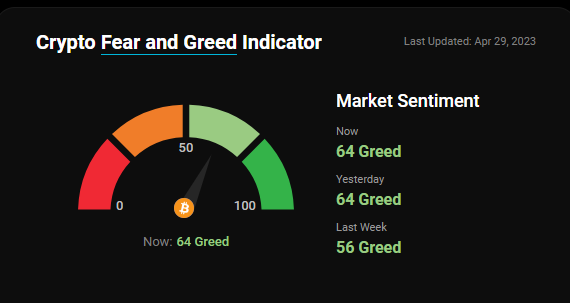

Bitcoin (BTC) traders are displaying a excessive stage of optimism regardless of the latest value volatility, with the Worry & Greed Index tracked by Coinstats Explorer indicating a robust and bullish market sentiment. Presently, at a stage of 64, the index could be very near the yr’s excessive, suggesting that traders are extra grasping than fearful.

The Worry & Greed Index makes use of quite a lot of elements, together with social media posts and Google Developments, to gauge the temper of the bitcoin market and assigns a rating from 0 to 100. A rating above 55 signifies a prevailing sense of greed, whereas a rating beneath 45 signifies concern. Regardless of latest value fluctuations between USD 31,000 and USD 26,600, the index exhibits that BTC traders stay optimistic about the way forward for the cryptocurrency.

Associated Studying: New Atomic Malware On MacOS Targets Crypto Wallets

Bitcoin has sustained a bullish market sentiment for many of 2023, reaching a peak of 68 this month. This stage has not been noticed since 18 months in the past, when Bitcoin reached its all-time excessive of $69,000. This month, the cryptocurrency’s value peaked at $31,000, its highest level in practically a yr, with greed reaching a stage of 68. Though bitcoin later fell to $26,600, market sentiment stays elevated.

Will Bitcoin Hit $40,000?

The latest value surge previously week has resulted in renewed predictions from analysts and stakeholders about the way forward for the main coin. Whereas some imagine a serious correction is coming, others have a constructive view of the market pattern.

One in all these is standard market analyst Michael van de Poppe, who believes a correction is wholesome for Bitcoin. He predicts that if Bitcoin stays above $25,300, it can proceed to rally towards the $40,000 to $50,000 ranges. Van de Poppe additional displayed his ideas utilizing a chart, displaying that this value stage had been key previously, serving as a assist and resistance zone for Bitcoin minimums and maximums in 2021 and 2022.

Associated Studying: Mastercard’s Head Of Crypto Seeks More Partnerships Amid Growing Regulatory Scrutiny

Van de Poppe believes that with Bitcoin’s appreciation of over 60% up to now this yr, it may proceed to rise to greater than $40,000 within the second half of 2023. He additionally foresees a reversal to $30,000, its present resistance, which might turn out to be its assist.

Nonetheless, he famous that this state of affairs will depend on the US Federal Reserve not pivoting or altering financial coverage. For now, the Fed doesn’t present any indication of fixing its determination to lift rates of interest, which may impression the cryptocurrency’s value.

Santino Cripto, a distinguished market analyst, additionally shares this outlook. He believes that Bitcoin may attain $40,000 by August. One of many elements cited for this projection is that BTC’s increased minimal costs point out an uptrend. In keeping with him, the market correction skilled this week is just like earlier weeks and exhibits a pure and rational phenomenon throughout a bullish season.

Bitcoin Worth

As of the time of writing, Bitcoin is up 1% within the final 24 hours and buying and selling for $29,319 with a market dominance of 47%.

Featured Picture from istock.com, charts from Coinstats, Twitter, and Tradingview.