Michael Saylor despatched a brief, cryptic message on X on November 2, 2025: “Orange is the colour of November.” The submit included a chart tied to Technique’s (previously MicroStrategy) Bitcoin tracker. Experiences have disclosed that crypto retailers and market watchers rapidly learn the road as a touch at one other company Bitcoin purchase.

Associated Studying

Bitcoin Purchase: Orange Dot Indicators

In accordance To screenshots and media protection, the submit echoed previous Saylor posts that used orange imagery to flag Bitcoin strikes. Some retailers known as it a tease for a thirteenth straight buy by Technique.

That description comes from reporters monitoring the agency’s shopping for sample, not from an official Technique assertion. The tweet didn’t lay out timing or greenback quantities.

Technique Holdings And Latest Buys

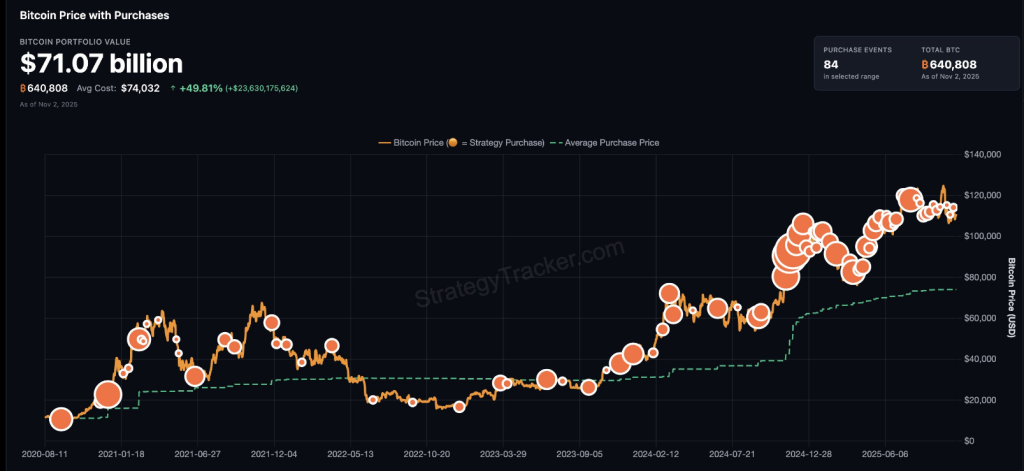

Based mostly on studies and filings summarized in market protection, Strategy at present holds roughly 640,808 BTC, with a mean price foundation close to $74,302 per coin.

The corporate’s final disclosed acquisition was about 390 BTC, which market trackers put at roughly $43 million. These figures come from public disclosures and monitoring companies that comply with company treasury buys.

Orange is the colour of November. pic.twitter.com/M3JoIuDpRk

— Michael Saylor (@saylor) November 2, 2025

Market Reactions And Dangers

Merchants reacted quick. Some consumers pushed costs larger on the concept one other company purchaser was about to enter the market.

Others offered into the noise, treating the tweet as a sign that may not instantly result in a commerce. Headlines linking the submit to different large political or financial occasions—corresponding to reporting on US President Donald Trump—appeared in a couple of retailers, however analysts say such connections are speculative until tied to filings or on-chain strikes.

Why Watch For Filings

Based mostly on previous follow, Technique tends to file disclosures after finishing purchases. That sample makes regulatory filings and on-chain addresses price anticipating anybody monitoring precise flows.

If a recent 8-Ok seems or a pockets tied to the corporate posts motion, that may flip rumor into confirmed motion. Till then, the market runs on interpretation and expectation.

What This Means For Buyers

For holders, company accumulation usually serves as a sentiment enhance. For brief-term merchants, it raises volatility. Institutional watchers will likely be wanting not just for extra purchases but in addition for any change in scale.

The corporate’s giant stake—tons of of 1000’s of BTC at a multi-thousand greenback common—signifies that public buys or gross sales have the ability to maneuver sentiment.

Associated Studying

What To Watch Subsequent

Based mostly on studies, the clearest indicators to observe are regulatory filings, updates from Technique itself, and on-chain transfers tied to identified firm addresses.

Market information suppliers who tracked the final 390 BTC buy will doubtless flag any new motion rapidly. Till these objects seem, the tweet stays a robust trace however not proof of an imminent giant buy.

Featured picture from Unsplash, chart from TradingView