The worth of Bitcoin seems to have returned to its uneven motion inside the $82,000 — $86,000 consolidation vary, reflecting the extent of indecisiveness at the moment taking place out there. Nevertheless, a specific class of BTC investors appears to be shifting within the crypto market with utmost confidence and conviction.

In line with the newest on-chain commentary, long-term buyers seem like rising their publicity to the world’s largest cryptocurrency by market capitalization. Beneath is what this new shift in market dynamics means for the present Bitcoin cycle.

Has The Bitcoin Bear Market Began?

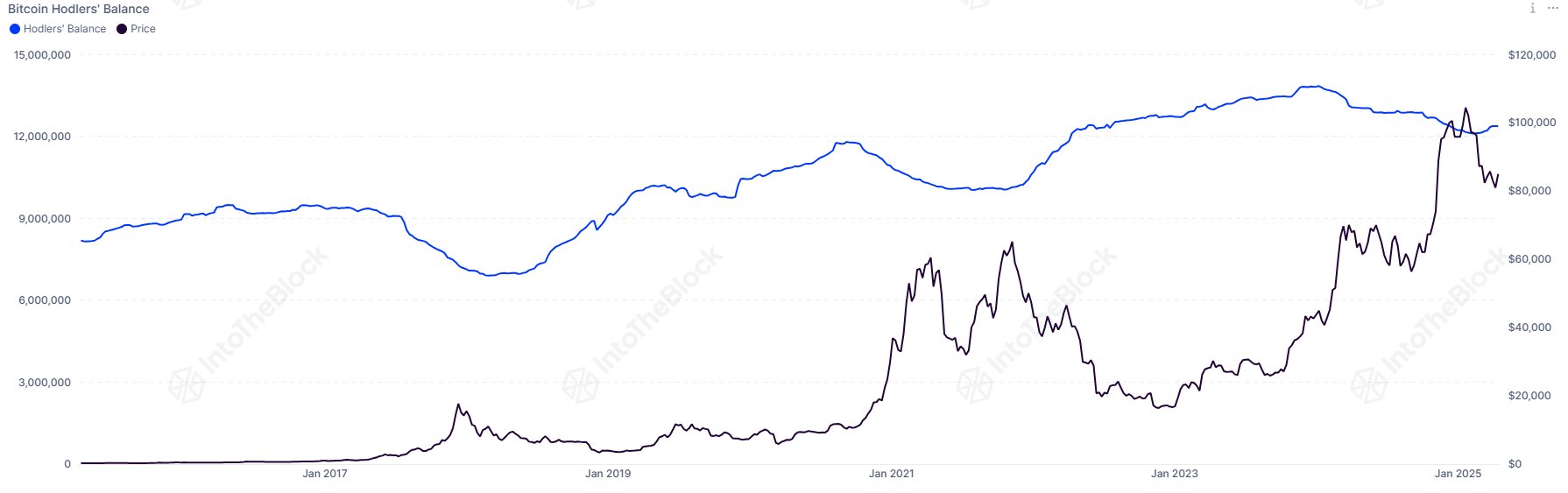

In a brand new put up on the X platform, crypto analytics agency IntoTheBlock shared {that a} dependable indicator that provides perception into Bitcoin’s cyclical habits is flashing an attention-grabbing sign once more. The related on-chain metric right here is the long-term holders (LTH) steadiness, which tracks the quantity of BTC held by wallets for greater than a 12 months.

In line with IntoTheBlock’s put up on X, the Bitcoin LTH steadiness has witnessed a pointy upswing in latest months, coinciding with the premier cryptocurrency’s drop from the cycle highs. The on-chain agency talked about {that a} rising long-term holder steadiness is traditionally correlated with the onset of a bear market.

Supply: @intotheblock on X

As noticed within the chart above, long-term investors are likely to accumulate closely in the beginning of bear markets and early accumulation phases. This sample will be seen in late 2018 and 2022, the place the LTH balances skilled a pointy improve adopted by worth drawdowns.

Finally, this accumulation sample means that seasoned buyers could be shifting their funding technique in anticipation of huge worth actions. However, it’s value mentioning that this is also a mid-cycle breather, with the Bitcoin worth consolidating now to renew its bullish run later.

Lack Of Retail Exercise Suggests Room For Upward Progress

Curiously, a separate—and contrasting—piece of on-chain data has emerged, suggesting that the Bitcoin worth may not have reached its cycle high simply but. This analysis is predicated on the quantity of “retail exercise via buying and selling frequency” skilled by the premier cryptocurrency throughout its final surge from $70,000 to above $110,000.

In line with distinguished crypto analyst Ali Martinez, Bitcoin worth tops have traditionally coincided with surges in retail exercise. Martinez famous the retail exercise lacked the identical momentum when BTC’s worth transfer from $70,000 to $110,000 in the direction of the top of 2024 and early 2025. If historical past is to go by, this implies that there would possibly nonetheless be room for upward progress for the flagship cryptocurrency.

As of this writing, the worth of Bitcoin stands at round $84,730, reflecting a 0.4% soar previously 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.