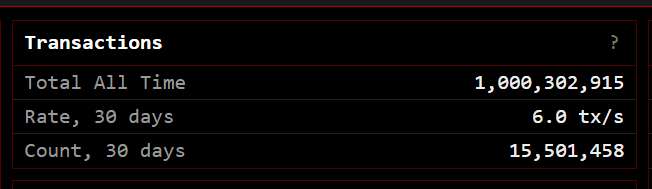

Bitcoin, the trailblazer of cryptocurrencies, reached a symbolic milestone this weekend, processing its 1-billionth transaction. This achievement has ignited a celebratory temper amongst proponents, who hail it as a testomony to the digital forex’s rising legitimacy and potential. Nonetheless, beneath the champagne toasts, whispers of warning linger as analysts grapple with the true significance of this benchmark.

Bitcoin’s Blockchain Bonanza: Safety And Pace Take Middle Stage

On the coronary heart of the celebration lies the accomplishment itself. Bitcoin’s decentralized community, usually touted for its safety, has demonstrably facilitated 1 billion transactions – a testomony to its means to perform flawlessly at scale.

This feat, based on data by Clark Moody, is especially noteworthy when in comparison with established fee giants like Visa, which took roughly 25 years to achieve the identical milestone. Proponents like Tarik Sammour emphasize this achievement, highlighting that “Bitcoin has executed so flawlessly, securely, and with none centralized middleman,” a stark distinction to the standard monetary system.

What’s superb is just not that the #Bitcoin community has now processed 1B transactions, however that it has executed so flawlessly, securely, and with none centralised middleman. https://t.co/XC09H5bO6u

— Tarik Sammour (@tarik_sammour) May 6, 2024

Bitcoin Vs. The Goliaths: Can Crypto Actually Compete?

The celebratory temper extends to Bitcoin’s potential as a viable funds platform. Analysts level to the speedy development of Bitcoin in comparison with established gamers like Visa and Mastercard. Founding father of the Orange Capsule App, Matteo Pallegrini, emphasizes this level, underscoring Bitcoin’s resilience regardless of dealing with giants with “billions of {dollars} in advertising spend and 1000’s of staff.”

This comparability fuels the narrative that Bitcoin is disrupting the funds panorama, providing a sooner and extra clear various.

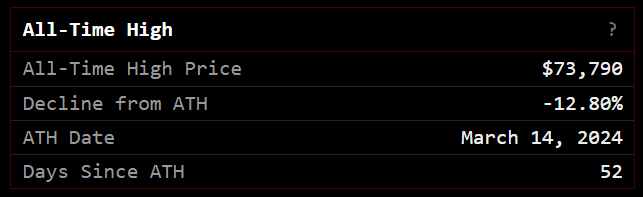

A screenshot of Bitcoin Community's transactions and BTC value efficiency. Supply: Clark Moody.

A Look Past The Billion: Challenges On The Horizon

Whereas the celebratory refrain is loud, a more in-depth look reveals some lingering considerations. Bitcoin grapples with scalability points, struggling to deal with the excessive transaction quantity obligatory to actually compete with conventional fee processors.

This usually interprets to excessive transaction charges, doubtlessly hindering broader adoption. Moreover, the environmental influence of Bitcoin mining, which depends on huge quantities of vitality, stays a major level of rivalry.

Bitcoin is now buying and selling at $64.244. Chart: TradingView

The Verdict: A Toast With Reservations

The 1 billion transaction milestone undoubtedly marks a major second for Bitcoin. It underscores the rising recognition and potential of this digital forex. Nonetheless, a balanced perspective acknowledges the challenges Bitcoin faces – scalability, transaction charges, and environmental considerations.

Associated Studying: XRP Holders Stack Coins Despite Price Dip: Bullish Signal Or HODL Of Desperation?

Whereas institutional funding and comparisons to web adoption are encouraging indicators, widespread particular person adoption stays a query mark. The way forward for Bitcoin hinges on its means to deal with these points and evolve into a very viable various within the international monetary panorama.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site totally at your personal threat.