The worth of Bitcoin (BTC) has not been notably spectacular over the weekend, which has been a considerably constant theme of the cryptocurrency market thus far within the yr 2025. The premier cryptocurrency continues to hover across the $108,000 mark, displaying indicators of indecision amongst the buyers.

With the coin’s indecisive value motion, the dialog has been about when the Bitcoin value will return to its all-time excessive. Curiously, the newest on-chain knowledge reveals that buyers have gotten more and more assured within the long-term promise of the flagship cryptocurrency.

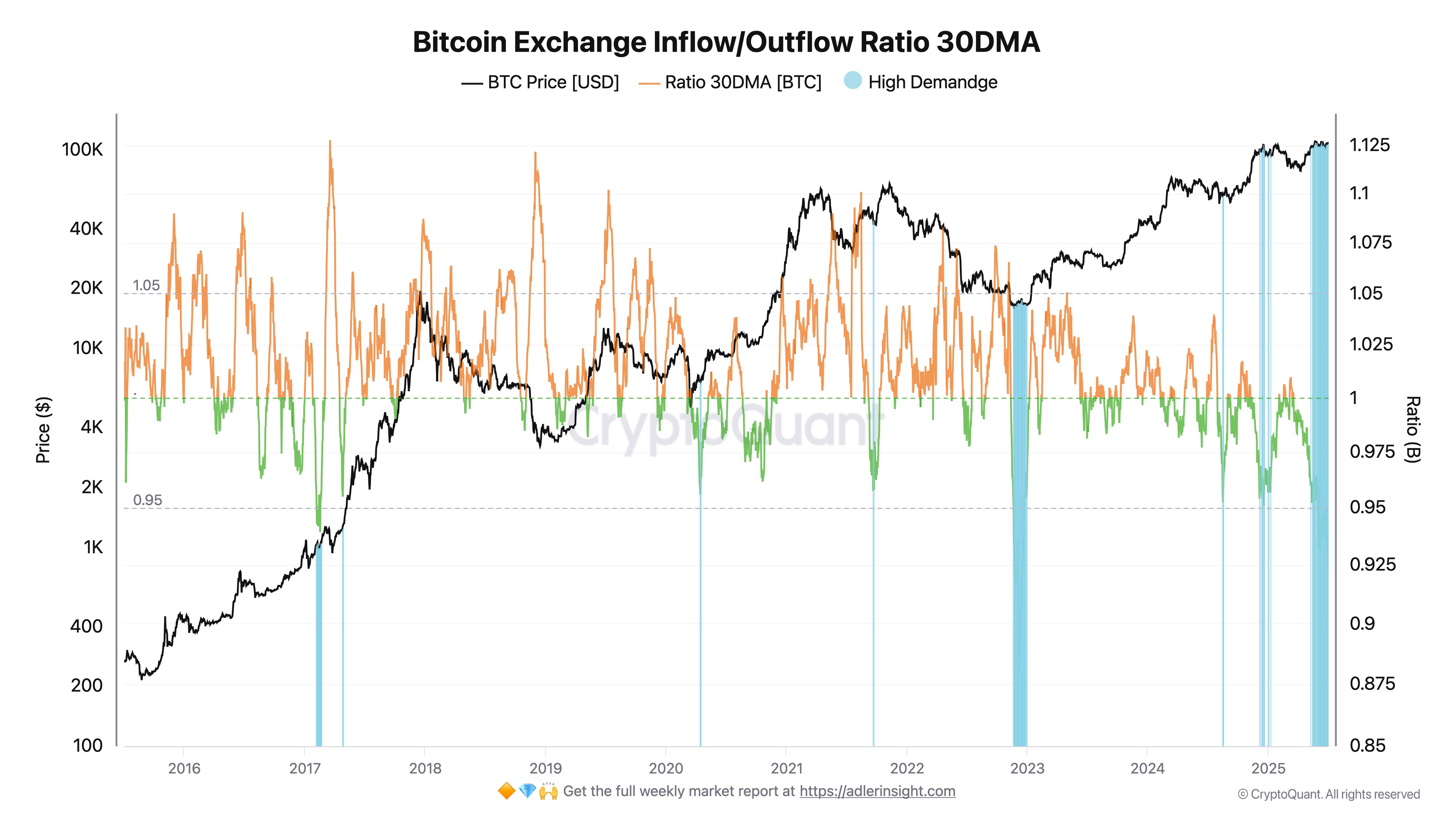

Bitcoin Alternate Influx/Outflow Ratio Under 1: On-Chain Analyst

In a July 5 put up on the X platform, an on-chain analyst with the pseudonym Darkfost revealed that Bitcoin has continued to move out of centralized exchanges over the previous few months. The net crypto pundit talked about that this development displays the rising confidence of buyers in the long run.

This on-chain statement is predicated on the Bitcoin Alternate Influx/Outflow Ratio 30DMA, a metric that measures the amount of BTC flowing out and in of centralized exchanges over a interval of 30 days. A excessive ratio (>1) signifies extra inflows than outflows into exchanges, signaling elevated promoting strain for the premier cryptocurrency.

Then again, a low ratio (<1) implies that extra cash are flowing out of fairly than into centralized exchanges. When the Alternate Influx/Outflow Ratio has a low worth, it means that buyers are accumulating and holding their cash in the long run.

In accordance with Darkfost, the Bitcoin month-to-month outflow/influx ratio just lately fell to round 0.9, its lowest degree because the bear market of 2023. With the metric now beneath the 1 threshold, it implies that Bitcoin trade outflows are dominant, reflecting a strong and sustained demand on the spot market.

The on-chain analyst mentioned:

As of in the present day, demand stays current as outflows proceed to dominate, with a rising variety of long-term holders stepping in.

In the end, Darkfost believes that the arrogance being proven in Bitcoin’s long-term promise is anticipated, contemplating the rising adoption by main companies and governments, most notably in the US. “BTC is regularly evolving right into a retailer of worth, more and more used to strengthen treasury methods,” the crypto analyst added.

Bitcoin Value At A Look

As of this writing, the worth of BTC stands at round $108,103, reflecting a mere 0.3% improve up to now 24 hours.