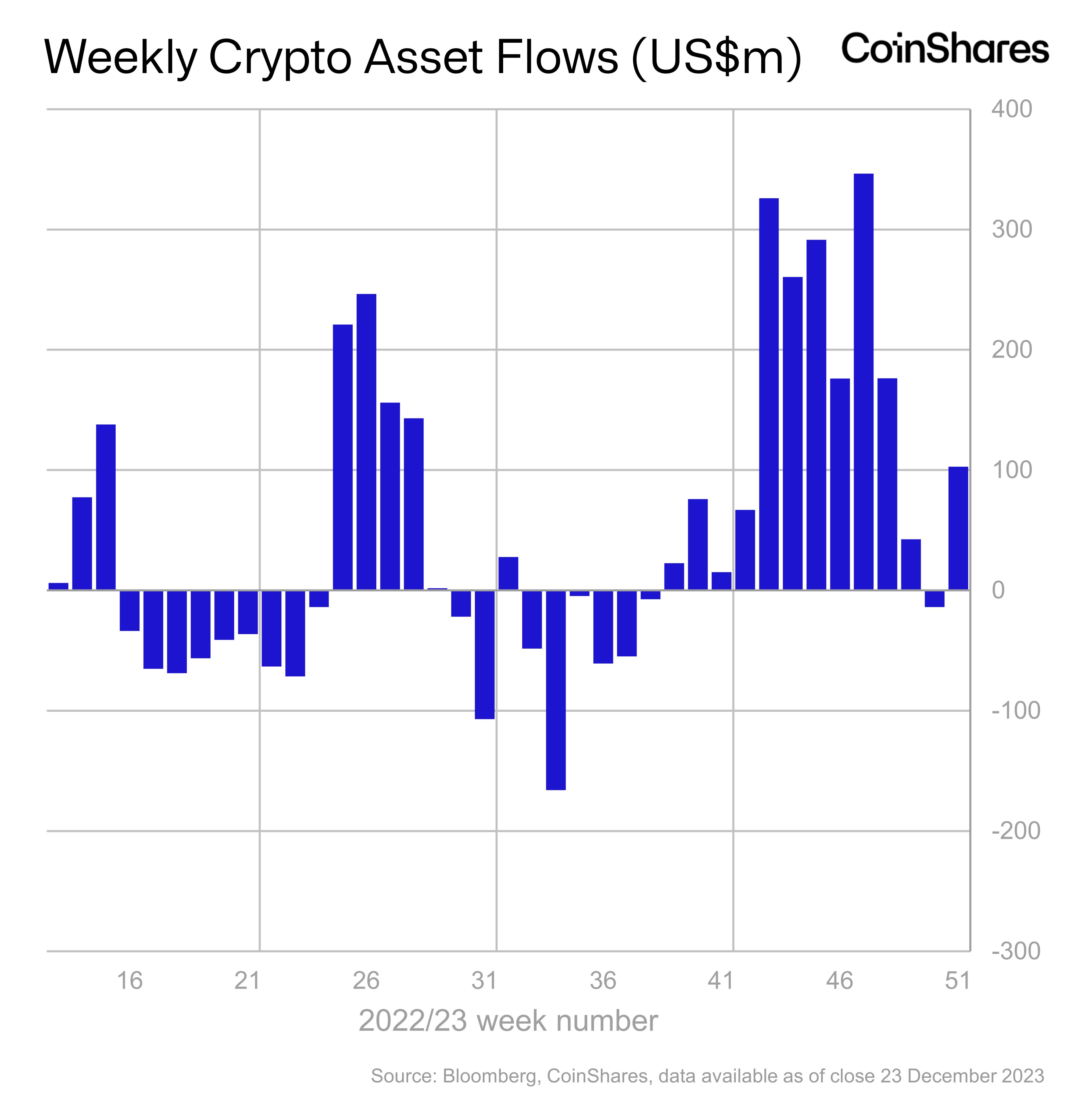

In a much-needed turnaround occasion, digital asset funding merchandise noticed one other week of inflows, as per the newest report by CoinShares. After a $16 million price of outflows that ended an 11-week run of inflows and noticed $33 million outflows of Bitcoin, the inflows have renewed constructive sentiment forward of doable spot Bitcoin ETF approval in early January.

Bitcoin Data Over $87 Million Of Weekly Inflows

Crypto asset funds recorded weekly inflows of $103 million, revealed James Butterfill, head of analysis at CoinShares, on December 25. Regardless of a small enhance, it’s important for the crypto market as spot Bitcoin ETF approval is simply across the nook. The U.S. SEC met with spot Bitcoin ETF issuers many occasions final week.

Bitcoin recorded an $87.6 million inflows, pushing inflows in the previous couple of weeks. Brief-bitcoin additionally noticed inflows of $0.4 million, with month-to-date inflows of $12.5 million. Whereas some stay skeptical in regards to the resolution on spot Bitcoin ETF, new Bitcoin ETF adverts by Bitwise and Hashdex introduced a refund into the market.

Ethereum additionally noticed inflows of $7.9 million indicating higher funding fundamentals and excessive demand for its staking yield. Solana noticed $6 million in every week and $20.1 million in inflows month-to-date, the third-largest amongst altcoins. inflows amongst altcoins.

Nonetheless, Cardano inflows declined to only $1 million, whereas Avalanche, Litecoin, and XRP recorded outflows as buyers seemed to different crypto belongings.

Germany, Canada, the U.S., Switzerland, and Brazil led the crypto asset funds’ inflows.

Additionally Learn: Bitcoin Price Stagnates, Altcoins Rally On Christmas — Is A Santa Claus Rally In Effect?

BTC price shifting vary certain within the final 24 hours, with the value presently buying and selling at $43,660. The 24-hour high and low are $42,765 and $43,827, respectively. Furthermore, buying and selling quantity has elevated by 43% up to now 24 hours, indicating curiosity from merchants. It occurs as open curiosity rises after Bitcoin ended the week greater.

ETH price trades at $2296, up 1% up to now 24 hours. Nonetheless, the buying and selling quantity has decreased barely up to now 24 hours.

Additionally Learn: Binance Announces Special Listings Of ADA, AVAX, DOGE, LINK, MATIC & Other Crypto

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: