Despite the fact that Bitcoin (BTC) was rejected at $45,500, hope for one more substantial advance within the cryptocurrency market has reappeared. Bulls are actually aiming to beef up their protection on the $43,000 help stage.

In line with TradingView data, after reaching a weekly excessive of $45,500 early on Feb. 8, bears had been in a position to decrease the value of Bitcoin to $42,900 throughout afternoon buying and selling as buyers realized earnings and ready to put bids at $38,000. On the time of writing, the pioneer token is price $44,091.

Bitcoin Steadies At $44k

Bitcoin (BTC) bulls have efficiently returned the principle digital foreign money’s worth to the $44K help stage, boosted by encouraging occurrences. Most notably, the Canadian subsidiary of accounting main KPMG just lately introduced that it has built-in BTC and ETH to its company treasury. As well as, Tesla Inc reported in a just lately filed 10-Ok that it possessed practically $2 billion in BTC on the finish of final yr.

The fast rise caught many merchants off shock, as headlines throughout the crypto group predicted the beginning of a prolonged bear market, however such grim predictions might have been untimely, in keeping with knowledge from a latest Glassnode analysis. In line with the blockchain analysis firm, “costs have bounced off plenty of basic ranges which have traditionally signaled undervaluation or a “honest worth” worth.”

The founder and CEO of multi-strategy agency Banz Capital, John Iadeluca, commented on this development, saying:

“Tesla’s 10K SEC submitting replace was launched yesterday, reaffirming notions that Tesla held onto their BTC holdings amidst declines in Bitcoin’s worth to the decrease 30 hundreds. Mixed with the information of KPMG Canada including Bitcoin onto its steadiness sheet, inspired a pointy rise in constructive Bitcoin worth sentiment.”

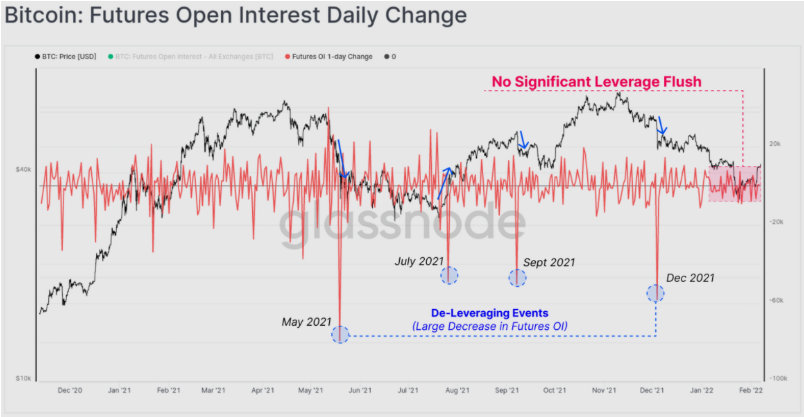

Bitcoin futures open curiosity day by day change. Supply: Glassnode

Glassnode noticed that in earlier cases of extreme worth losses, futures open curiosity (OI) skilled enormous drawdowns or “de-leveraging occasions,” as evidenced by the big downward crimson spikes on the graph above, a characteristic that’s strikingly absent from this latest worth decline. The agency mentioned:

“This will point out the chance of a brief squeeze is decrease than first estimated, or that such an occasion stays potential ought to the market proceed greater, reaching clusters of quick vendor stop-loss/liquidation ranges.”

Associated article | Valkyrie Bitcoin Mining ETF “WGMI” Approved For Nasdaq Listing

Bitcoin In Longest Rally

Bitcoin new rally is BTC longest streak since final September. After the latest dip, investing in a number of of those dangerous asset teams has turn out to be significantly extra comfy.

Whereas the market isn’t out of the woods but, there may be nonetheless a lot uncertainty on plenty of fronts, together with how swiftly the Federal Reserve can act to fight rising inflation.

In the meantime, veteran merchants, notably the pseudonymous Twitter consumer Pentoshi, are seizing the chance. This contains amassing some earnings and repositioning your self for what the longer term holds. Pentoshi put it this fashion:

“Taking the final highs now. In search of one final spike up however $44,000–$46,300. In my view, great place to shut longs out and re-evaluate.”

BTC/USD trades $44k. Supply: TradingView

Regardless of BTC’s elevated sense of optimism when it comes to pricing, some merchants stay gloomy on the highest cryptocurrency. Allen Au, a Bitcoin skilled and Twitter consumer, shared a graph depicting the final worth motion’s influence on futures markets. Following a drop in open curiosity, there was a $71 million liquidation of Bitcoin shorts. Au described this as a “quick squeeze” that can most actually proceed to advertise worth will increase. As well as, he acknowledged:

“Perpetual futures funding charges are destructive regardless of BTC breaking above $44K. Merchants are nonetheless bearish about BTC.”

Associated article | As Bitcoin Price Jumps Above $40k, Tesla Reveals Holdings Tapped $2 Billion

Featured picture from iStockPhoto, Charts from TradingView.com