Amid the present market turmoil, the Bitcoin Fear & Greed Index has continued on a pointy decline. This decline has seen the index fall to its lowest stage in over three months as crypto buyers change into extra fearful and maintain their investments from the market.

Bitcoin Concern & Greed Index Takes A Nosedive

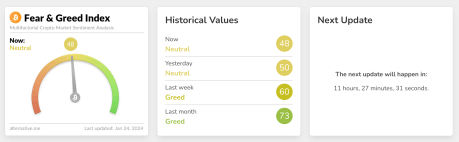

Within the months main as much as the top of the yr 2023, the Bitcoin Concern & Greed Index climbed steadily till it reached excessive greed ranges. Now, this index takes quite a few components into consideration to position investor sentiment throughout quite a few classes starting from Excessive Concern, Concern, Impartial, Greed, and Excessive Greed.

The Fear & Greed Index represents investor sentiment utilizing scores between 1 and 100, with the decrease finish of the rating representing worry ranges and the upper ends representing greed. A rating between 1 and 25 places investor sentiment in Excessive Concern, 26-46 is Concern, 47-52 is Impartial, 53-75 is Greed, and 76-100 is Excessive Greed.

In 2023, the rating climbed as excessive as 74 as Bitcoin rallied towards $50,000. Nevertheless, because the market has retraced, so has investor sentiment, which is at the moment trending towards worry. On the time of writing, the Bitcoin Concern & Greed Index is exhibiting a rating of 58, which places it in Impartial territory. It is usually two scores down from yesterday’s figures of fifty which implies that investor sentiment is trending extra towards worry than greed.

Supply: different.me

The present determine is the bottom that the index has been since October 2023. The final time the Bitcoin Fear & Greed Index fell beneath 48 was on October 17 2023. In circumstances like these, it exhibits that buyers are much less inclined to place cash into the market. This causes demand to fall, and because of this, costs of property throughout the area undergo for it.

BTC value begins to point out power | Supply: BTCUSD On Tradingview.com

When Will The Bleed Cease?

Thus far, the decline within the Bitcoin value has been triggered by huge outflows from the Grayscale Bitcoin Trust (GBTC) as buyers redeemed their shares. Over $2 billion in BTC has flowed out from the fund, and this has put plenty of promoting strain on the asset.

Nevertheless, because the week progresses, the outflows are anticipated to decelerate as buyers cease promoting. In such a case, the demand could be all to meet up with the provision being dumped available on the market, thereby giving Bitcoin and different property an opportunity to get better.

On the time of writing, the Bitcoin price continues to be trending round $40,000 after a bounce again from a dip to $38,500. The worth is up 2.6% within the final week, in keeping with knowledge from Coinmarketcap.

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual threat.