On-chain information reveals Bitcoin leverage ratio has hit a brand new all-time excessive (ATH). This may occasionally imply {that a} value correction might quickly comply with.

Bitcoin Leverage Ratio Reaches New Highs, Correction Incoming?

As identified by an analyst in a CryptoQuant post, the BTC leverage ratio has made a brand new ATH lately. This will increase the potential for a correction taking place quickly to flush out all the surplus leverage.

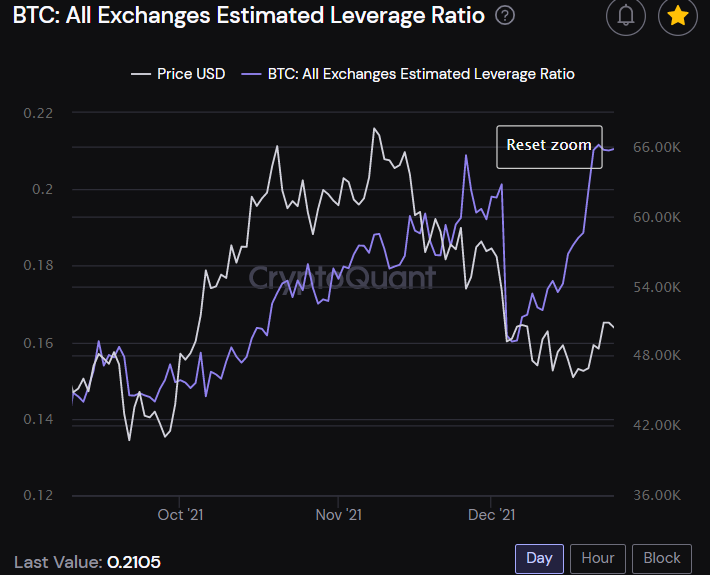

The “all exchanges estimated leverage ratio” is an indicator that estimates how a lot leverage is utilized by Bitcoin traders on derivatives exchanges, on common.

There are two associated metrics right here. The primary is the “open interest,” which measures the whole quantity of futures contracts at the moment open available in the market. And the opposite is the “alternate reserve” that tells us how a lot BTC is saved in derivatives alternate wallets.

The worth of the leverage ratio is calculated because the open curiosity divided by the alternate reserve. With the assistance of this metric, it turns into potential to inform whether or not traders are at the moment taking low threat or excessive threat.

When the worth of the indicator rises, it means traders are taking over extra leverage. Excessive values of the metric might imply the market is at the moment over-leveraged, which might result in larger volatility in Bitcoin.

Associated Studying | Quant Explains How Large Bitcoin Leverage Ratio Can Help Turnaround Price

Alternatively, low values of the indicator suggest there isn’t a lot leverage available in the market proper now. Here’s a chart that reveals the pattern within the BTC leverage ratio over the previous few months:

Seems just like the indicator has lately hit a brand new ATH | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin leverage ratio has been on the rise these days. Only in the near past the metric additionally achieved a brand new all-time excessive.

Associated Studying | Growth Of Bitcoin ETFs & Other Instruments Doesn’t Support Supply Shock Narrative

The quant believes that such excessive values of the ratio might imply {that a} correction within the value of the coin might quickly come, wiping away all the surplus leverage with it.

BTC Value

On the time of writing, Bitcoin’s price floats round $50.9k, up 11% within the final seven days. Over the previous thirty days, the crypto has stacked 6% in losses.

The beneath chart reveals the pattern within the value of BTC over the past 5 days.

BTC's value surged up a number of days in the past, however has since moved sideways | Supply: BTCUSD on TradingView

Bitcoin has established a footing above the $50k value stage up to now few days, however it’s unclear in the intervening time when the coin may retest larger ranges. If the leverage ratio is something to go by, one other correction may quickly wipe away this restoration as an alternative.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com