Bitcoin is buying and selling round $107,000 after its current flash crash, sustaining stability to stop additional decline however is but to return to buying and selling above $110,000. Notably, fashionable crypto analyst Titan of Crypto shared an in depth Gaussian Channel evaluation on X that factors to Bitcoin’s macro bull construction remaining intact despite short-term volatility. His submit, which was accompanied by a Bitcoin value chart, reveals how Bitcoin’s place relative to the Gaussian Channel gives a transparent view of the continued cycle.

Associated Studying

Bull Market Intact Above Gaussian Channel

Titan of Crypto noted that Bitcoin’s placement above the Gaussian Channel represents power within the long-term pattern. As proven within the weekly candlestick value chart beneath, the inexperienced channel corresponds to bullish phases, whereas crimson areas signify bearish downturns, a first-rate instance being the 2022 bear market.

On the time of writing, the higher band is positioned round $101,300 and trending upward. Subsequently, Bitcoin’s value motion round $107,000 implies that it’s but to interrupt into the Gaussian channel and its general market construction remains to be strong. From this, it may be inferred that Bitcoin’s present pullback from the October 6 all-time excessive above $126,000 is just a brief pause within a larger bull market.

Bitcoin Gaussian Channel. Source: Titan of Crypto on X

Nonetheless, though the Gaussian Channel studying seems favorable, Titan of Crypto famous that the indicator shouldn’t be handled as a buying and selling set off. “It’s not a purchase sign, it’s a macro context indicator,” he stated. Being above the Gaussian Channel doesn’t essentially equate to purchasing extra. It merely means the bull market construction remains to be intact.

The Gaussian Channel works greatest when combined with other indicators corresponding to buying and selling quantity, transferring averages, and on-chain accumulation traits to verify directional momentum.

Coinbase Premium Hole Turns Purple

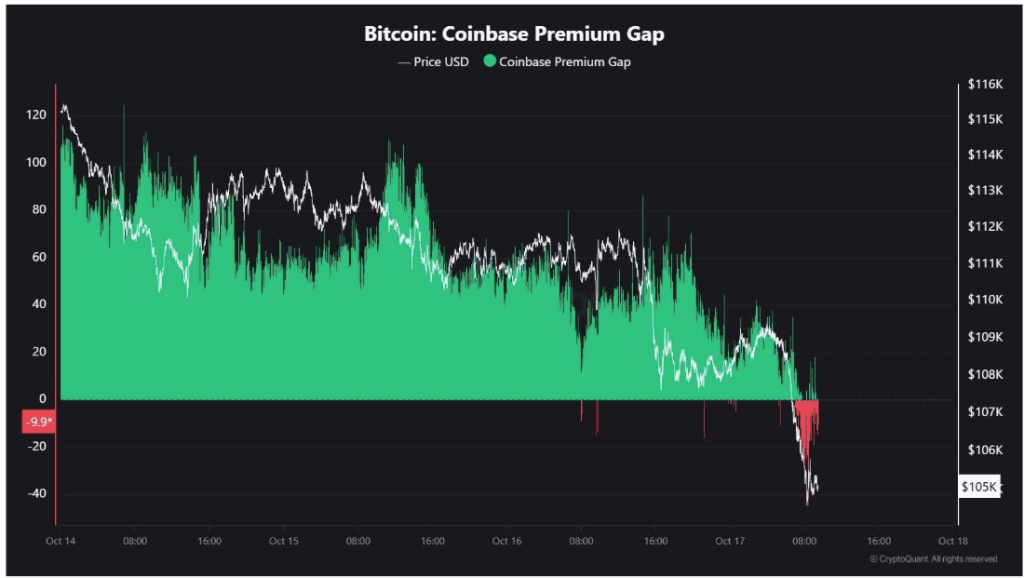

Talking of different indicators, on-chain information from CryptoQuant reveals that the Coinbase Premium Hole, a metric evaluating Bitcoin’s value on Coinbase versus different exchanges, has turned crimson. As proven within the chart beneath, Coinbase’s Premium Hole went on a pointy decline from optimistic premium ranges above +60 earlier within the week to as little as -40 when the Bitcoin value fell to $101,000.

Curiously, the Coinbase Premium Hole has elevated to round -10 on the time of writing, that means US buyers are starting to turn bullish again. This may be seen as a bullish sign, as related dips in US demand have been recorded between March and April earlier than the Bitcoin value ultimately rallied greater than 60% to achieve new all-time highs.

Associated Studying

Nonetheless, a crimson Coinbase Premium Hole alone is just not decisive. It ought to be interpreted alongside other information factors, together with ETF inflows, buying and selling quantity, liquidity, and derivatives funding charges. On the time of writing, Bitcoin was buying and selling at $107,120.

Featured picture from Vecteezy, chart from TradingView