Susquehanna Worldwide Group, a behemoth in asset administration with a buying and selling quantity dealing with quite a few monetary merchandise globally, has made a considerable funding in Bitcoin via numerous exchange-traded funds (ETFs). A disclosure to the Securities and Change Fee (SEC) on Might 7 revealed that Susquehanna held roughly $1.2 billion in spot ETFs throughout the first quarter of 2024.

The Bitcoin ‘Monster Whales’ Are Right here

The small print of the funding are notably notable for his or her scale and variety. Susquehanna now holds 17,271,326 shares within the Grayscale Bitcoin Belief (GBTC), which alone is value roughly $1.09 billion as of March 31, 2024. This single funding represents a good portion of the whole BTC funding, indicating Susquehanna’s choice for Grayscale on account of its excessive liquidity.

Additional diversification in Susquehanna’s holdings contains 1,349,414 shares of Fidelity‘s spot Bitcoin ETF (FBTC), valued at roughly $83.74 million. As well as, the agency has considerably elevated its stake within the ProShares Bitcoin Technique ETF (BITO), which provides publicity to BTC futures contracts. Susquehanna owned 7,907,827 shares of BITO as of the identical date, valued at roughly $255.42 million — this represents a 57.59% enhance from a February submitting that listed 5,021,149 shares.

Moreover, Susquehanna’s Bitcoin ETF portfolio contains stakes in different high-profile funds such because the BlackRock ETF, ARK21 ETF, Bitwise ETF, Valkyrie ETF, Invesco Galaxy ETF, VanEck ETF Belief, and WisdomTree ETF. The agency’s strategic choice of funds illustrates its complete strategy to capitalizing on totally different features of Bitcoin’s funding potential.

Susquehanna Worldwide Group, LLP holds over $1 Billion in Bitcoin ETFs in Current Portfolio Replace pic.twitter.com/0UPzLUVRsK

— Phoenix » PhoenixNews.io (@PhoenixTrades_) May 7, 2024

Julian Fahrer, CEO and co-founder of Apollo, commented on the magnitude of this improvement, stating, “HUGE: Susquehanna Worldwide Group is the most important Bitcoin ETF whale but! $1.2 Billion held throughout 10 ETFs! The monsters are right here.” This enthusiastic endorsement displays the rising optimism and institutional curiosity in cryptocurrency investments.

Regardless of these appreciable stakes, Susquehanna’s allocation to BTC stays a comparatively minor fraction of its whole portfolio. With whole investments surpassing $575.8 billion, the $1.2 billion in Bitcoin ETFs constitutes roughly 0.22% of the agency’s holdings, signaling a cautious but important entry into the digital asset area.

This transfer by Susquehanna has far-reaching implications for the market. Bitcoin ETFs acquired off to a roaring buying and selling begin and have seen interest wane in current weeks. The rise in institutional funding, as evidenced by Susquehanna’s actions, is predicted to boost Bitcoin’s credibility and stability as a monetary asset.

Furthermore, Susquehanna’s various funding isn’t just restricted to direct Bitcoin publicity. The corporate additionally reported oblique publicity via its holdings in MicroStrategy stock, which possesses a considerable Bitcoin reserve on its steadiness sheet. Nonetheless, in a current rebalancing, Susquehanna lowered its stake in MicroStrategy by practically 15%, adjusting its publicity according to its strategic portfolio changes.

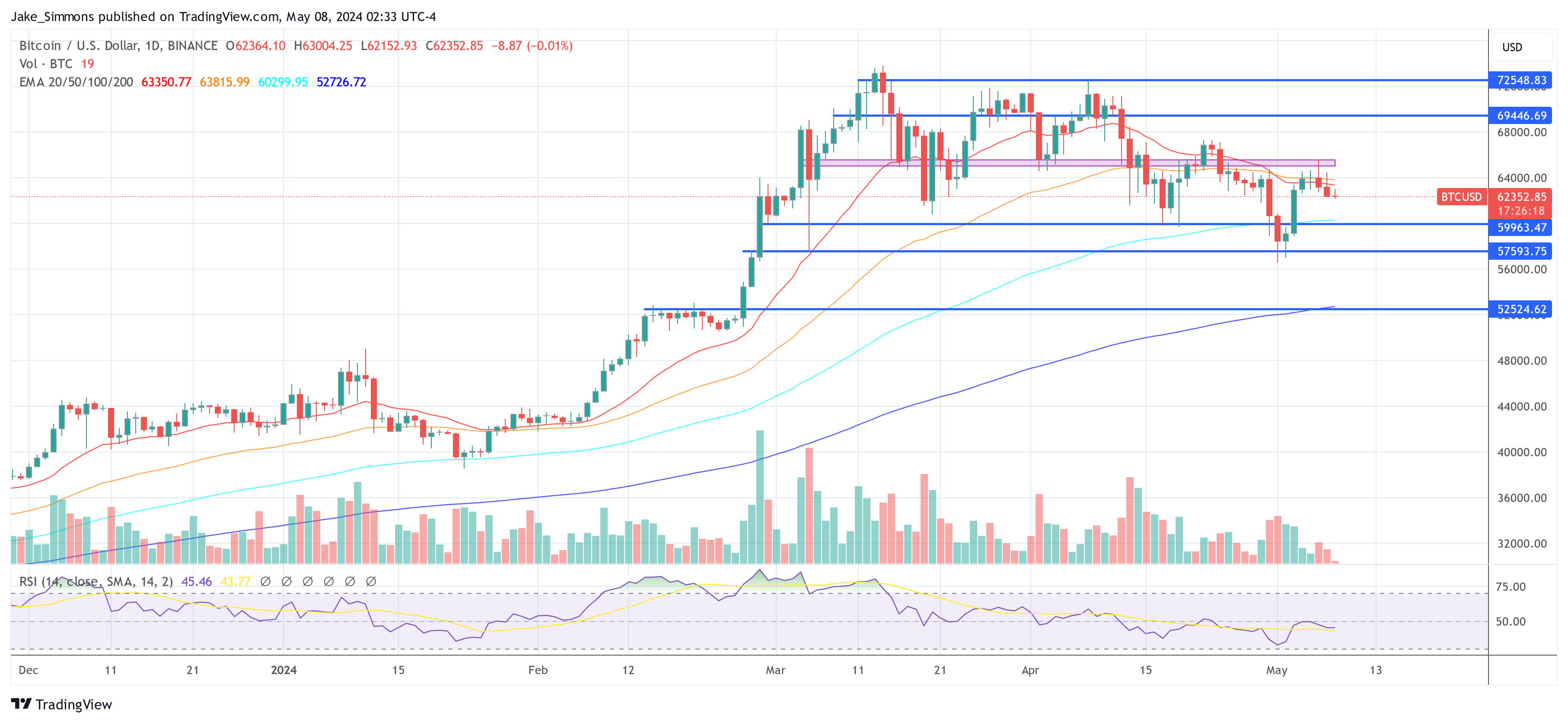

At press time, BTC traded at $62,352.

Featured picture from Rémi Boudousquié / Unsplash, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual danger.