The US CPI information is the primary financial occasion of the buying and selling week. Inflation has been the primary driver of financial coverage for greater than a yr now; thus, each market participant is on standby till the information comes out.

Crypto merchants loved a pleasant rebound of the complete market at first of 2023. Bitcoin, for instance, rallied near $24k, the place it met resistance.

Bitcoin’s adoption by many institutional buyers made it wise to US financial information. In different phrases, the US greenback’s volatility strikes Bitcoin too. Due to this fact, right now’s inflation information is a key driver not just for the fiat currencies but in addition for the cryptocurrency market due to Bitcoin’s affect on the general crypto market.

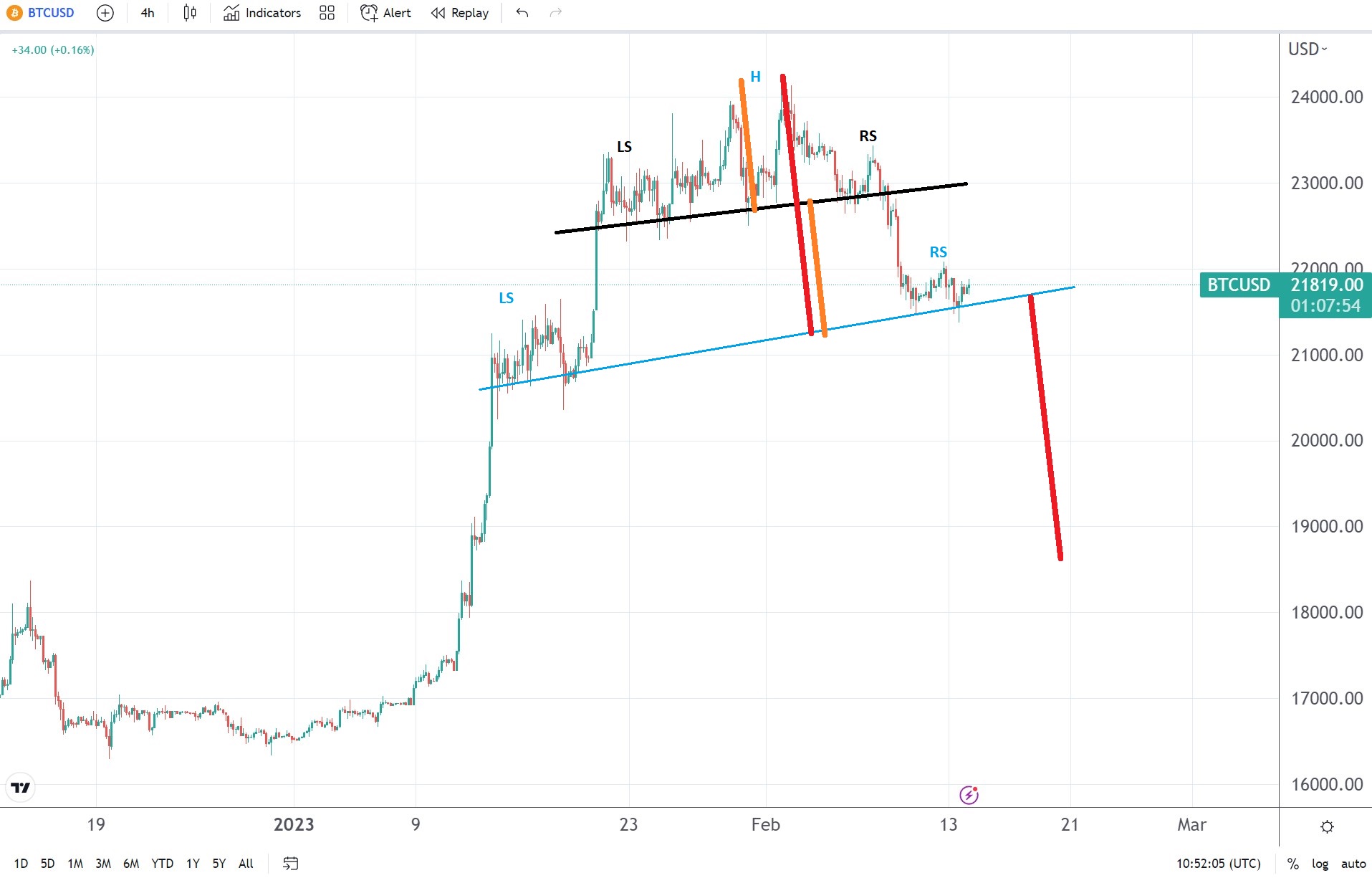

Head and shoulders sample factors to a drop beneath $19k

Crypto lovers cheered the sturdy begin to the buying and selling yr as Bitcoin rallied aggressively. However in doing so, Bitcoin solely adopted the general US greenback’s weak point seen throughout the FX dashboard.

If the US CPI report for January reveals renewed inflationary pressures, the US greenback ought to surge throughout the dashboard.

On such a launch, the market should purchase the greenback in anticipation of additional tightening from the Fed. Therefore, the greenback ought to strain Bitcoin.

From a technical perspective, there may be one head and shoulders sample that ought to hold bulls at bay. The market at the moment consolidates above the neckline, and if the greenback will get stronger after the CPI report, then the sample’s measured transfer factors to a drop beneath $19k.

The market shouldn’t climb above the best level within the earlier head and shoulders sample for the sample to work. Extra exactly, it ought to stay beneath $23,500 for the bearish sample to stay legitimate.