On-chain information reveals Bitcoin funding charges have sunk into deep unfavorable values, one thing that might pave method for a brief squeeze out there.

Bitcoin All Exchanges Funding Charge Has A Pink Worth Proper Now

As identified by an analyst in a CryptoQuant post, BTC may even see a slight uplift within the brief time period due to the present funding charges.

The “funding rate” is an indicator that measures the periodic price that Bitcoin futures lengthy and brief merchants alternate between one another.

When the worth of this metric is optimistic, it means longs are paying a premium to the shorts proper now to carry onto their positions.

Since there are extra longs out there, such a pattern reveals {that a} bullish sentiment is dominant within the futures market in the mean time.

Associated Studying | Is Coinbase Losing Its Edge? Nano Bitcoin Futures Sees Low Interest

Alternatively, unfavorable values of the funding price suggest that there are extra shorts out there presently, and that the general sentiment is bearish proper now.

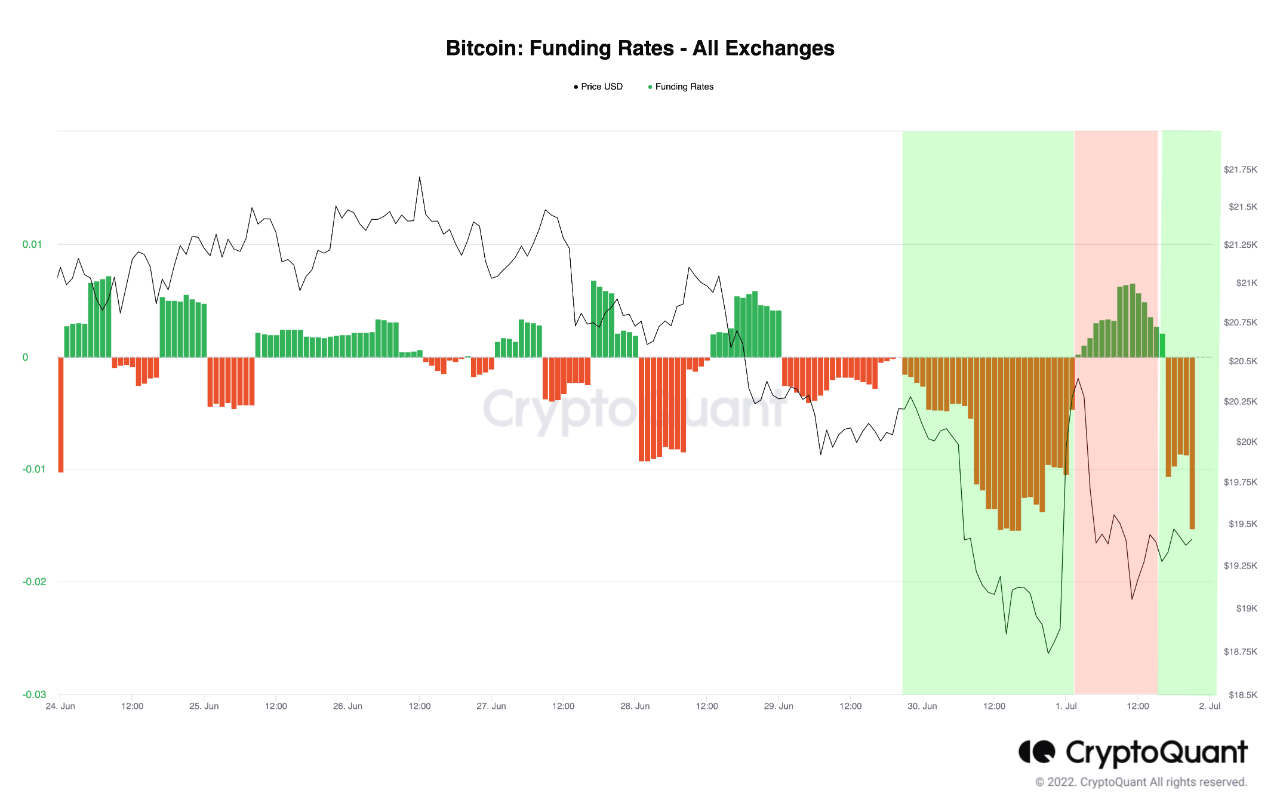

The beneath chart reveals the pattern within the all exchanges Bitcoin funding charges over the past week.

The worth of the indicator appears to be lower than zero in the mean time | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin funding price has gone down over the previous day and has a comparatively unfavorable worth proper now.

Which means that futures merchants are piling up shorts out there, An analogous pattern additionally came about simply a few days again because the chart reveals.

Associated Studying | Samsung To Make Chips That Can Power Bitcoin Mining – Will This Energize Crypto?

Again then, the value reversed upwards sharply and brought on a brief squeeze, which additional amplified the value swing.

A “brief squeeze” happens when mass liquidations of brief merchants happen on account of a sudden sharp swing within the value.

Massive liquidations additional transfer Bitcoin within the path of the reversal, inflicting much more leverage to be flushed. On this method, liquidations cascade collectively and the occasion is known as a “squeeze.”

Since shorts are accumulating within the BTC futures market proper now, it’s attainable {that a} swing within the value might trigger such a squeeze, bringing some uplift for the crypto.

Nevertheless, similar to a few days in the past, it’s seemingly that such liquidations would solely present a rise within the brief time period.

BTC Worth

On the time of writing, Bitcoin’s price floats round $19.2k, down 9% prior to now week. The beneath chart reveals the pattern within the worth of the crypto over the past 5 days.

Seems to be like the value of the coin has sunk down over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com