On-chain knowledge exhibits the a part of the Bitcoin realized cap held by the long-term holders has elevated and is now at almost 80%.

Bitcoin Lengthy-Time period Holders Personal Nearly 80% Of Realized Cap

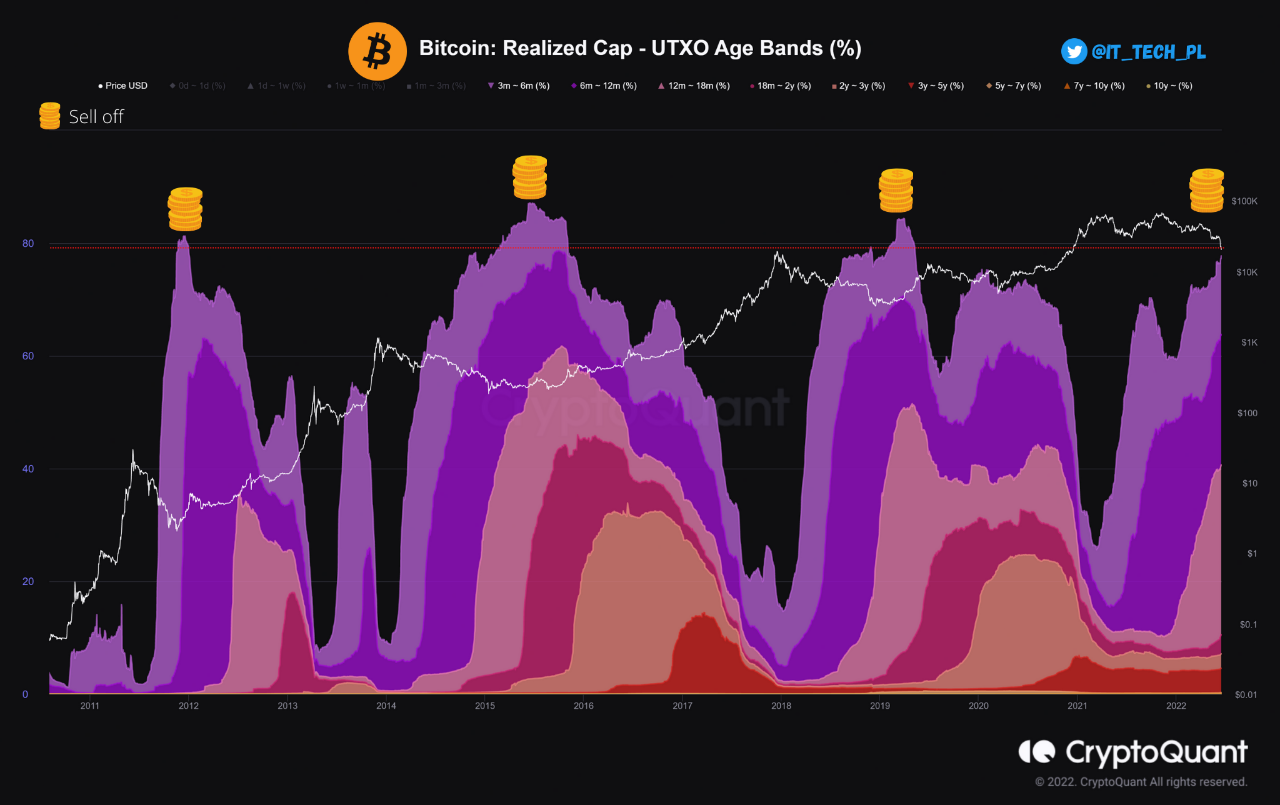

As defined by an analyst in a CryptoQuant post, the crypto has traditionally tended to type bottoms round when the long-term holder share of realized cap has exceeded 80%.

The “long-term holders” (LTHs) are all these Bitcoin traders who’ve been holding onto their cash with out promoting or transferring since at the least 155 days in the past.

The realized cap is a approach of assessing the capitalization of the crypto the place every circulating coin’s worth is taken as the value it was final moved or offered at, fairly than the present BTC worth.

Now, the related on-chain indicator right here is the “realized cap – UTXO age bands (%),” which tells us what half are the varied teams within the Bitcoin market contributing to the overall realized cap of the coin.

Associated Studying | Bitcoin Exchange Reserve Spikes Up, Selloff Not Over Yet?

The assorted age bands denote the period of time traders belonging to a bunch have been holding their cash for.

As talked about earlier, LTHs embody all cohorts holding since at the least 155 days in the past. Here’s a chart that exhibits how the contribution to the realized cap by these traders have modified over the historical past of Bitcoin:

Seems to be like the worth of the metric has noticed rise not too long ago | Supply: CryptoQuant

Within the above graph, the quant has marked all of the related factors of development associated to the Bitcoin realized cap share of the LTHs.

It looks as if each time the indicator’s worth has crossed the 80% mark, a backside within the worth of the crypto has taken place.

Associated Studying | Bitcoin Funding Rates Remain Negative But Open Interest Tells Another Story

Presently, the metric’s worth has been rising up in current weeks, nonetheless, it has nonetheless not gone above the brink simply but.

Nonetheless, the indicator is sort of there. If its worth continues to rise and the historic sample holds this time as nicely, then Bitcoin might observe a bottom quickly.

BTC Value

On the time of writing, Bitcoin’s price floats round $21k, down 30% within the final seven days. Over the previous month, the crypto has misplaced 30% in worth.

The beneath chart exhibits the development within the worth of the coin over the past 5 days.

The worth of the crypto appears to have been transferring sideways over the previous couple of days | Supply: BTCUSD on TradingView

For the reason that crash a couple of days in the past, Bitcoin has been principally consolidating across the $21k mark. Presently, it’s unclear whether or not the decline is over, or if extra is coming.

If the LTH share of the realized cap is something to go by, then BTC might first seen a bit extra decline earlier than the underside is lastly in.

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com