Coinspeaker

Bitcoin Miner Exchange Deposits Surge to $4 Billion as BTC Price Flirts at $90,000

Inside simply three days since November 12, Bitcoin miners have moved a complete of 45,000 BTC to exchanges simply as BTC value

BTC

$91 558

24h volatility:

1.1%

Market cap:

$1.81 T

Vol. 24h:

$55.28 B

touched a brand new all-time excessive above $90,000.

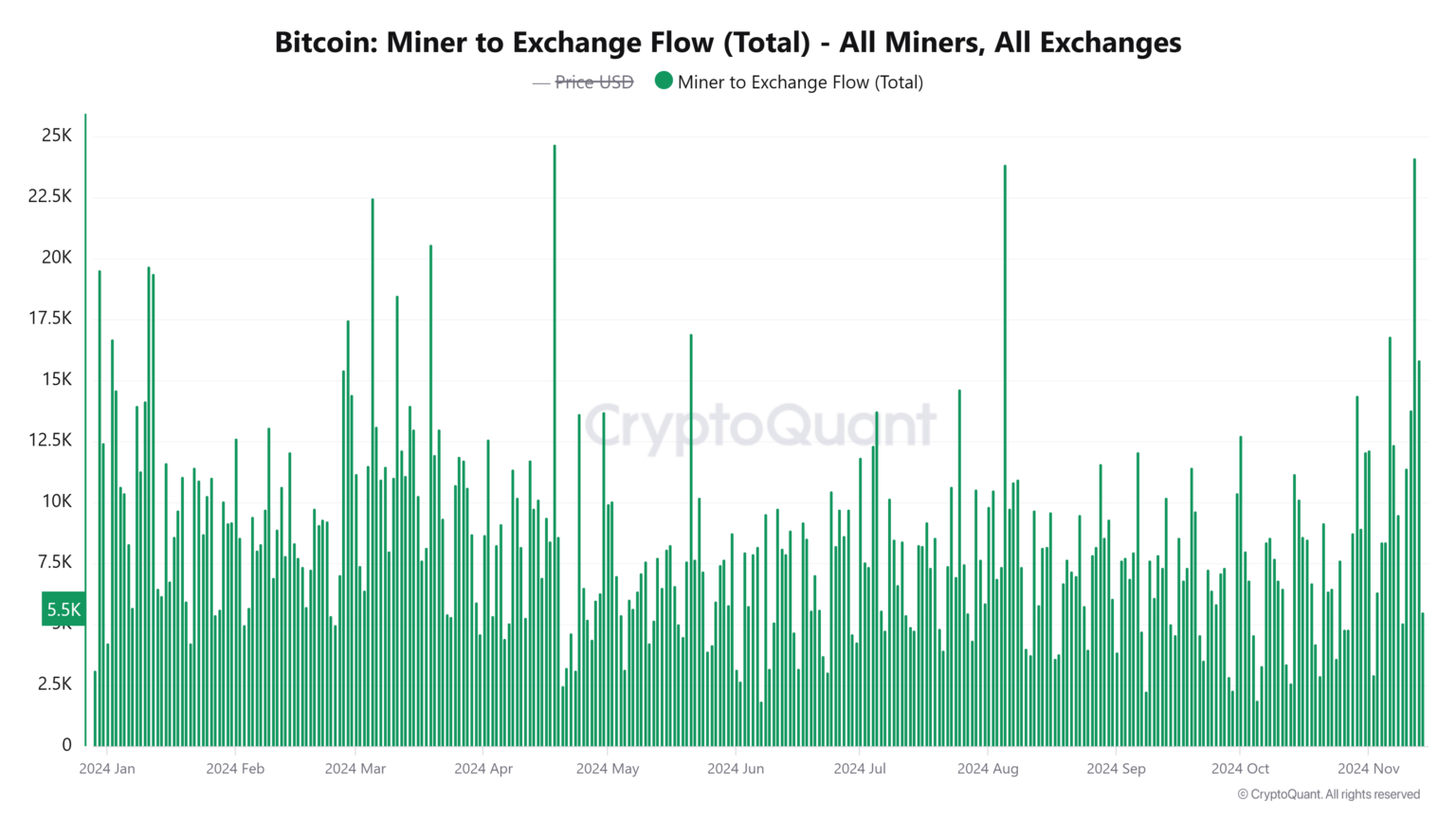

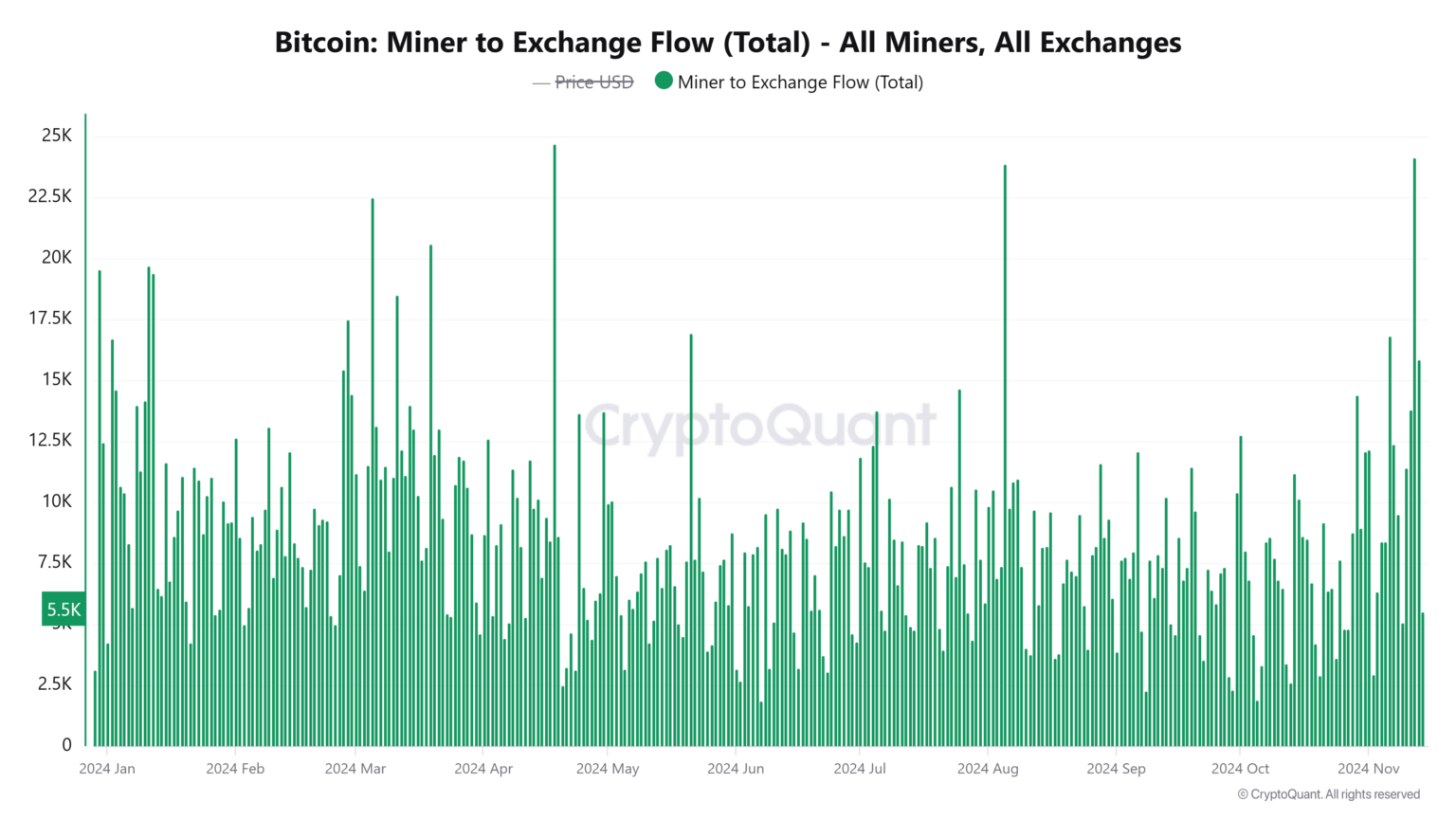

As per the on-chain knowledge from CryptoQuant, Bitcoin miners collectively moved 24,138 BTC on November 12. This was the primary main transfer from this cohort and the second-largest each day outflow from miners this yr.

Nonetheless, on the subsequent day because the BTC rallied all the way in which previous $93,000 ranges, the miners moved an extra 15,840 BTC to exchanges. The pattern continued additional on November 14, with miners shifting one other 5,500 BTC to exchanges. In consequence, Bitcoin miners have transferred a complete of 45,000 BTC cumulative within the final three days.

-

Courtesy: CryptoQuant

Massive transfers to exchanges are sometimes seen as an indication that miners could intend to promote, probably capitalizing on the current value surge. Notably, this surge in transfers coincided with a slight correction in Bitcoin’s value, which briefly dropped beneath $90,000 and is now buying and selling round $87,000.

Nonetheless, such outflows don’t all the time point out promoting exercise. Miners generally transfer Bitcoin to exterior addresses for operational functions, and in some circumstances, these transactions could merely contain inside pockets reorganizations.

Different Components Resulting in BTC Worth Drop

Other than simply Bitcoin miner sell-off, there are different elements as properly resulting in a BTC value sell-off. For instance, the present US inflation knowledge reveals a spike within the quantity that will possible arrest the long run Fed fee cuts shifting forward. This might most likely additionally delay the long run BTC rally.

Other than Bitcoin miners, the whale deposits to crypto exchanges have additionally surged. A whale lately deposited 1,920 BTC, valued at roughly $169 million, to Binance only one hour in the past, in accordance with Lookonchain knowledge. Over the previous three days, the identical whale has deposited a complete of 4,060 BTC, price round $361 million, to the alternate.

A whale deposited 1,920 $BTC($169M) to #Binance 1 hour in the past.

The whale has deposited a complete of 4,060 $BTC($361M) to #Binance up to now 3 days.https://t.co/8D2y9MbfFn pic.twitter.com/6NlWDPKoVx

— Lookonchain (@lookonchain) November 15, 2024

In a current publish on X, Ali Martinez highlighted that $5.42 billion in Bitcoin income had been realized as the worth surged. This improve additionally introduced the sell-side threat ratio to 0.524%, signaling warning for buyers. Moreover, the Bitcoin RSI additionally reveals that the asset is at the moment within the overbought situations.

The each day RSI reveals #Bitcoin $BTC is in overbought territory, sometimes signaling a possible value correction forward! pic.twitter.com/61k7MXDZia

— Ali (@ali_charts) November 14, 2024

Other than this, the spot Bitcoin ETFs registered a staggering $400 million outflows on Thursday, November 14. This occurred after days of sturdy inflows into the funding merchandise following the Donald Trump victory on November 5.

Whereas BlackRock’s Bitcoin ETF (IBIT) has seen an inflow of $126.5 million, different funds like Constancy’s FBTC and Ark Make investments’s ARKB have skilled $100 million outflows every.

Bitcoin Miner Exchange Deposits Surge to $4 Billion as BTC Price Flirts at $90,000