The Bitcoin price has had a rocky begin to the brand new week after shedding its footing above $52,000 on Tuesday. Nonetheless, all hope shouldn’t be misplaced, as indicators nonetheless level to a continuation of this pattern. Crypto analyst Tony The Bull has recognized an necessary pattern within the Bitcoin chart which might set off a continuation of the pattern again above $52,000.

Bitcoin 1-Week Fisher Rework At Essential Level

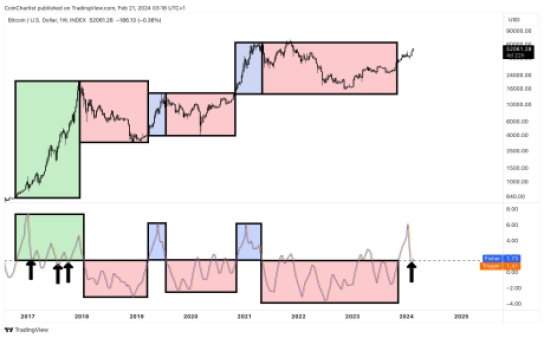

In an evaluation posted on X (previously Twitter), the crypto analyst shared a chart that confirmed the Bitcoin Fisher Rework compared to value. Most significantly, the chart confirmed the 1-week Fisher Rework and the way it has moved since 2017.

The evaluation reveals some similarities between the present pattern and the developments seen in 2017. An identical pattern was additionally seen in 2019 and 2021, the place the Fisher Rework rose quickly earlier than falling. However the significance of this pattern lies in the place the Fisher Rework heads subsequent from right here.

The present necessary stage is the 1.5 Commonplace Deviation, which has been a vital level each time this pattern has occurred. Now, if the Fisher Rework is ready to keep above this stage, it’s bullish for the price. Nonetheless if it falls under this customary deviation, it is rather bearish for the worth.

Supply: Tony The Bull on X

“This can be a pivotal space based mostly on historic value motion and its exhibiting 2017-like habits not seen in 2019 or 2021,” the crypto analyst explains. “Beneath it tends to incite bearish developments, whereas holding above provides bulls additional vigor.”

BTC value at $51,100 | Supply: BTCUSD on Tradingview.com

Bears And Bulls Vie For Management Over BTC Value

The curiosity within the subsequent route of the Bitcoin value has seen bulls and bears lock horns over which camp will reclaim management of BTC. This has seen the worth of the digital asset fluctuate wildly over the previous couple of days, going from $53,000 to under $51,000, earlier than bouncing again up as soon as once more within the early hours of Wednesday.

This tug-of-war continues to hold the price of Bitcoin down, however investor sentiment appears to be climbing even by way of this. In response to the Bitcoin Worry & Greed Index, investor sentiment has reached Excessive Greed for the primary time in a single 12 months.

Traditionally, the index going into excessive greed has signaled the highest of the market, with costs trending downward not too lengthy after. Nonetheless, Bitcoin is still seeing positive indicators, with its buying and selling quantity rising greater than 40% within the final 24 hours alone.

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site completely at your individual danger.