Traditionally, the Bitcoin value is an indicator of the blockchain’s well being, with excessive exercise usually correlating with sturdy and optimistic value motion. Nonetheless, the most important cryptocurrency market appears to have witnessed a major shift, with costs now much less conscious of modifications in on-chain activity.

As an example, the Bitcoin value continues to carry above $95,000 and appears set to reclaim the $100,000 stage regardless of the sustained dip in blockchain exercise. An on-chain analytics agency has weighed in on how and why that is potential for the flagship cryptocurrency.

Why BTC Worth Is Much less Correlated To On-Chain Exercise

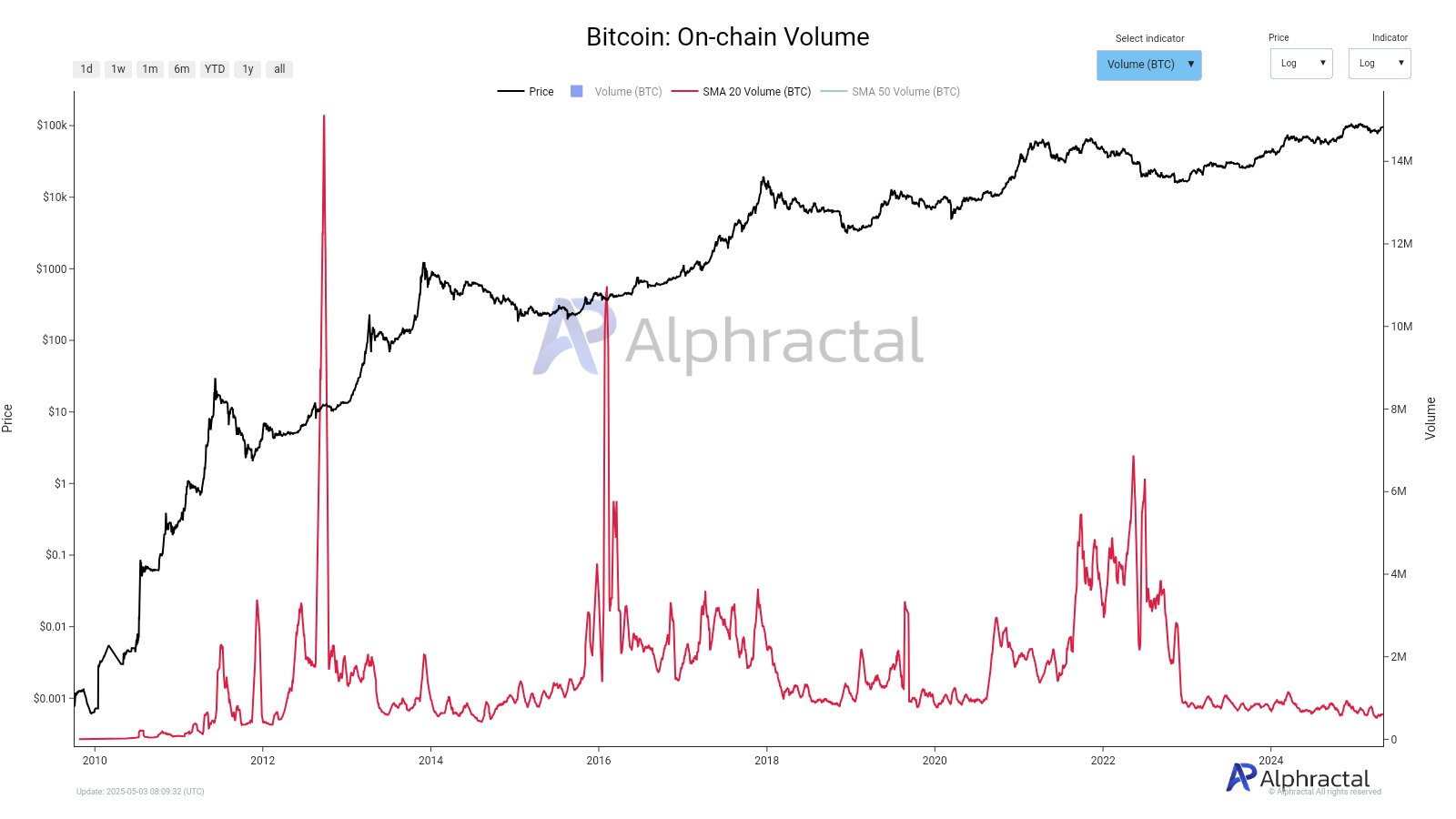

Crypto analytics platform Alphractal shared in a brand new put up on X the main the explanation why the Bitcoin value has managed to remain afloat regardless of transaction quantity and energetic addresses being at low ranges. In line with the agency, BTC’s value rise doesn’t essentially correlate to elevated blockchain utilization.

Firstly, Alphractal acknowledged that the Bitcoin market skilled a dynamic shift when the US spot exchange-traded funds (ETFs) have been permitted in January 2024. The worth of BTC is now being pushed by capital inflows via these monetary merchandise moderately than blockchain exercise.

Supply: @Alphractal on X

The on-chain agency additionally talked about that the historically low volatility available in the market has had a significant half to play within the low Bitcoin community exercise. With comparatively little value motion, merchants are much less incentivized to take new positions, resulting in decrease on-chain exercise.

Moreover, Alphractal talked about that the Bitcoin value has been stored afloat largely by the actions of speculative merchants via derivatives and different monetary devices. Because of this, there was a decreased on a regular basis adoption and restricted sensible demand for the Bitcoin community.

Alphractal additionally alluded to the macroeconomic uncertainty that has clouded the worldwide monetary markets in latest weeks. In line with the on-chain analytics agency, this market situation, despite the fact that bettering, has most buyers ready for clearer bullish alerts earlier than making any transfer.

Lastly, Alphractal highlighted synthetic trade volumes amongst the principle causes for the Bitcoin price staying afloat. “Some trade quantity could also be inflated, making a deceptive sense of exercise whereas actual community utilization stays modest,” the on-chain platform added.

Bitcoin Worth At A Look

As of this writing, the price of BTC stands at round $96,150, reflecting an over 1% decline previously 24 hours. Regardless of the uneven value motion this weekend, the premier cryptocurrency continues to be up by practically 2% on the weekly timeframe, in accordance with knowledge from CoinGecko.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.