Bitcoin has felt the results of warfare, identical to the remainder of the world. The present geopolitical scenario generates uncertainty for each households and markets. The query of 1,000,000 {dollars} for bitcoin appears to be whether or not it could actually nonetheless work as a hedge in opposition to inflation or has February confirmed the alternative.

Geopolitics And Bitcoin

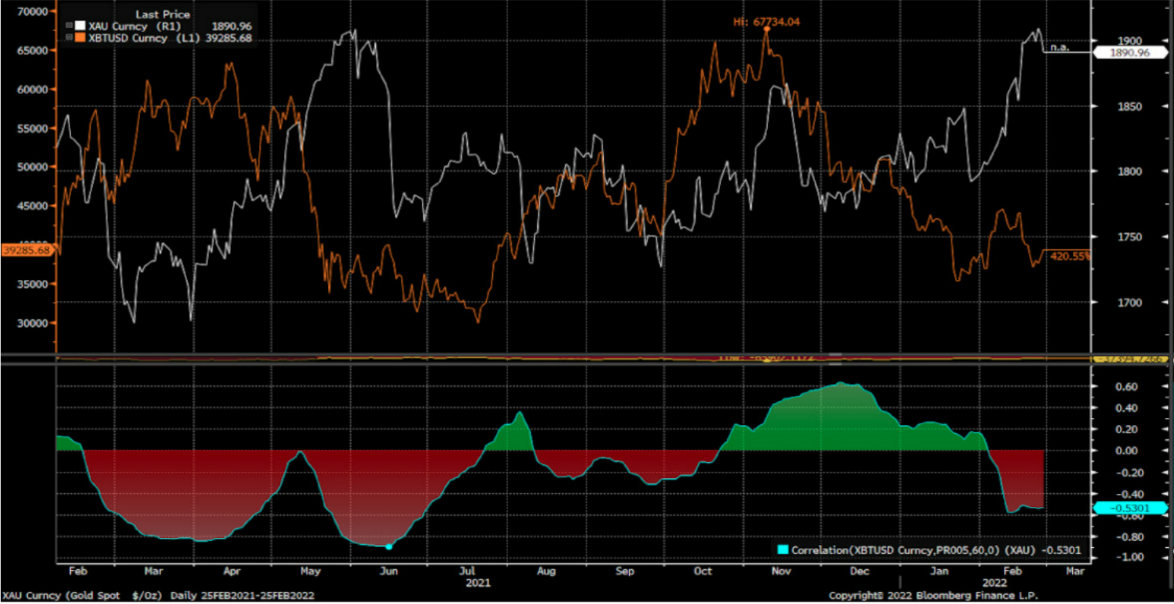

A report by QCP Capital factors out that, traditionally, the has been a poor correlation between BTC and Gold costs, which places into query if the digital asset might be handled as a hedge in opposition to inflation to assist defend the worth of investments and people’ financial savings.

Sanctions in opposition to Russia will likely be felt by everybody all over the world. International oil and fuel costs have already surged and are anticipated to escalate additional. Inflation will increase because the financial penalties of the pandemic meet with a warfare.

Investopedia explains that “Belongings which are thought of an inflation hedge might be self-fulfilling; buyers flock to them, which retains their values excessive regardless that the intrinsic worth could also be a lot decrease.”

Because of this, gold has been the go-to hedge in opposition to inflation asset for years. And bitcoin has been long-described as “digital gold”, however the little correlation between them throughout instances of risk-off means the digital asset has traded extra like “a high-beta leveraged danger asset with a powerful correlation to Tech and NASDAQ.”

Nonetheless, there are extra issues to think about as we enter what appears to be a key level in historical past for the crypto market and blockchain know-how.

The report additional notes that “the place BTC has extra essential macro use-case now could be its capacity to function the first weekend hedge for occasion danger, whereas conventional markets are closed.”

Offering spot and choices liquidity always makes it work as the brand new final resort hedge for merchants who beforehand used center japanese markets. Additionally, Bitcoin has confirmed to mirror draw back danger earlier than some other markets can open.

Furthermore, NewsBTC recently reported how Gold had been outperforming Bitcoin after Russia began the assault on Ukraine, however the digital coin took again its dominant place after recovering to roughly $40,000 final Thursday whereas Gold declined.

Associated Studying | Bitcoin Volumes Surge As Ruble Plummets

Whereas at firsts buyers ran to gold amidst geopolitical considerations, it’s exactly in these instances of turmoil when bitcoin makes its case as it’s extra accessible, straightforward to maneuver, and use –as a type of cash–than gold.

And BTC Is Rallying In the present day

In a Fox Enterprise Dwell with Euro Pacific Capital CEO Peter Schiff and journalist Layah Heilpern, the stockbroker continued to slam at BTC and favor gold solely. He has claimed for years that the digital asset will stoop to $0 and that it “shouldn’t be going to hedge in opposition to something.”

Heilpern had her bitcoin arguments greater than prepared and slammed again saying that Schiff’s projection has by no means come to a realization and the elemental worth of bitcoin has been working completely throughout this yr’s turmoils:

“You’ll be able to’t commerce peer to see in gold. Bitcoin is actually another financial system.”

As Heilpern defined, you can not ship donations to Ukrainians –or anybody– in gold; you can not flee a rustic carrying gold bars.

Associated Studying | Possible Scenarios For Bitcoin, How The Market Has Reacted To Past Wars

Reportedly, amidst frozen financial institution accounts many civilians from Ukrania and Russia have began to make use of BTC as each populations have been tremendously affected by a warfare they didn’t begin.

Furthermore, the warfare will solely make the U.S. inflation increased, and the case for Bitcoin is something however closed as mass adoption is a risk that will probably shift the narratives totally in its favor.

And on high of that, the digital coin has been surging in value as we speak. Dealer Sven Henrich shared his view on the present Bitcoin rally. The professional claims there are 4 primary causes for it:

- Basic: “Adoption & acceptance continues to increase, i.e #ebay but additionally institutional. This path will proceed in my opinion. There is no such thing as a signal of regression, however continued growth.”

- Sentiment: “The Ukraine disaster highlights how Bitcoin can act as a help mechanism to lift funds when conventional avenues are reduce off. Blockchain & decentralized cash to change into extra related.”

- Technical: “Bitcoin made a better low versus equities in February displaying a constructive divergence & protection of a key development. Begin of correlation decoupling course of?”

- Security Commerce: “Sanctioned cash could search Bitcoin as a protected haven (unconfirmed) This additionally invitations danger because it offers an excuse to speed up regulation (long run constructive/brief time period danger).”