Crypto asset funding merchandise skilled their largest week of inflows this yr, pushed by rising market optimism and surging costs.

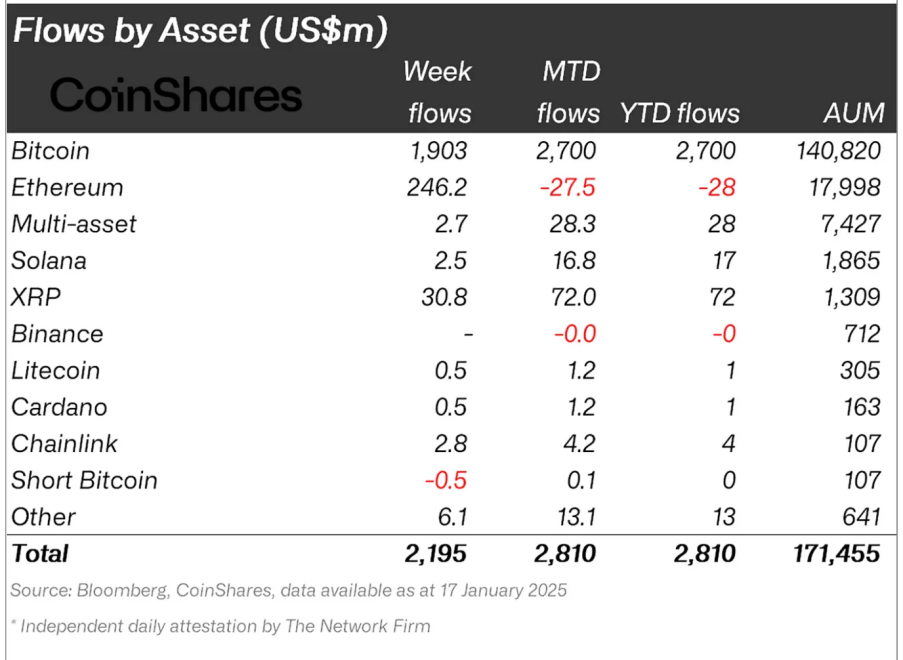

CoinShares, a outstanding European digital asset supervisor, revealed that funding merchandise noticed $2.2 billion in inflows final week, bringing the year-to-date whole to $2.8 billion. This marks a major milestone for the digital asset market, with whole property beneath administration (AuM) now at a report $171 billion.

Bitcoin, Ethereum Lead Inflows; Altcoins See Blended Exercise

In response to the CoinShares report, Bitcoin continued to dominate the market, attracting $1.9 billion in inflows final week, pushing its year-to-date whole to $2.7 billion.

Curiously, whereas the latest price rally may need been anticipated to attract short-position inflows, CoinShares famous minor outflows of $500,000 from brief Bitcoin merchandise. This departure from typical conduct suggests shifting dynamics in how buyers are positioning themselves.

Ethereum additionally rebounded, with inflows of $246 million, reversing its earlier outflows this yr. Nevertheless, regardless of the latest restoration, Ethereum stays the poorest performer by way of cumulative inflows year-to-date.

Different altcoins confirmed restricted exercise: XRP garnered an extra $31 million final week, pushing its whole inflows since mid-November to $484 million. In the meantime, Solana saw $2.5 million in inflows, and Stellar recorded $2.1 million, however general altcoin exercise was subdued.

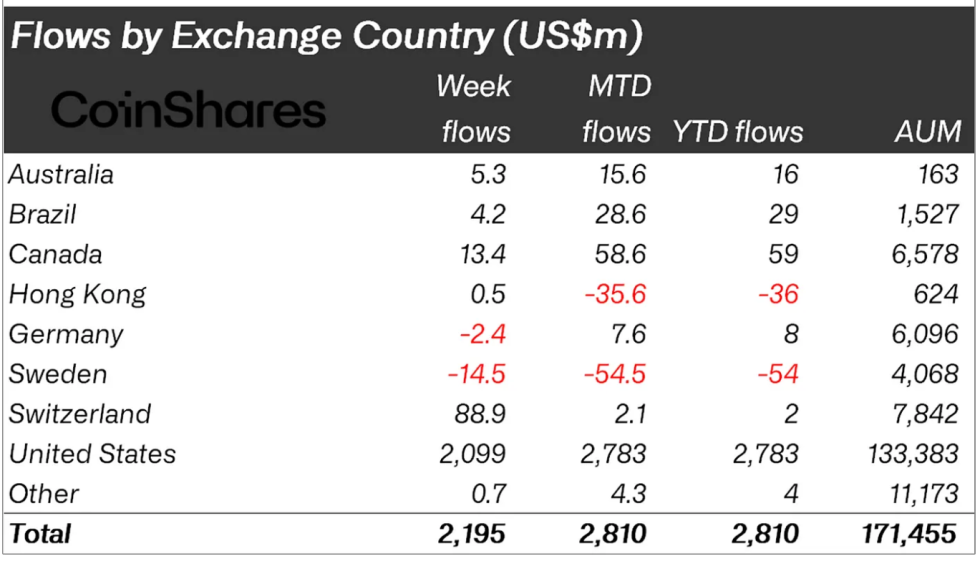

Regionally, the USA accounted for almost all of inflows, with $2 billion, whereas Switzerland and Canada additionally contributed $89 million and $13 million, respectively. These figures highlights the rising international participation in digital asset funding merchandise.

What Was Behind The Influx Surge?

In response to CoinShares’ Head of Analysis, James Butterfill, final week’s inflows have been accompanied by excessive buying and selling volumes on exchange-traded merchandise (ETPs), reaching $21 billion—about 34% of whole Bitcoin buying and selling volumes on trusted exchanges.

Moreover, final week’s surge in crypto inflows—notably in Bitcoin—may be linked to the inauguration of the pro-crypto Donald Trump administration. Butterfill wrote within the report:

Digital asset funding merchandise recorded inflows of US$2.2bn final week amid the Trump inauguration euphoria, the biggest week of inflows thus far this yr, bringing year-to-date (YTD) inflows to US$2.8bn.

Talking of inauguration, there was some vital occasions that has occur within the crypto market simply few days previous to the inauguration. On Saturday Donald Trump who’s now the forty seventh president of the Unites States launched his personal memecoin with the ticker TRUMP.

Curiously, in lower than 48 hours, Tump’s spouse Melania additionally launched her personal memecoin with the ticker MELENIA. These occasions resulted in notable volatility available in the market with BTC and different major assets seeing a decline prior to now seeing a restoration as of earlier at the moment.

The Official Melania Meme is dwell!

You should buy $MELANIA now. https://t.co/8FXvlMBhVf

FUAfBo2jgks6gB4Z4LfZkqSZgzNucisEHqnNebaRxM1P pic.twitter.com/t2vYiahRn6

— MELANIA TRUMP (@MELANIATRUMP) January 19, 2025

Featured picture created with DALL-E, Chart from TradingView